We all know that our President watches the stock market. So perhaps he was watching the price action last week as the major indexes moved lower. The bearish crowd got a little louder as expected, and the bulls demurred. And in the midst of that Mr. President ramped up the tariff talk again. And what happened? Well not much. At least so far.

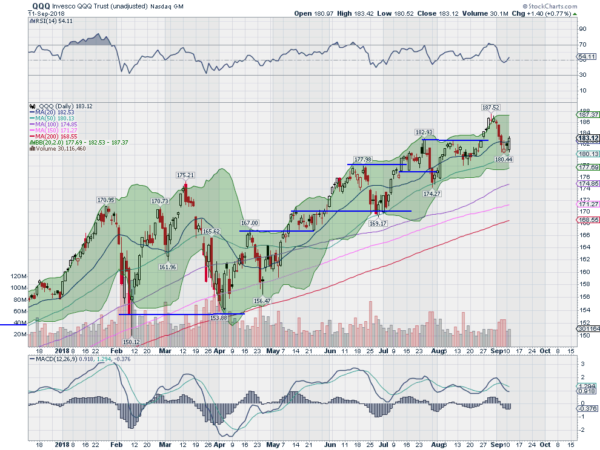

All of the major Indexes were down on the week. But not by much. And in some views all that happened was a healthy reset. A pullback to important support levels to burn off some momentum and set up for the next move. The Nasdaq 100 ETF is a good example of that. The chart below shows the story.

Since the iShares Russell 2000 (NYSE:IWM) made a higher high in June, it has trended higher. But in that trend it has pulled back 3 times to reset momentum. First in June and then at the end of July and now at the end of last week. Each time the price has dropped to the 50 day SMA. And there it has found support and turned higher. The early indication is that this time is no different. A bounce Monday and then strong move Tuesday.

If you are looking for that big drop maybe first look for a move and hold below that 50 day SMA as a trigger. Until then it seems markets are only retesting important levels to rest up for the next move.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.