Novartis AG (NYSE:NVS) announced that its Chief Executive Officer (CEO), Joseph Jimenez will step down from his position in 2018. Vasant Narasimhan, M.D., Global Head of Drug Development and Chief Medical Officer, will replace him effective Feb 1, 2018. Narasimhan is a member of the Executive Committee and joined Novartis in 2005.

Narasimhan led the Consumer Health Division and was the Division Head of Novartis Pharmaceuticals.

Novartis is currently going through a transitional stage. In March 2015, Novartis acquired certain oncology products and pipeline compounds from GlaxoSmithKline plc (NYSE:GSK) for $16 billion. In exchange, it sold its non-influenza Vaccines business to Glaxo for $7.1 billion.

In January 2015, Novartis divested its Animal Health Division to Eli Lilly (NYSE:LLY) for approximately $5.4 billion.

The company’s blockbuster drug, Diovan, is facing stiff generic competition in the United States, EU and Japan. Gleevec lost exclusivity in the United States in February 2016. The company also lost patent protection for the drug in EU in December 2016 leading to generic competition. The loss of patent protection for these top-selling drugs continue to hurt sales.

Of late, the performance of the Alcon business has been quite disappointing due to lower surgical equipments sales as a result of competition faced by intraocular lens and a slowdown in demand for equipment purchases. Despite the restructuring initiatives of the company, the segment’s performance remains dismal. In particular, the surgical business is taking longer to turnaround.

Hence, Novartis is mulling strategic options for Alcon which includes retaining the business to separation via capital transactions such as a spin-off or an initial public offering. The company will throw light on its plans for Alcon later in 2017.

Last week, the company got a boost when the FDA has approved its breakthrough gene transfer treatment, Kymriah (tisagenlecleucel) suspension for the treatment of patients up to 25 years of age with B-cell precursor acute lymphoblastic leukemia (ALL). The approval opens up new frontiers in the treatment of cancer by advancing immunocellular therapy for children and young adults with r/r B-cell ALL which comprises approximately 25% of cancer diagnoses among children under 15 years and is the most common cause of childhood cancer in the United States.

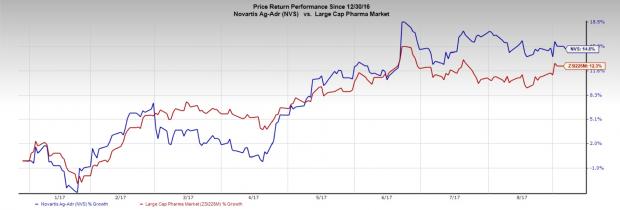

Novartis stock has rallied 14.8% in the year so far compared with the industry’s 12.3% gain.

Zacks Rank & Key Pick

Novartis currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the healthcare sector is Aduro Biotech, Inc. (NASDAQ:ADRO) which carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Aduro Biotech’s loss per share estimates narrowed from $1.44 to $1.32 for 2017 and from $1.33 to $1.24 for 2018 over the last 30 days. The company delivered positive surprises in two of the trailing four quarters with an average beat of 2.53%.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month. Learn the secret >>

Eli Lilly and Company (LLY): Free Stock Analysis Report

Novartis AG (NVS): Free Stock Analysis Report

GlaxoSmithKline PLC (GSK): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

Original post

Zacks Investment Research