Walls have been part of history for a very long time. They have been built for protection. They have been used to keep things in and out. They have become a part of the fabric of civilization. It was opening the wall at the city of Troy that allowed the Trojan Horse to enter. The Great Wall of China has now become a major tourist destination. The Berlin wall was a symbol of hatred and its destruction one of reunification.

There are walls in markets as well. They do not get the same attention as the walls mentioned above, and for good reason. The walls in the market are often built in our minds, just figurative walls. A wall of worry for stock prices to climb. Markets made a low on Christmas Eve only to see massive rallies drive the major indexes up between 9.5% and 14% this year. But they still have a wall to scale.

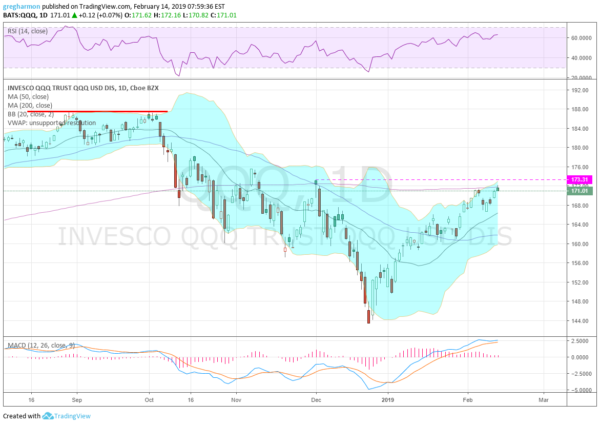

The Nasdaq 100, represented by the ETF QQQ above, may be the first to scale that wall. In fact there are two barriers in this chart. The first is the 200-day SMA. The QQQ has not spent more than 2 consecutive days above it since October. It is right up against that wall again right now. The second is the December 3 high. A push over that, to a higher high, would be a first move over the wall.

Momentum is on its side. The RSI is rising and in the bullish zone while the MACD is positive, avoiding a cross down. The Bollinger Bands® have also shifted to the upside. Clearing these barriers will not guarantee that the markets are free of a downturn but it will draw in new investors from the sidelines, setting up for the next ascent to another new high.