- Nasdaq 100 continues on a bullish note despite recent negative economic data

- Nvidia and Meta keep leading the index, but are starting to look extended.

- Are fears of a tech bubble burst justified?

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

The stock market has been resilient to potentially unfavorable news and macroeconomic data so far.

Despite hotter-than-expected inflation readings on Tuesday, the correction has been, till this point, very limited, as the bulls continue to dominate. Meanwhile, the market consensus for the first rate cut has shifted from March to June.

Technology giants, particularly Nvidia (NASDAQ:NVDA) and Meta Platforms (NASDAQ:META), continue to lead gains on the Nasdaq 100, unfazed by the recent events.

But as many draw parallels to the dot-com bubble burst in the early 2000s, the counter argument is that such comparisons aren't strongly reflected in the current data.

Let take a look at the drivers of this rally to see where we stand right now.

Can This Year's Winners Keep Leading the Market Higher?

Nvidia has shown an impressive nearly 50% return in 2024, following a remarkable 150% return in 2023.

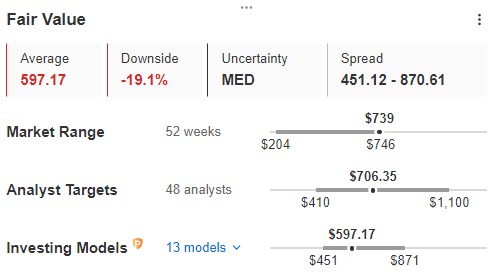

Given this performance, a potential correction seems natural, supported by InvestingPro's fair value, which suggests a 19% discount.

The upcoming key factor for the company's stock price will be its financial results, set to be published on February 21.

Source: InvestingPro

Since the beginning of the year, Meta stock has surged by 33.7%, positioning it just behind Nvidia.

The primary catalyst for this upward momentum was the release of quarterly financial results, which exceeded expectations to such an extent that the share price experienced an immediate gain of over 20%.

However, the same indicator that hinted at an 8% correction risk for Nvidia suggests a similar potential risk for Meta as well.

Source: InvestingPro

Will History Repeat Itself Once Again?

As we assess the Nasdaq, Nvidia, and other technology giants, a crucial question arises:

Are we on the brink of a repetition of the 2001 scenario, marked by the burst of the technology bubble?

To see this analogy unfold, we need to identify specific triggers, including:

- A prolonged period of high interest rates.

- A slowdown in the remarkable ascent of Big Tech companies that currently dominate the indexes.

- A potential recession in the US economy.

- Challenges faced by the US consumer, given that 70% of the nation's economy relies on consumption.

While this discussion provides room for speculative insights, it is essential to closely monitor market behavior as one or more of the aforementioned triggers start to materialize.

Nasdaq 100 Technical View: Break Above 18K Looking More Possible

The Nasdaq 100 is looking to breach the 18,000-point barrier and extend its upward trajectory.

The demand side has successfully corrected historical highs, achieving a notable milestone at the round level of 18,000 points.

Despite relatively flat corrections, opportunities to enter the trend at more favorable prices have been limited.

However, the technical outlook suggests a correction with the possibility of a resumption of the uptrend, contingent upon avoiding a US recession and the Federal Reserve expediting the pivot.

The initial rebound target is approximately 16700 points, marked by the support formed from the previously breached peak.

Additionally, it's crucial to observe the confluence of the uptrend line and the key level of 16000 points, anticipating a demand reaction if tested.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

Now with CODE INWESTUJPRO1 you can get as much as a 10% discount on InvestingPro annual and two-year subscriptions.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.