Last week I put the finishing touches on the 2017 End of Year Special Edition of the Weekly Macro Themes report - something which is fast becoming a tradition here! The report brought together the charts that worked (as well as those that didn't!), some honorable mentions, the ones to watch in 2018, a few fun charts at the end, and of course - the topic of this blog post - my favorite charts of 2017. These are my favorites for a few reasons, they might have been about a critical issue or may have simply been a new way of looking at something. Anyway, I hope you enjoy them, and be sure to check out the report (which is being made available as a one-off free download to my followers).

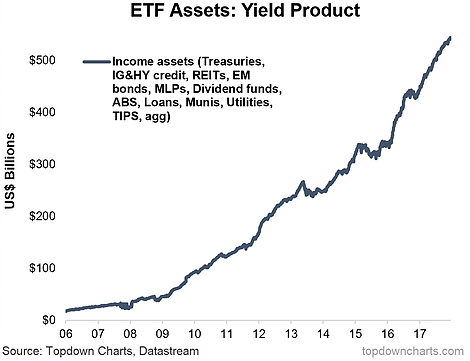

1. Global lending standards and the global GDP weighted monetary policy rate (3 Nov 2017) “However one reason for optimism is the point that global (DM focused) lending standards remain easier and at an aggregate level monetary policy rates remain low.”

I like this one because it brings in 2 really key gauges of global monetary policy settings and financial conditions, and provides a unique view.

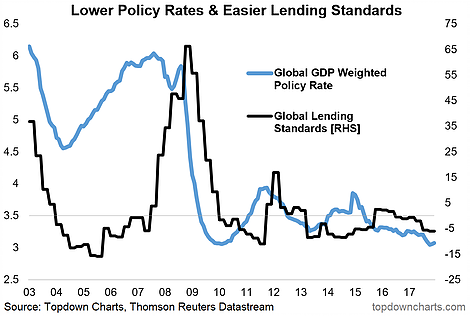

2. Tax takes and GDP growth (10 Feb 2017) “While there are many factors at play, the rise of general government receipts as a % of GDP could be a contributing factor to the slowing of GDP growth through time for OECD countries.”

I like this one because, while only one factor, it's fairly intuitive and a relatively clear link.

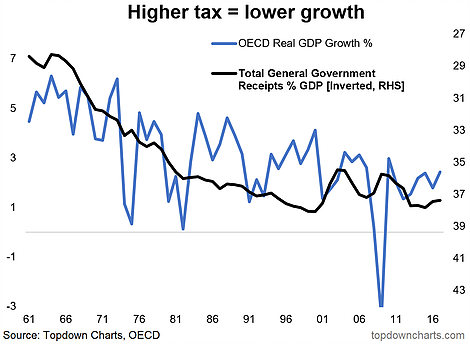

3. Retail investor cash allocations – about as low as it gets [signs of capitulation buying] (2 Jun 2017)

I like this one because it shows just how stark the exodus from cash has been; some of the exodus has been to bonds (to get more income) but mostly it's to stocks by active reallocation and market driven drift. Again, at the time it was a unique view - you saw it here first!

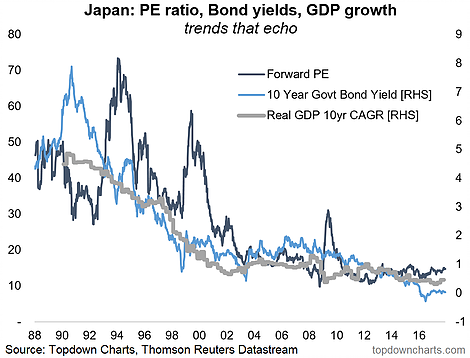

4. On the mantra that low bond yields are automatically a good thing for stocks… (4 Aug 2017) “The conundrum of valuation, risk free rates, and growth in Japan”

I like this one (again a unique chart) because it dispels the notion that low bond yields automatically equal higher valuations. In this case low bond yields came with lower GDP growth and hence lower PE ratios - thus higher bond yields equally may not mean lower valuations.

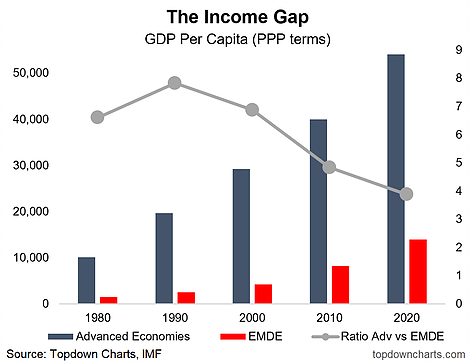

5. The income gap (EM vs DM): (14 Apr 2017) “The ratio of DM to EMDE GDP per capita went from a high of 8x in 1990 to below 5x in recent years - while it's unrealistic to expect parity there is still scope to move on this with trends like productivity gains, structural reforms, and the impact of technology on inclusion and enabling.”

This is a bit of a feel good chart in that it shows a closing of the gap between the rich and poor at a high level (looking at developed vs EM and developing countries).

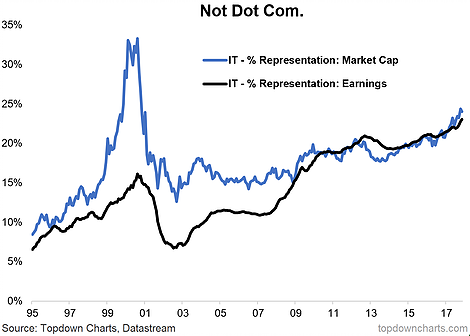

6. Market capitalization and earnings share of the S&P 500 [tech sector]. (7 Jul 2017) “Not Dot Com”

This one because it shows the big contrast in now vs 2000 with the tech sector now accounting for a much larger share of S&P 500 earnings: it really is the "new economy" now.

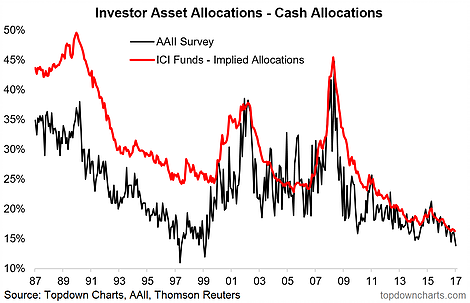

7. The great yield rush… (4 Aug 2017) “The yield oriented ETF market has ballooned to over half a trillion dollars.”

This one, again a unique view, shows one facet of the amazing surge in income assets; a product of the search for yield (both a reflection of demographic shifts and cyclical factors like QE).