Two weeks ago, we used the Elliott Wave Principle (EWP) to determine where the NASDAQ 100 (NDX) could potentially bottom.

We expected:

“The market is…in a counter-trend rally: green W-b/2. Corrections…are often…complicated price structures, so we can allow for another small rally toward the $15050-15150 zone before W-c/3 commences. Regardless of where precisely the green W-b/2 will top, we anticipated another leg lower, which should present us with a low-risk buying opportunity for the red W-v to ideally $15565+/-75."

And we were aware of the fact that:

“At this stage, we cannot narrow the green W-c/3 target zone more than shown [between $14300-725.] because we do not know yet if the green W-b/2 has topped and what the relationship between W-a/1 and W-c/3 will be. Or, in other words, we cannot look around two corners at once, although we have a reasonably good idea of what should lie around that 2nd corner."

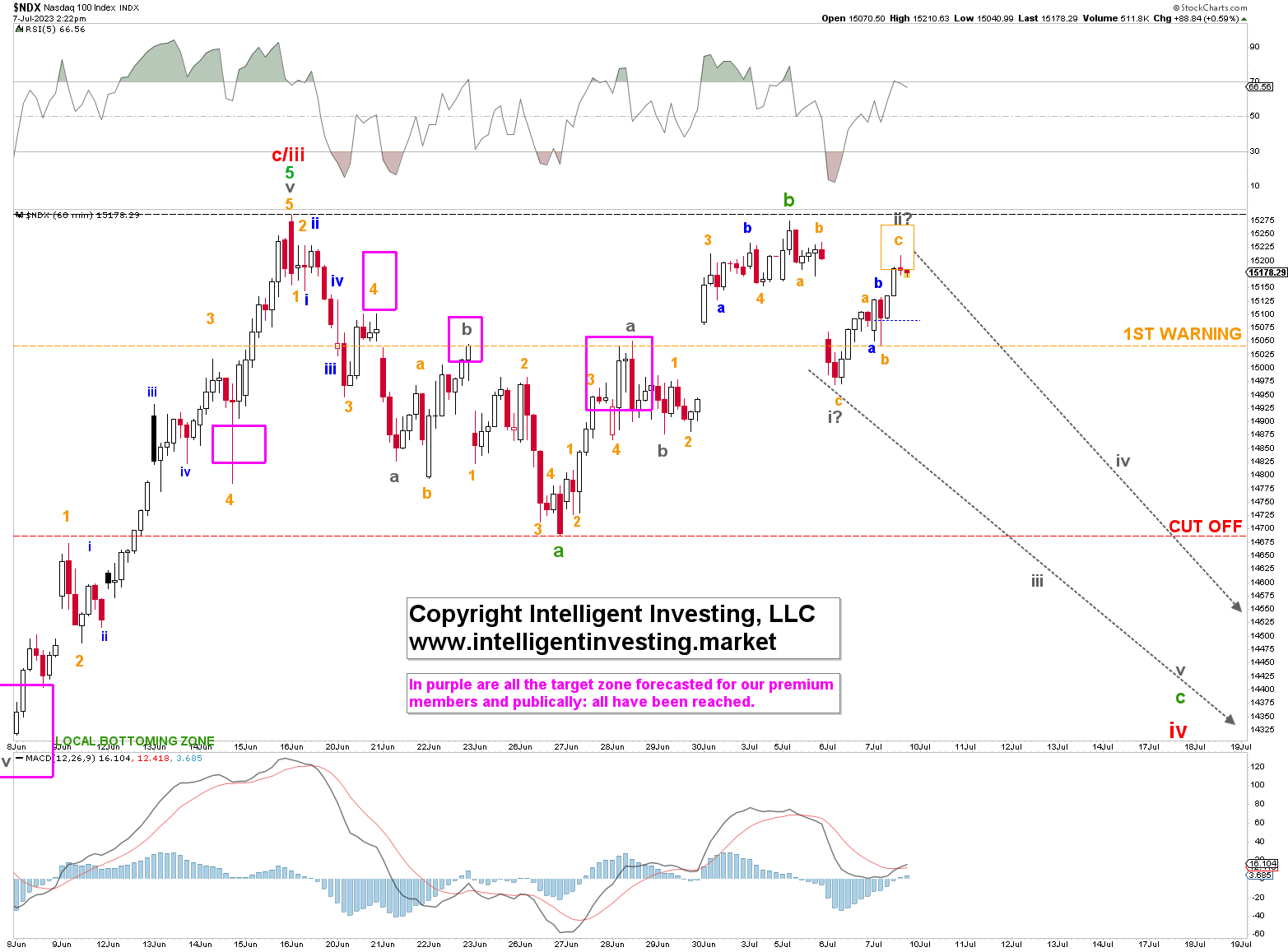

Fast forward, and the index topped that same day at $15044, dropped to $14689 four days later, and topped at $15275 this week. See Figure 1 below. Thus, despite all the news, reactions to economic reports, pundits, opinions, etc., the EWP has been able to accurately and reliably forecast where the index would top and bottom.

Figure 1

However, now things are getting a bit trickier. Allow me to explain.

Namely, the rally from the June 26 low into this week’s July 5 high ($15275) counts best as only three waves back up, which retested the previous June 16 high ($15284). Thus, we can label those import data points as green W-a and green W-b. See Figure 1 above.

Moreover, we know that “after three waves down, expect at least three waves back up.” Why’s that? Because corrections can always become more complex. In this case, we start with a simple zigzag (grey W-a-b-c) from the June 16 high to the June 26 low: three (3) waves lower. But a zigzag is also the basis for, e.g., a flat. That is a 3-3-5 corrective pattern. Thus, although after three waves lower, a correction can be considered complete, we must be mindful that it can morph into something more complex depending on new information that becomes available to the market. For example, yesterday’s hotter-than-expected ADP jobs report.

Yesterday, the index gave the bulls their first warning by dropping below the June 28 high. It has since rallied to close the opening gap. The NDX will have to fall again below that level, i.e., today’s low, to suggest the index is in grey W-iii of green W-c of red W-iv. Remember, c-waves in a flat comprise five waves and can either be an impulse or an ending diagonal. In this case, we are then likely dealing with a diagonal.

The anticipated pattern will officially be confirmed below the June 26 low, but below $14870 will already be a severe warning for the Bulls that $15500+ will have to wait a while, and the index should first revisit $13900-14230. Our thesis will be proven wrong on a break above $15284. In that case, we should expect, ideally, $15435-525.