I last wrote about the NDX:VXN ratio in my post of January 23.

At time of writing yesterday, it was trading in between two important price levels, namely, 500 and 550, as shown on the following daily ratio chart.

The RSI is sitting just below the 50 level, the MACD has formed a bullish crossover, and the PMO is preparing to cross over to the upside.

However, a recent bearish moving average Death Cross formation awaits above, as mentioned in my post above.

Failure of this ratio to break and hold above 550, then break and hold above the 200-day moving average (currently around 668), will signal more weakness, indecision, and volatile swings ahead for the Nasdaq 100 Index (NDX).

A drop and hold below 500 will signal extreme weakness in the NDX and the Technology Sector.

The MicroSectors™ FANG+™ Index 3X Leveraged ETN (NYSE:FNGU), mentioned in my post above, managed to hold above 20.00, then break back above 25.00, as shown on the following monthly chart.

Price action in between major resistance at 30.00 and major support at 25.00 is very thin, and there's not much to stop it from retesting the 20.00 level, or plunging even lower.

The February candle is being supported, thus far, by weak Buyers, as depicted on the Balance of Power indicator below.

So, watch for a drop and hold below 500, then 400 for the NDX:VXN ratio and a drop and hold below 25.00, then 20.00 for FNGU as a sign that extreme weakness is in store for the Nasdaq 100 Index and the Technology Sector.

Otherwise, look for further volatility and extreme swings in both directions in the NDX, the Technology Sector, the NDX:VXN ratio, and the FNGU ETN for the foreseeable future.

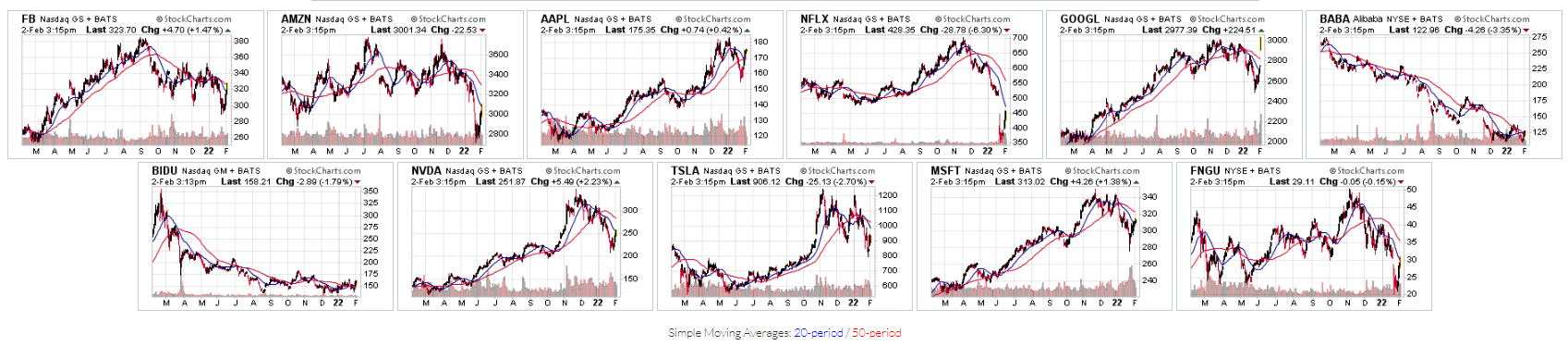

P.S. By the way, apparently Twitter (NYSE:TWTR) has been replaced by Microsoft (NASDAQ:MSFT) in the FNGU ETN basket of stocks. The following revised one-year daily chart-grid of FNGU and its 10 stocks incorporates this update.