- The US economy is showing strong resilience, leading some analysts to question whether we might see a "no landing” scenario for the economy.

- The possibility of the US economy avoiding a recession also implies that the Fed may have to raise interest rates by more than expected.

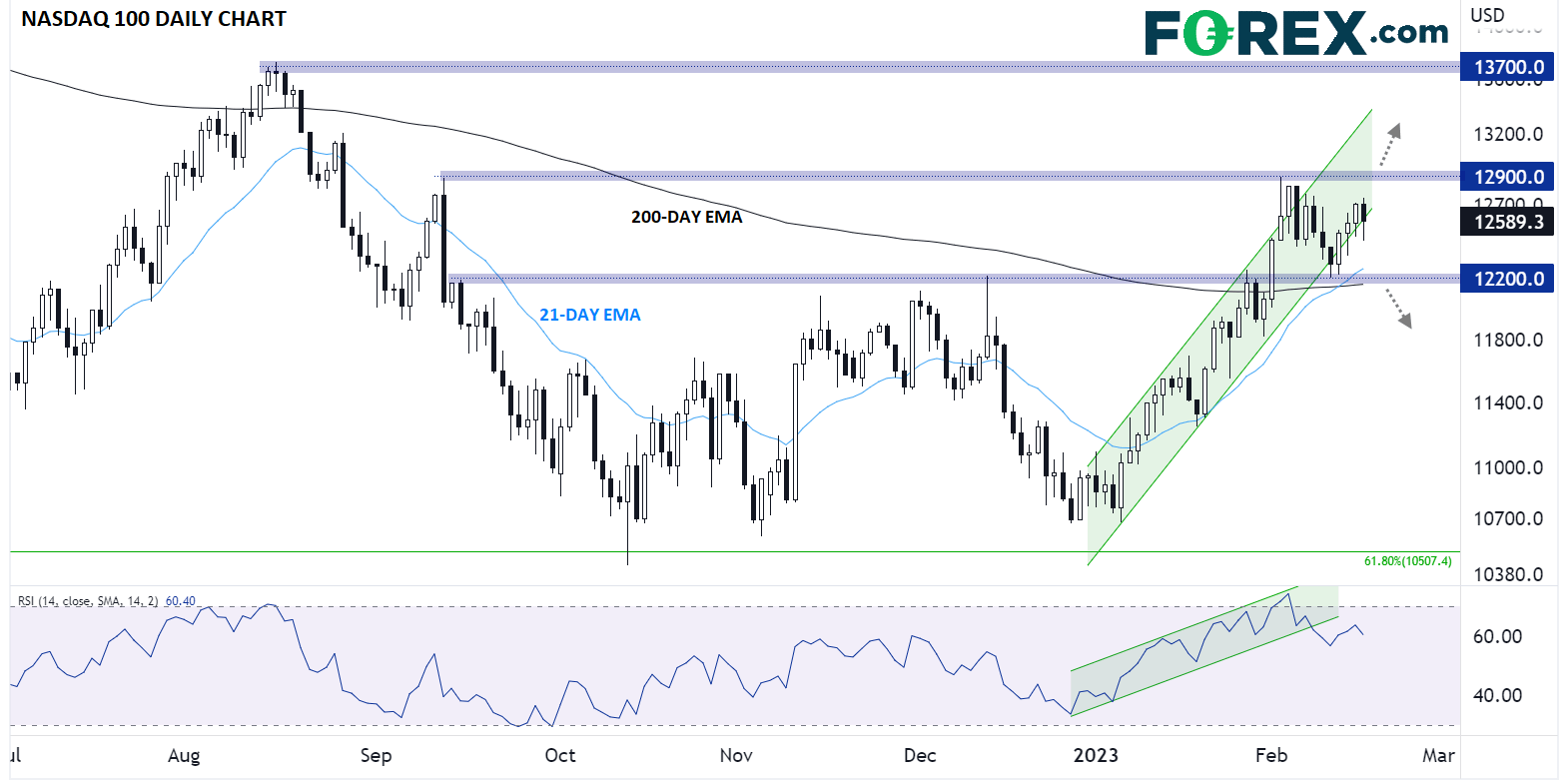

- Nadaq 100's price-action this week shows that the market is still divided over whether rising rates or a robust economy are more important to stocks.

What if We Don’t See a Hard or Soft Landing for the US Economy?

Heading into 2023, the big debate was how “hard” the global economy would fall. The so-called "hard landing" scenario involves a sudden and steep economic decline, with little to no time for central banks to implement policies to prevent it. This could lead to a recession or depression. A "soft landing" scenario is a gradual economic decline that central banks can mitigate with policies to avoid a recession.

The steady drumbeat of economic data that we’ve gotten so far has many analysts thinking that we may not see either of those scenarios play out this year.

Many strategists now foresee a scenario of "no landing," where the US economy maintains growth while central banks continue to impose restrictive policies. This has led banks like Barclays) to raise their growth and inflation forecasts for the US, which is supporting risk assets like indices. The picture in the stock market is not clear, however, with bulls and bears still battling over what matters more: rising rates or a resilient economy.

What a “No Landing” Scenario Would Mean for Fed Policy

The "no landing" scenario is looking increasingly likely, given the resilience of the US economy. This scenario implies that central banks will continue implementing restrictive policies like higher interest rates for longer.

This is supported by the latest fund manager survey from Bank of America, where investors are less pessimistic about the economy than a few months ago. Only 24% of respondents expect a recession, compared with 77% in November, though the number of investors expecting a rate cut in the next 12 months is at the highest since March 2020; recent figures will likely see that figure contract sharply in the coming months.

Fed officials are taking the latest inflation data (including this week’s hotter-than-expected CPI and PPI reports) as a signal that interest rates will need to move back to higher levels to ensure that inflation continues to fall. The market debate is now centered on whether the economy's interest rate sensitivity is higher than previously assumed and whether the neutral rate should be higher.

Nasdaq 100 Technical Analysis

As the “no landing” scenario has gained credence, traders are divided over what matters more to stocks: rising rates or a resilient economy. This week’s trading reflects this, with the Nasdaq 100 gapping lower before rallying to close on a positive note every day so far as traders weighed still-high prices against recent economic and earnings data that give a scant sign of a serious slowdown.

Source: TradingView, StoneX

Looking at the chart, prices are still barely hanging within the year-to-date bullish channel, though the 14-day RSI has already broken below an equivalent channel. The most immediate levels to watch are the previous resistance at 12,900, with a break above there opening the door for a potential continuation toward 13,700, and 12,200, a logical first downside objective if the channel is definitively broken this week.