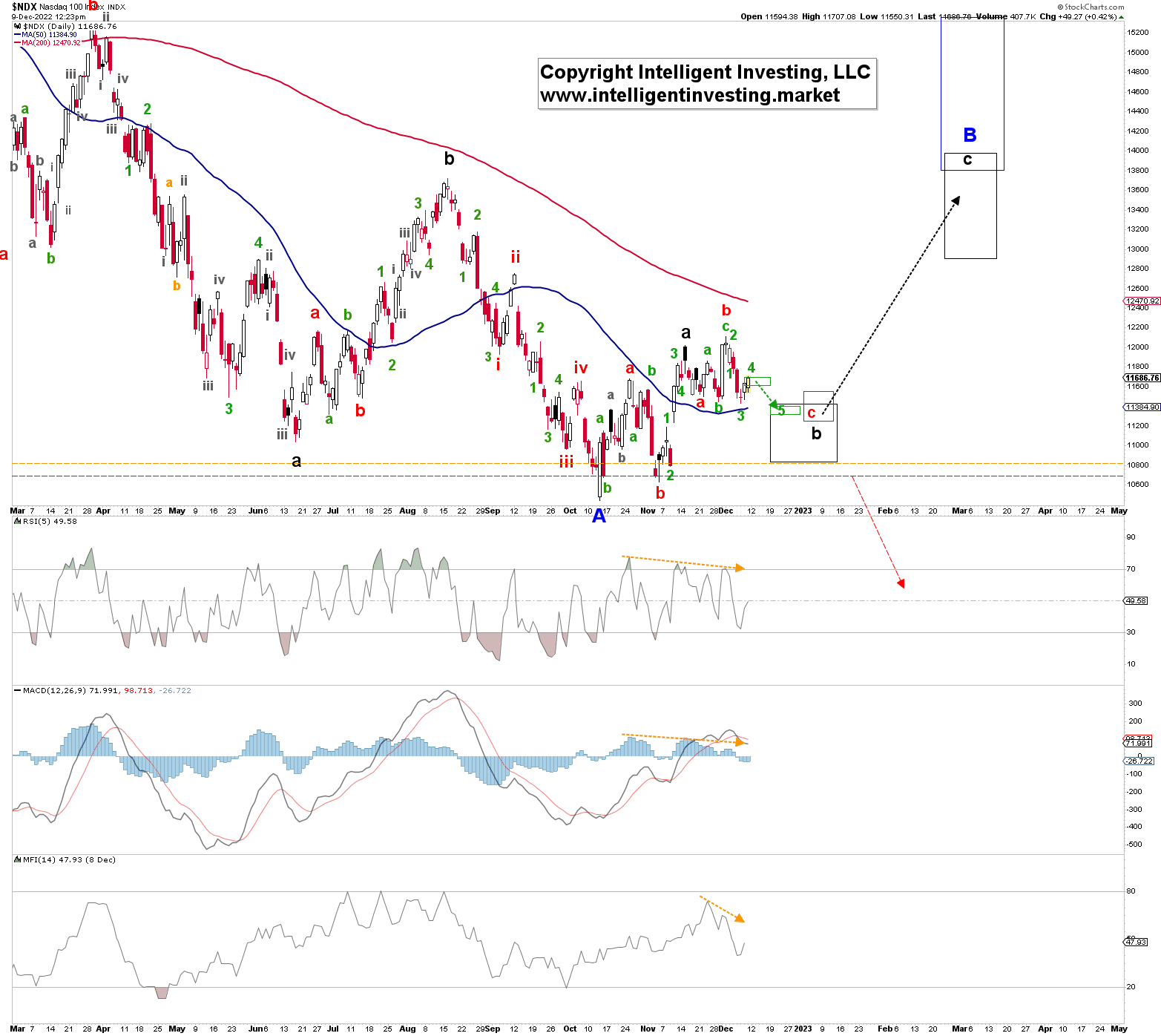

Last week (see here), we found for the Nasdaq 100 (NDX) using the Elliott Wave Principle (EWP):

"The primary expectation is that the index topped …. It should now be working on the final (red) c-wave lower to ideally $11300-11600 for the larger black W-b before the next rally (black W-c of blue W-B) to ideally $13.8-15.4K starts. The technical indicators look slightly tired, with negative divergences …, and ready to move lower."

The market validated our primary expectation and reached the ideal downside target zone set last week ($11432 on December 7 vs. the $11300-11600). Thus technically, it has done enough to consider all of the black W-b complete. See Figure 1 below.

However, since we are most likely dealing with an irregular expanded flat, a 3-3-5 pattern, the decline from the December 1 high (red W-b) should unfold in five waves. Thus I expect the current rally to fizzle out at around $11,700+/-100 for green W-4 before green W-5 takes hold to ideally $11,355+/-55 (green dotted arrow). That will bring the index even more profound and better into the ideal red and black target zones.

From there, my primary expectation is the next more significant rally (black W-c) to $13.4+-/-0.5K to complete the blue W-B. The index will have to rally back above the December 1 high to tell us "the dip" is already complete. Conversely, a break below $11,200 is a first warning for the Bulls the black W-c will not happen. The 2nd and final warning for the Bulls are at $10,800 and $10,700 (dotted orange and red horizontal lines), respectively.

Bottom line

Last Friday's decline was, in fact, "the initiation of the final decline to that W-b target zone before W-c starts." Thus, the "red W-c of black W-b lower" remains our primary battle plan. Short-term, we can expect the index to top out at around $11,700+/-100 before the last leg lower to ideally $11,355+/-55 kicks in. From there, the primary expectation is for a rally to $13.4+/-0.5K. Our contingency plan is that on a more immediate breakdown below $10,700 -with the first warning below $11,200- we will look for the index to reach the $9000s.

*Since financial markets are -like life in general- probabilistic, it has options. Thus, there's always a chance one's primary expectation is wrong, i.e., when the markets break above or below certain price levels determined by the EWP rules.* Thus, one must always have an alternative expectation available. This approach is no different from placing an actual trade. One has a primary expectation -based on high odds, say 10:1- the trade will become profitable. Why else place the trade!? But at the same time, one has a certain price level -the stop loss level- below (or above, in case one is short) the purchase price where one knows the trade is wrong and must be abandoned: the alternative. We also always hope the trade will be profitable, but we know with certainty, not all trades are consistently profitable. Understanding that trading and forecasting the markets using the EWP primary and alternative are the same, one can then use those invalidation levels determined by the EWP as one's stop loss levels for trading.