Covered call writing and selling cash-secured puts are considered conservative, low-risk option strategies. Naked option trading is acknowledged to be a more speculative approach to trading options. In the case of covered call writing especially, this is confirmed by the fact that brokerages require a higher level of trading approval for naked option trading than for covered call writing. Moreover, our government permits covered call writing in self-directed IRA accounts but not naked options. This was confirmed by a recent Department of Labor ruling. In this article we will compare covered call writing (selling call options after owning the underlying security) and selling naked call options.

Rationale to covered call writing

Covered call writers look to generate monthly cash flow by leveraging an underlying security that displays outstanding fundamentals, technicals and meets our common sense parameters (like minimum trading volume). The degree to which we are bullish on the stock or exchange-traded fund (ETF) and our overall market assessment will dictate the strike price we select.

Rationale to naked call-selling

When a call option is sold without owning the underlying security, the option seller is neutral to bearish on the stock or ETF. It’s like shorting a stock (borrowing the stock from our broker and then selling it with the expectation to buy it back at a lower price). We expect the value of the option to decline so we can buy it back at a lower price or allow it to expire worthless. Although both strategies involve selling call options, covered call writing has a bullish outlook on the underlying while naked call-selling has a bearish perspective where we want the market price to be below the strike of the call we sold, so that it expires worthless. Selling naked calls should be executed when we expect the underlying stock to fall or stay flat.

When naked calls are sold we are obligated to selling the stock at the strike price if assigned. Sincethe naked call seller does not own the shares of the stock when assigned, those shares must be purchased at the current market price. This is the reason that brokerages require a margin account for individuals who wish to sell naked calls. It is also the reason that selling calls is considered an options strategy with high risk and requires a high level of trading approval. Stock prices can go up exponentially, and so the risk of a naked call is unlimited. Most of us should avoid naked call selling.

Real-life example with SWHC

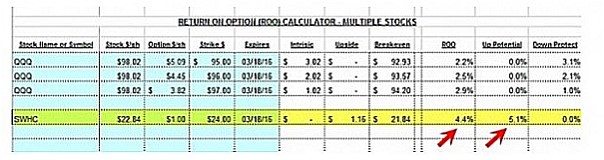

On 2/15/2016, Smith & Wesson Holding Corporation (NASDAQ:SWHC) was trading at $22.84 and the March 18, 2016 $24.00 call option had a bid price of $1.00. If we sold three contracts, our initial returns would be $300.00 less small trading commissions. Let’s first feed this information into the multiple tab of the Ellman Calculator for covered call writing:

The row highlighted in yellow shows an initial 1-month return, of 4.4% with the possibility of an additional 5.1% if share price moves up to the $24.00 strike. Note how an increase in share price results in a positive additional return.

Delta and changing option prices

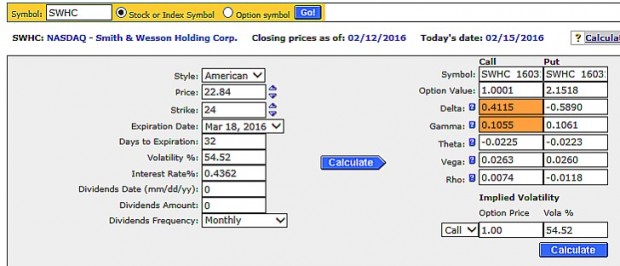

If naked calls had been sold and share price started rising, the option-seller may be required to buy the shares at a price higher than the strike or buy back the option to avoid exercise. As share price moves higher, the option value will also rise by its Delta. Using a Greek Calculator, let’s have an initial look at the potential risk from a Delta perspective:

In the cells highlighted in brown, we see a Delta of 0.41 and a Gamma of 0.10. If the price of SWHC rises by $2.00, the cost to buy back the option would be about $2.00 based on current Delta and Gamma stats.

What if share price moves to $28.00 by expiration?

Covered call writing perspective

We have generated a 9.5%, 1-month return and can either allow our shares to be sold at the strike or roll the option if appropriate.

Naked call selling perspective

Uh oh…If assignment is allowed, shares would need to be purchased at $28.00 and sold at $24.00 for a loss of $1200.00 ($4.00 x 300 shares). Since $300.00 was generated initially, that would result in a position loss of $900.00. If we bought back the option to avoid assignment near expiration, the intrinsic value of the $24.00 strike would be $4.00 plus a small time value component, let’s say $0.10. This would compute to a net position loss of $930.00.

Discussion

Naked call selling and covered call writing are both forms of option-selling but they reside in two completely different risk galaxies…one conservative and low-risk; the other radical and high-risk. Of course, along with high-risk comes the possibility of higher returns. It is crucial to align the strategies we embrace with our personal risk tolerances and trading comfort levels.

Market tone

Global stocks moved lower on the week in volatile trade as markets reacted to the possibility that the United Kingdom may vote to leave the European Union next Thursday. Crude oil prices fell to $47.27 per barrel from $49.31 last week. The Chicago Board Options Exchange Volatility Index (VIX) rose to 19.16 from 16.02 last week. This week’s reports and international news of interest:

- The Federal Open Market Committee this week voted unanimously to keep rates unchanged and indicated that the path for future rate hikes will likely be more gradual than the committee had forecast in March

- The Bank of Japan, the Bank of England and the Swiss National Bank (SNB) all held policy steady this week

- The Japanese central bank lowered its inflation outlook, potentially setting the stage for additional policy action in July, while the SNB warned that the franc is significantly overvalued due to safe-haven buying ahead of the Brexit vote

- Brexit concerns surged as the vote nears and a change in opinion polls in favor of the “Leave” camp put markets on edge this week

- Despite the fact that retail sales and industrial production data in China met market expectations, fixed asset investment was weak, raising concerns that China may not be able to sustain its 6.5%–7% growth target this year

- More global sovereign debt is trading with negative interest rates, with the yield on 10-year German bunds dipping below zero for the first time and Swiss 30-year bonds doing the same. UK 10-year gilts fell to a record low of 1.10%

- IMF warns on political risk to eurozone recovery relating to next week’s Brexit vote, about the EU project could derail the eurozone’s fragile recovery

- After labeling it a carcinogen 25 years ago, the World Health Organization this week reversed course and said not only does coffee not cause cancer, it may actually guard against certain cancers

THE WEEK AHEAD

- US Federal Reserve Chair Yellen delivers the Fed’s semiannual monetary policy report to the US Congress on Tuesday and Wednesday, June 21st – June 22nd

- The UK referendum on EU membership takes place on Thursday, June 23rd

- Global flash purchasing managers’ indices for June are released on Thursday, June 23rd

- US durable goods orders data are released on Friday, June 24th

For the week, the S&P 500 declined by 1.18% for a year-to-date return of +1.35%.

Summary

IBD: Uptrend under pressure

GMI: 4/6- Buy signal since market close of May 25th

BCI: Cautiously bullish but not entering new positions until a market assessment can be made after the Brexit decision later this week. I am 1/3 in cash from exercise of all in-the-money strikes. Without the upcoming Brexit decision, I would have rolled several of those positions. In addition to Brexit, Janet Yellen will be testifying before Congress this week.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The charts are demonstrating signs of a neutral short-term outlook. In the past six months the S&P 500 and the VIX have both moved up about 2%, a mixed picture.