Ignore the pundits’ petrified bleating over rising interest rates. Sure, the yield on the 10-Year Treasury has spiked to 2.9%, but you’re still not retiring on it!

Look at it this way: if you dropped, say, $500,000 into Treasuries tomorrow, you’d still only get $14,500 in income. That’s just a hair over the poverty line of $14,342 for two people aged 65+ living under one roof.

That’s an insult after a lifetime of hard work!

And it’s exactly why I’m going to show you 3 simple steps you can take to rack up safe dividends that average 6.6% now (and some go well beyond 9.4%).

That’s more than double the yield on the 10-Year and triple the pitiful 1.9% you’d get from the typical S&P 500 stock. Plus there’s easy double-digit upside for you here, too.

The Key to Retiring Rich

At the core of my 3-step income secret is a set of poorly understood investments called closed-end funds. (If you’re not familiar with CEFs, don’t worry; our CEF “professor,” Michael Foster, has written a simple-to-follow primer you can access here.)

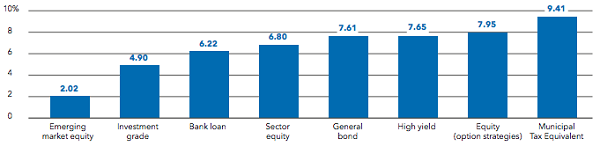

CEFs deserve a spot in your portfolio for one simple reason: dividends! Look at the latest numbers from BlackRock showing the average yields on the main CEF sectors.

Where the Biggest Yields Live

Source: BlackRock October 2017 Closed-End Fund Market Review

When you average these sectors out, you get a gaudy 6.6% payout. So if we swing back to our investor sitting on a cool half-mil, they’d be getting a tidy $33,000 income stream from your “average” CEF. That’s more like it!

(CEFs’ high dividends are the reason why I’ve included them in my powerful new “8% Retirement Portfolio.” It’s custom build to hand you a safe $40,000 income stream on your $500k investment. You can read all about it here.)

The “Stodgy” Dividend Play That Pops Like a Small Cap

Which brings me to the other benefit you might love even more than CEFs’ outsized payouts: a predictable shot at fast double-digit upside.

That stems from one figure you can easily find on any CEF screener worth its salt: the discount to net asset value (NAV), or the difference between a CEF’s market price and what it’s underlying portfolio is worth.

We don’t have to get into detail here; the upshot is this: getting in on a CEF trading at a big discount to NAV can unleash exciting gains as that markdown slams shut (or better yet turns into a premium to NAV).

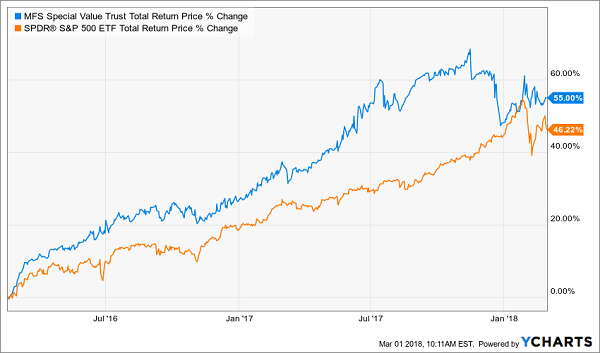

This is the fun part of investing in CEFs—and it’s exactly what happened for folks who bought the MFS Special Value Trust (NYSE:MFV) in February 2016. At that time, MFV traded at a totally unusual 12% discount to NAV.

Fast-forward to today, and it trades at a 2.6% premium. That huge swing acted like an afterburner on the share price, driving it to a huge gain in just 2 years:

Disappearing Discount Ushers in a 27% Win

It gets better: if you throw in MFS’s massive dividend (it yields 9.8% as I write), you get a return that easily tops the market:

Putting It All Together

And don’t forget that half of that gain was in cash!

Today, with MFV well into premium territory, that “discount afterburner” is spent—and I never buy CEFs at a premium, especially when there are still plenty of bargain funds out there.

Which brings us to the first step in my 3-part CEF-buying strategy:

Step 1: Watch the Relative Discount

A hefty discount isn’t much good if that window never closes. That’s why you need to look beyond a fund’s current discount to its historical discount to see if you’re seeing an unusual pattern you can profit from … or just another laggard (which, to be perfectly honest, most CEFs are).

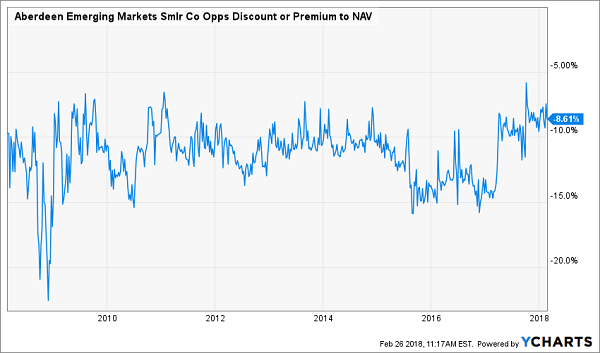

Take the Aberdeen Emerging Markets Smaller Company Opportunities (NYSE:ABE), which trades at a 7.6% discount to NAV. Sounds great, right? Too bad ABE’s been bumping along at a big discount for years.

ABE: Always on Sale

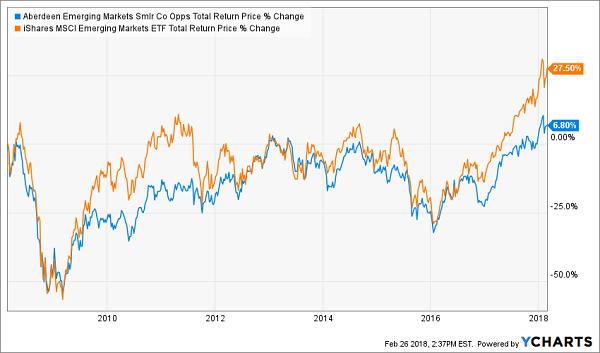

No wonder the fund has badly trailed the iShares MSCI Emerging Markets ETF (NYSE:EEM) over the past decade—even with dividends included!

Flat Discount = Flat Returns

In the past 12 months, ABE’s average discount to NAV has averaged 9.5%, and the 52-week low is 14.4%. That means the current discount is more likely to widen, not draw closer to NAV, weighing down ABE’s share price even more.

Step 2: Don’t Obsess Over Fees

Many folks flee from CEFs before they even get started. Why? Because they look at the fees, compare them to what they pay on passive ETFs … and that’s where the conversation ends.

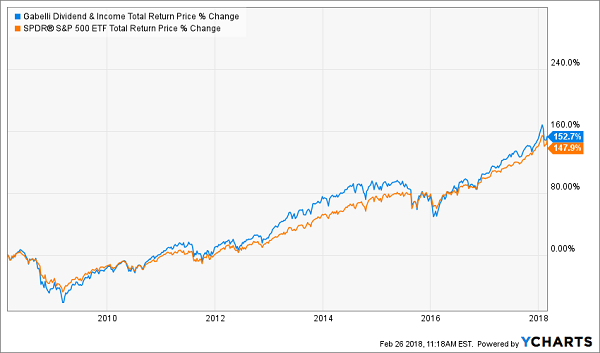

After all, with the likes of the SPDR S&P 500 ETF (NYSE:SPY) charging almost imperceptible fees of 0.09%, what to make of CEFs like, say, the Gabelli Dividend & Income Closed Fund (NYSE:GDV), which charges 1.4%?

Answer: that 1.4% gets you inside the mind of famed value investor Mario Gabelli, who manages GDV. With CEFs, top-flight management is a must—and well worth paying for. GDV is the perfect example: it’s outperformed SPY in the last 10 years, fees included:

This Pro Earns His Salary

GDV’s win may look narrow, but again we’re talking total returns (including dividends) here, and this fund is throwing off a 5.8% yield today—more than tripling SPY’s payout—so a big chunk of this gain was in cash.

I’m happy to pay GDV’s 1.4% fee for a return like that. And also keep in mind that CEF fees come out of the fund’s NAV, so it’s not like you’re getting a bill here.

Step 3: Be Careful When You Buy New

It often pays to wait till a CEF has at least a couple years of history behind it, because these funds always trade at a premium in the early going. That’s because the IPO costs weigh down the fund’s NAV, pulling it lower than the share price, and it can take a while for this to work itself out.

Take the RiverNorth Doubleline Strategic Inc R, which launched in late September 2016. Today you can grab shares at a 5.9% discount to NAV, but if you’d bought at the IPO, you would have paid a 2.2% premium. Ouch!

You can see this happening again with the latest IPO, the Dreyfus Alcentra Global Credit Income 2024 Target Term Fund, Inc. (DCF), which launched in October 2017 with a 1.6% premium. That rose as high as 3.8% in November before turning south. DCF now trades at a 1.9% discount.

My prediction: that markdown will likely widen further before heading back for premium territory, so hold off a while before even thinking of giving this fund a look.

An “Extra” $40,000 in SAFE Income This Year—Here’s How

As I just showed you, when you combine a big discount to NAV and a fat dividend yield, you get nothing less than the perfect retirement investment.

That’s why CEFs make up half of my powerful 8% “No-Withdrawal” retirement portfolio.

Here’s a little more detail on the 3 retirement lifesavers you’ll find in this breakthrough collection of investments:

- A 9.1% payer trading at a ridiculous 7.5% discount to NAV: This bargain-priced bond fund is run by one of the smartest minds in the business. Your strategy here is simple: BUY, grab that incredible yield and wait for your upside as the discount vanishes—as it must.

- An 8.8% payer with a buyback secret! Every time this one moves lower, management executes its smartly run buyback plan, throwing a floor under the share price and setting it up for “locked in” upside.

- A totally ignored 8.5% payer that not 1 in 1,000 people even know about.

When you add these 3 funds to the 3 other under-the-radar investments (including one with a breathtaking 9.7% dividend!) in this portfolio, you get 3 advantages you simply can’t find anywhere else:

- A sky-high average 8.0% payout that delivers a cool $40,000 yearly income stream on your $500,000 nest egg!

- Monthly dividends, as almost all of these investments drop cash into your pocket every month, not every quarter.

- Unbeatable safety, thanks to the portfolio’s incredible diversification across just about every asset class you can think of—preferred shares, REITs, US stocks, foreign stocks, bonds and more.

All the top-secret investments in this one-of-a-kind portfolio are waiting for you now, and I can’t wait to take you on a free tour.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."