As dividend investors—and closed-end fund (CEF) investors, specifically—we know to stay the course when market corrections hit: we don’t want to sell and cut off our precious payouts!

That’s the opposite of the fanboys and girls who dabble in crypto, profitless tech stocks, NFTs and God knows what else. When recessions arrive, they’re free to bail—though they always do so way too late. Then they’re forced to sit and watch what’s left of their cash get devoured by inflation!

By staying the course, we don’t have to worry about those risks: with our CEFs’ high yields, we can sit tight during rocky times, happily collecting our payouts until things calm down.

In fact, we can do more than just sit tight—we can look to one reliable indicator that tells us when the next recession will arrive (hint: it says there isn’t one on the horizon now). When our “recession signal” goes off, we can pick up CEFs that boost our income and smooth out our volatility. We’ll discuss two below.

But first, let’s talk about that recession signal, which you’ve probably heard of: the yield curve.

The Recession Predictor With A 100% Success Rate

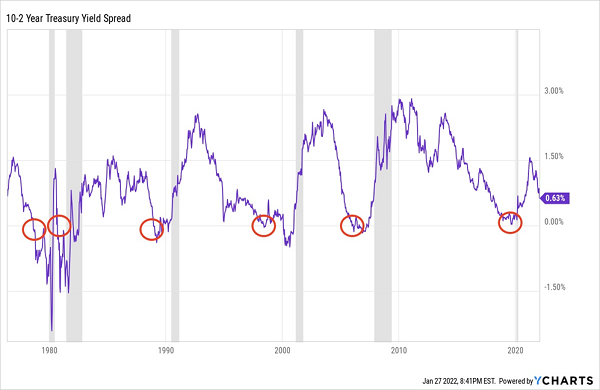

This chart shows the difference between the 10-year US Treasury yield and the 2-year US Treasury yield. As I write this, the former is 1.816% and the latter is 1.196%. Thus the “spread” between the two is 0.62, a positive number.

That makes sense. After all, when you buy a 10-year Treasury, your money is locked up for a decade, so you should be compensated for that lack of liquidity. As you can see in the chart, that’s how things normally go.

But six times over the last 45 years, that number has gone negative, meaning investors were getting less interest for holding a longer-term bond. That makes no sense! When it happens, it’s called an inverted yield curve. And every time this setup occurs, a recession follows, often within six to 18 months.

So if we want to predict the next recession, we just need to watch the Treasury yield curve and, once it flips, we know a recession is coming.

How To Beat The Next Recession (With “No-Drama” 7%+ Dividends)

This is where our high-yield closed-end funds (CEFs) give us a big advantage because we always demand a discount when we buy. That’s because a CEF with a deep discount to net asset value (NAV, or the value of the fund’s portfolio) can act as a “shock absorber” for our portfolio, as it’s tough for a deep-discounted fund to get cheaper!

We saw that in action with the two healthcare CEFs in our CEF Insider portfolio, the Tekla Life Sciences Investors (NYSE:HQL) and Tekla Healthcare Investors (NYSE:HQH) funds, which both traded at discounts around 11% in early March 2020.

As you can see in the chart below, this duo didn’t fall as far as the S&P 500 when the crash hit, and they bounced back faster (and higher) than the market as their discounts narrowed to around 7% by the end of the year:

CEF Insider Holdings Rode Their Discounts Through The 2020 Chaos

What’s more, both funds historically yield from 7% to north of 9%. And as the return above includes dividends, much of it was in cash.

Municipal-Bond CEFs Cruise Through Corrections

We don’t need to just rely on our discounts here: we can give ourselves another layer of protection by adding funds that actively reduce their own volatility (and boost our income, too). Take CEFs that hold municipal bonds, which are much less volatile than stocks and offer high dividends that are tax-free for most investors. Both of those strengths make them great options in tough times.

To see what I mean, consider the BlackRock Municipal Income Trust (NYSE:BLE) and the BlackRock MuniYield Quality Quality Closed Fund (NYSE:MQY), both of which I spotlighted in my Monday column. Both survived the last two recessions (they haven’t been around to see more than that) and made money along the way.

Muni-Bond Funds Sail Through Rough Waters

And we shouldn’t discount the value of that tax-free-income benefit. Right now, BLE yields 5.3%, which is healthy enough on its own, but that could be the taxable equivalent of an 8.8% payout for you if you’re in the highest tax bracket. Similarly, MQY’s 5.1% yield could be the same as an 8.1% payout on a taxable stock or fund for a high earner.

Covered-Call Funds Give You “Toned-Down” Stock Exposure

Another option is a covered-call CEF, which sells call options (contracts that give buyers the option to buy the fund’s assets at a fixed price in the future in exchange for cash now).

That’s a smart way to generate income because the stock either gets sold at the fixed price—called the “strike price”—or it doesn’t. Either way, the fund keeps the payment the buyer makes for this right, called the premium, and hands it to shareholders as part of their dividend. This strategy does particularly well in volatile times like today.

A popular covered-call CEF is the Nuveen S&P 500 Dynamic Overwrite Fund (NYSE:SPXX). As the name suggests, it holds the stocks in the S&P 500, so its portfolio looks much like that of a popular index fund, such as the SPDR® S&P 500 (NYSE:SPY), with Apple (NASDAQ:AAPL), as its top holding, followed by Microsoft (NASDAQ:MSFT), Alphabet (NASDAQ:GOOGL), Amazon.com (NASDAQ:AMZN), and Tesla (NASDAQ:TSLA).

But unlike SPY, which yields a minuscule 1.3%, SPXX gives you a serious dividend payout of 5.8%, thanks to its smart dividend strategy.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."