Medium-term technical outlook on Nasdaq 100 (US Tech 100)

Key Levels (1 to 3 weeks)

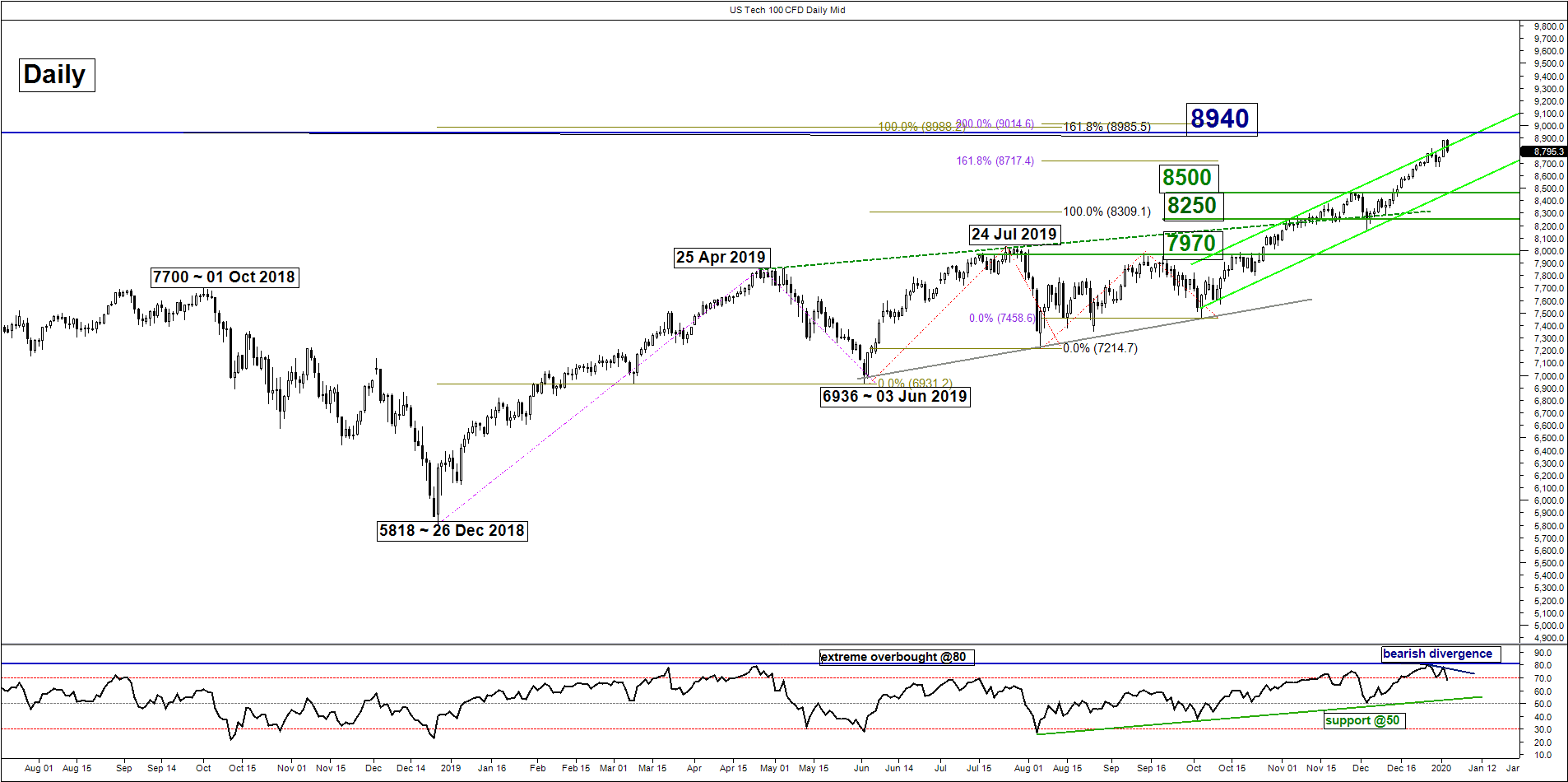

Pivot (key resistance): 8940

Supports: 8550/500 & 8250/180

Next resistance: 9170

Directional Bias (1 to 3 weeks)

In our previous report on the US Tech 100 (proxy for Nasdaq 100 futures) dated on 12 Dec 2019, the Index has rallied as expected and met the upside target/resistance of 8720 (printed a current intraday fresh all-time of 8889 in today’s Asia session). Interestingly, the latest push up is just a whisker away from a major resistance of 8940.

Flip to a bearish bias below 8940 pivotal resistance for a potential multi-week corrective decline sequence to target the next supports at 8550/500 and 8250/180 within a major uptrend.

On the other hand, a clearance with a daily close above 8940 invalidates the bearish scenario for the “high-flying Index” to reinsert its bullish tone for another push up to target 9170 (1.00 Fibonacci expansion of up move from 03 Oct 2019 low to 28 Nov 2019 high projected from 03 Dec 2019 low).

Key elements