Before we can assess what’s next, we must evaluate what we know. Last week (see here) we found for the NASDAQ 100 (NDX):

“The Dow is now only 2% below [the August] high, while the NDX is still 16% below. Thus, because of the bifurcation, the more complex red W-iv … is still possible for the NDX. But because all other indexes confirmed their anticipated counter-trend rally, the more complex W-a, b, and c path … is now the preferred option. I have been tracking this option since late October, which is playing out reasonably well as anticipated.”

Besides, we have known over the last several weeks that per the Elliott Wave Principle (EWP),

“a break back above the September 6 low ($11928) will throw a wrench in the Bear’s work, with a severe warning above $11642, and tell us the anticipated multi-month Bear market rally challenging the August highs is already underway.”

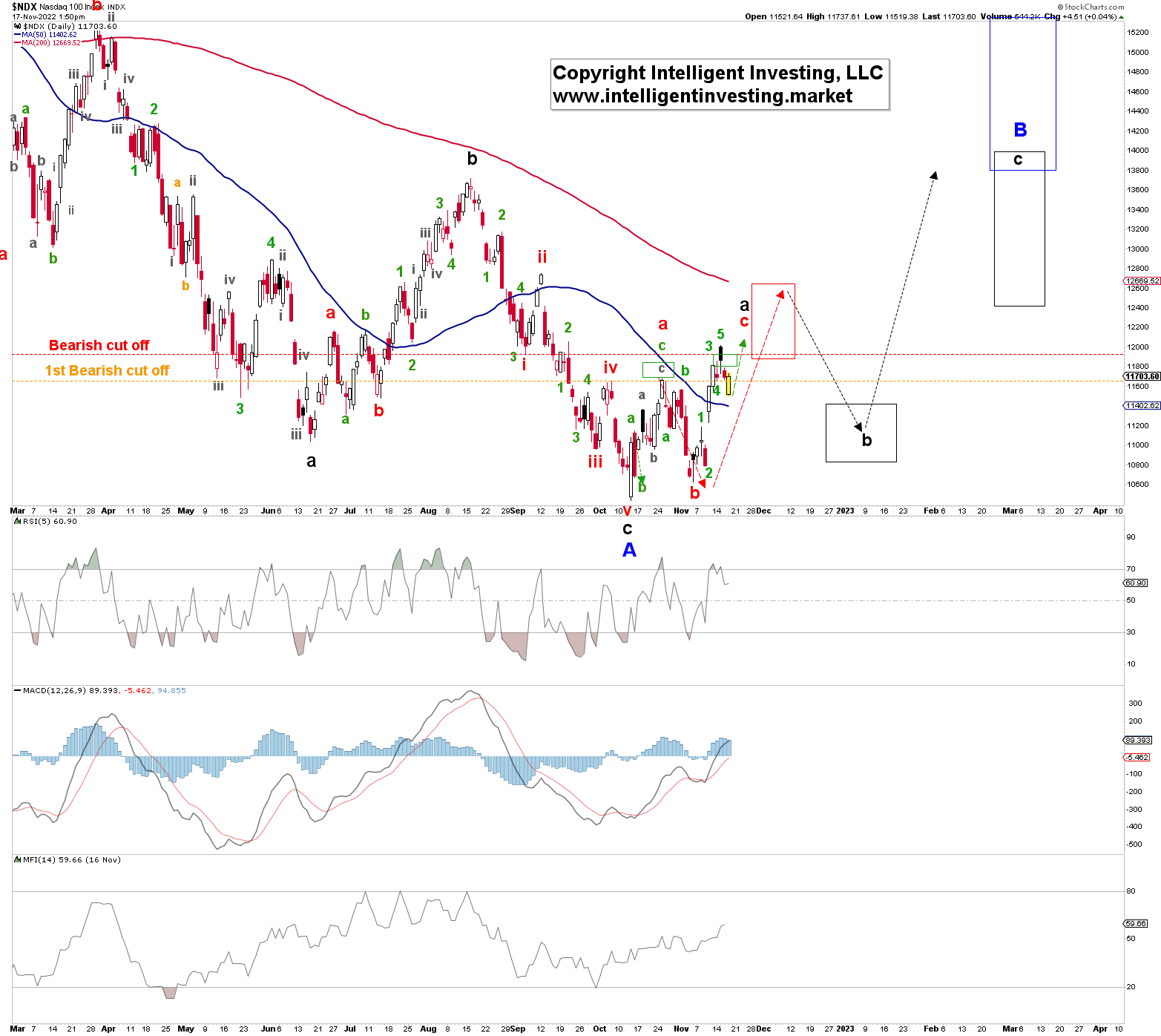

At last, like all other major US indexes, the NDX broke above that “pesky” $11928 level Tuesday this week. Thus, we can now focus on “the anticipated multi-month Bear market rally challenging the August highs” in the form of “the more complex W-a, b, and c path.” See figure 1 below.

On a smaller timeframe, the question is if Monday’s pullback was green W-4 of red W-c of black W-a, and Tuesday’s high was green W-5. Or if today’s low is that W-4.

In the former case, the price of the NDX will have to close below the orange “1st Bearish cut-off level”, which has acted as support this week. The black W-b target zone will then be our focus.

In the latter case, if the index cannot close below that level and instead closes back above the red “Bearish cut-off level,” then the green arrow is in play, targeting $12K. Possibly as high as $12.6K; the upper end of the black W-a ideal target zone.

Bottom line

Last week, we found that:

“Although the September 6 low ($11928) has not been broken yet, I am shifting focus for this index to the multi-month bear market counter-trend rally targeting ideally $13800-15400 as well.”

Changing my preferred POV was appropriate because the NDX broke above that price level this week. Now we are trying to nail the smaller degree waves, which is always fraud with less certainty due to the market’s increased variability, i.e., randomness, on shorter timeframes. As such, the general path laid out in late October remains our focus and is filling in rather well.

Once black W-a tops (ideally around $12-12.6K), I still expect a sizable pullback first (W-b) to ideally $11.2K +/- 200 before the next rally (W-c) starts to ideally $13.8-15.4K. I can narrow this target zone down once more price data becomes available.