Two weeks ago, see here, I was tracking a possible bullish setup for the Nasdaq 100: five waves higher as per the Elliott Wave Principle (EWP) from the June low.

Last week, see here, with the Nasdaq at 12900s, I found the index should rally back to around 13400+/-100 and then target around 12500+/-100 for a potential 4th wave low. The "must hold level" for the Bulls.

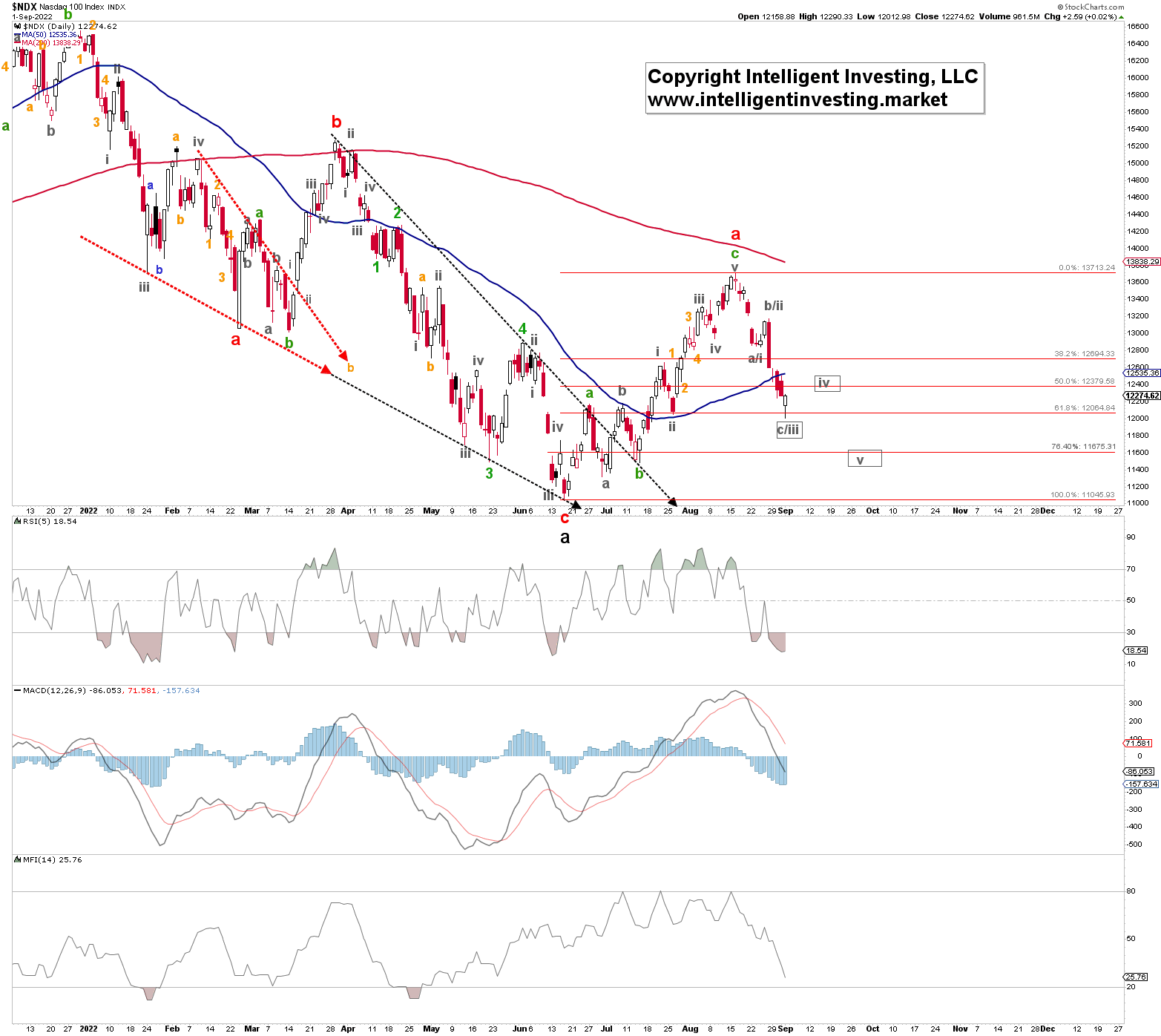

Last Friday, the index reached 13175 and today traded as low as 12013. Thus, my foresight for a bounce and drop was correct. However, the bulls failed to hold 12400 and are now staring at a critical overlap with the high made in June. See Figure 1 below. In my initial article, I had labeled it objectively as (green) wave-1/a because the market had not proven either wave label. Today it did, and that high is now marked as (green) wave-a. Subsequently, this labeling has ramifications for the intermediate- to long-term: see, for example, my article about a multi-year Bear market here.

Figure 1. Nasdaq 100 daily candlestick chart with detailed EWP count and technical indicators

Due to the overlap, I am now tracking for an impulse lower instead (grey waves i, ii, iii, iv, v) per the ideal 3rd, 4th, and 5th wave Fibonacci-based target zones. See Figure 1 above.

Today's reversal candle suggests wave-iii completed, and wave-iv should now be underway, targeting ideally 12400+/-100. The index should not move above last week's low of around 12900, or it would invalidate this possible impulse path. Once wave-iv completes, wave-v should ideally target about 11400-11600. At that stage, several more extensive options/paths are available to the market, which I will discuss then. But a more substantial rally from these lower levels is, for now, expected.