January provides us with a wealth of information that gets our year off to a good start financially and emotionally.

The data is specifically chosen to begin in 2009 because that is the bottom of the most significant bear market prior to the 2022 bear market, and 2009 represents the beginning of an era of distinctly different execution of monetary policy by the Federal Reserve.

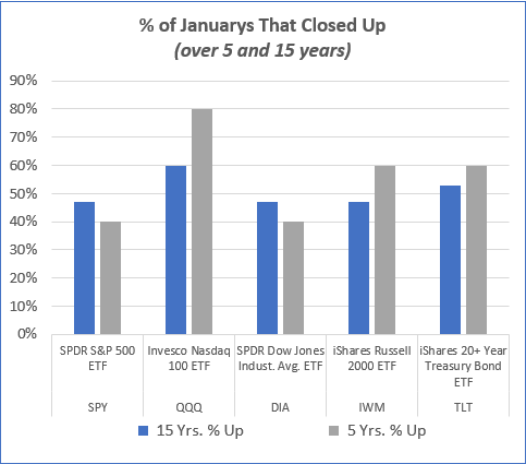

There’s clearly one index that stands out.

As you can see in the chart, QQQ is the best performer based on the percentage of times its January is positive.

However, a 60%-win rate over the last 15 years isn’t very impressive, and the other 3 stock indexes have been down more often than up over the 15 years.

So, one clear conclusion is that if you want to be long an index, QQQ has the best odds in January.

What's Next for Russell 2000?

Granddad Russell 2000 has been a stronger performer in January in the last 5 years.

We have started January 2024 thus far, weaker, but the real test will be 2-fold.

First, IWM holds 180.

Secondly, how IWM performs versus the 6-month high and low set in January.

This is the daily chart of IWM.

First, the horizontal green line will be the one that is reset this month for the new 6-month January calendar range.

IWM had a golden cross (the 50 DMA crosses above the 200-DMA) which puts this index officially in a bullish phase.

With a reversal top, we can see a 5-10% decline as normal. That puts the target anywhere between 195 and 185.

Thus far on the second day, IWM is trading around 195.

Important to note is that the Leadership indicator shows IWM trading on par with SPY. Given that SPY is typically not as strong as IWM in January, we do not want to see IWM underperform the SPY.

Lastly, our Real Motion Indicator shows a mean reversion and a golden cross between its 50 and 200-DMAs.

- We are encouraged that IWM is testing and holding support.

- We are encouraged that statistically, IWM has improved in January in the last 5 years.

- We are patient though, to see if Granny Retail XRT holds 70.00.

We are also patient on majorly adding discretionary swing trading positions until we see the January 6-month calendar ranges set.

ETF Summary

- S&P 500 (SPY) 480 all-time highs 460 underlying support

- Russell 2000 (IWM) 195 near-term support 180 major support

- Dow (DIA) Needs to hold 370

- Nasdaq (QQQ) 390 major support with 408 resistance

- Regional banks (KRE) 47 support 55 resistance

- Semiconductors (SMH) 160 major support and 170 now resistance to clear

- Transportation (IYT) Needs to hold 250

- Biotechnology (IBB) 130 pivotal support

- Retail (XRT) Tested 70.00 level which bulls need to see hold