Last week, using the Elliott Wave Principle (EWP), I forecasted the Nasdaq 100 “target ideally around $17,000 before [it] is ready to embark on the subsequent more significant correction.”

Back then, see here, the index was trading at $16,300, whereas yesterday it topped at $16,765. It now it sits at $16,180. Thus, the two options I presented last week are still valid, but please be aware even the bullish option (one more small leg higher) is akin to picking up pennies in front of a train.

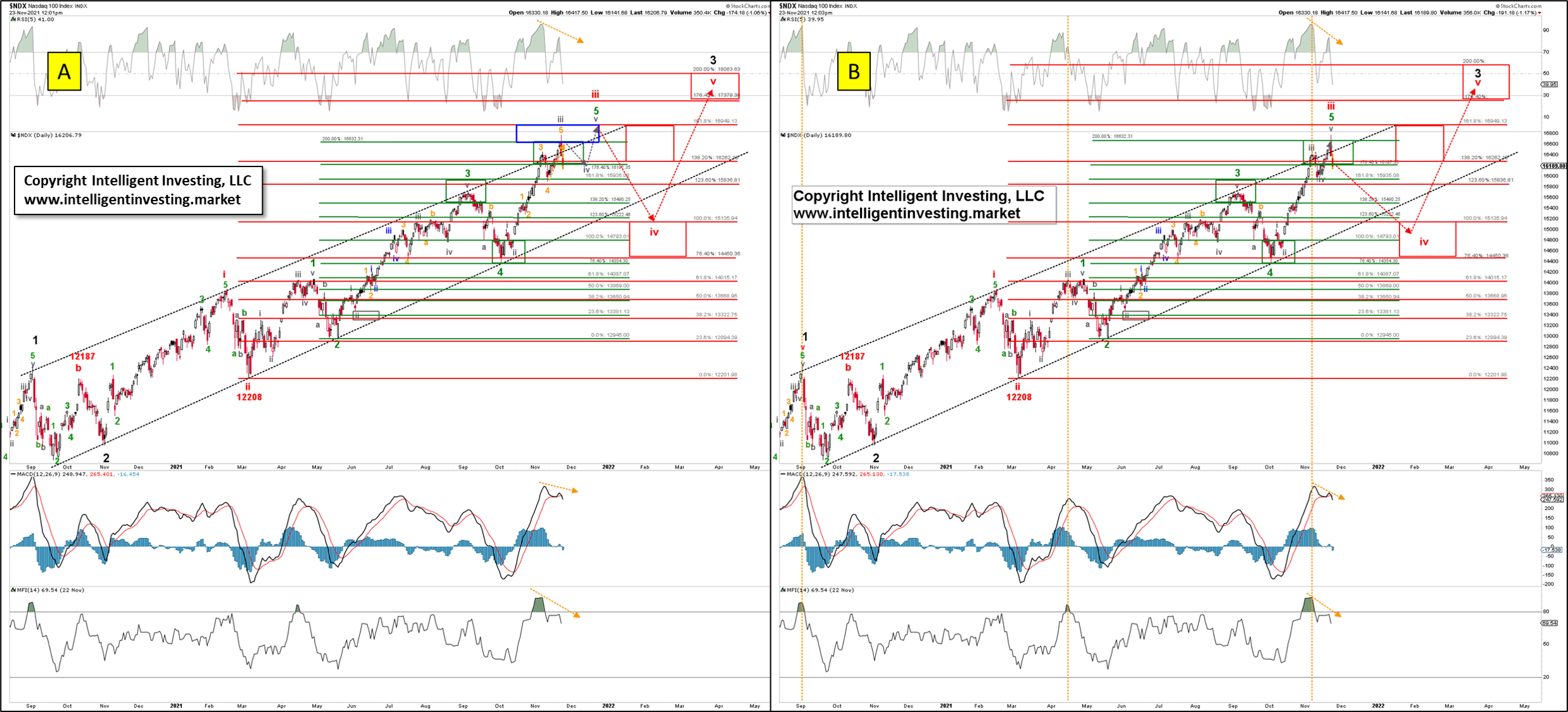

Figure 1: NDX100 daily candlestick charts with detailed EWP count and technical indicators.

Last week’s two EWP options remain the same:

Using the first option (Figure 1A), I had the NDX “see a local top soon…, ideally around $16.6K+/-200. Then, a minute-iv decline to ideally around $16.2K+/-200 followed by a final minute-v wave to ideally $17K+/-200. This last wave will then complete intermediate-iii, ... Besides, at ~$17K, the index has reached the (red) 161.80% Fibonacci-extension of wave-i, measured from the (early March) wave-ii low. A … typical 3rd wave target. If reached, I anticipate wave-iv to drop back to, ideally, the 100% Fib-extension at around $15135 before wave-v rallies the index to $18K+ to complete (black) major wave-3.” With yesterday’s $16765 high, the wave-iii target zone has been reached! Bingo and caution is advised.

The second option (Figure 1B): “The index will directly rally to $17K+/-200 for all of (grey) minute wave-v, which in this case may then only target the (green) 200% Fib-extension at ~$16.6K. Close enough to the as mentioned earlier ideal (red) intermediate wave-iii upside target.”

Thus, the upside target zone (blue box Figure 1A) has been reached. Bingo, and caution is advised. I want to add the facts that the technical indicators at yesterday’s high were all negatively diverging (orange dotted arrows), and when the money flow index (MFI14, bottom indicator) gets as overbought as it recently has, a decent pullback can be expected: see orange vertical lines.

There’s still no way of knowing which of these two options the market will take, but with the price action over the last two days and using the EWP, we can set a nice if/then scenario. Namely, bull markets see higher highs and higher lows. Thus, if the NDX drops below the Nov. 10 low at $15905 without making a new all-time high first, then the latter option is preferred. The former option is selected if the index stalls around current levels (a minute-iv decline to ideally around $16.2K+/-200) and then rallies. But even then, the more considerable decline remains inevitable because, and repeat after me, “… from the EWP we know after the 3rd wave come the 4th and 5th waves.”

Bottom Line: The EWP count can be considered complete for a more significant top, whereas the technical indicators support a local top. The last two days so far show how quickly a week of gains can be erased, so my advice from last week remains the same: “…please know the time frame you are trading because once ~$17K is reached, the downside risk increases, 10-15%, before the next 20% rally starts.”