If you have cash to deploy in this market, you’re in luck: dividend yields on some top-name stocks are scraping historic highs. And these same stocks are often so oversold they’re primed for big upside, too.

The obvious question follows: how do you find these income-and-growth plays? Let’s dive into a two-step “screen” that does just that. It starts with the lifeblood of share prices (and dividends): corporate earnings.

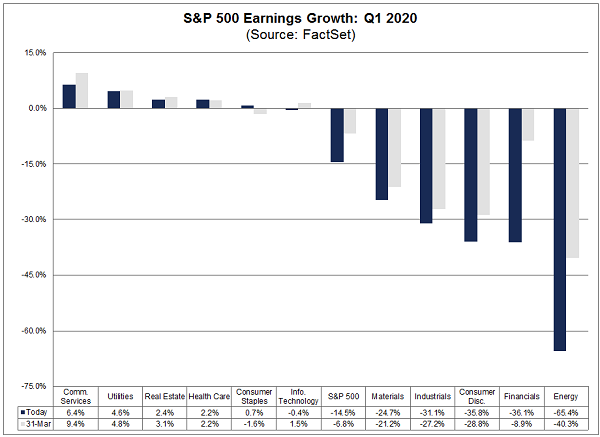

Unfortunately, growing profits are getting rarer these days. Look at this chart from FactSet, showing projected earnings for the just-completed first quarter, as more S&P 500 firms report:

Earnings Drop, But Look to the Left

So far, it appears that most companies will see earnings declines in the first quarter of 2020, but when we take the market apart sector by sector, we see that there are a few sectors, like consumer staples, utilities and health care, showing rising earnings—and in the case of utilities and telecoms, significant earnings gains.

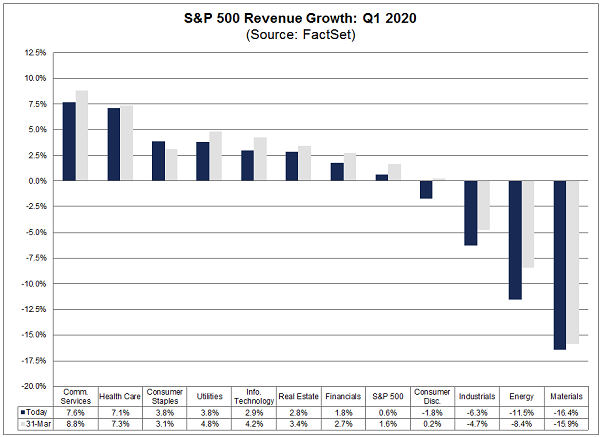

You can see a similar pattern with sales, which makes sense as people keep paying their utility and cellphone bills, while healthcare providers’ services remain in high demand during the pandemic:

Crisis Hits Sales—But Not Everywhere

Finding Pockets of Value

Of course, it’s one thing to say that earnings are rising in a particular sector, but that doesn’t give us much of a bargain if shares of these companies are rising at the same pace—or faster—than profits. So, are shares of utilities, communication services and healthcare firms being fairly valued for their resilience?

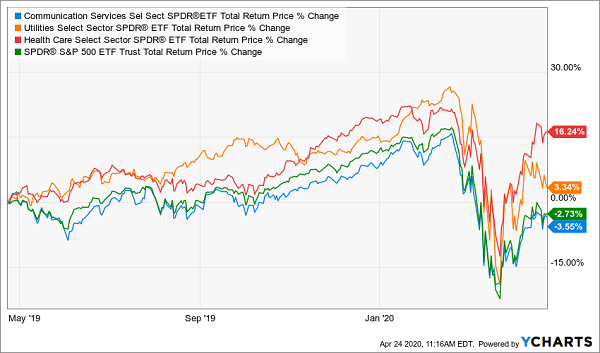

Let’s take a look, using the benchmark Communication Services Select Sector SPDR ETF (XLC), in blue below, the Utilities Select Sector SPDR ETF (NYSE:XLU), in orange, and the Health Care Select Sector SPDR ETF (NYSE:XLV), in red, over the last 12 months:

The Blue Line Is Way Too Low

As you can see, our communication-services ETF, XLC, is the only one that’s down from a year ago, as of this writing, and is trailing the S&P 500 in that time, too. That’s an obvious undervaluation for a sector that’s primed to lead the way in sales and profits in Q1—and a crystal-clear indicator that it’s not too late to buy some of these companies now.

So what do we mean, exactly, when we refer to communication services?

The top components of this sector (a relatively new one, by the way, which S&P only defined a couple years ago) are the kinds of companies that are benefiting from the shutdown, like Facebook (NASDAQ:FB), Alphabet (NASDAQ:GOOGL) (GOOG), T-Mobile (TMUS), Electronic Arts (NASDAQ:EA) and Netflix (NASDAQ:NFLX). These are the companies that Americans and much of the world are more dependent on than ever. And yet this sector is underperforming the market!

You can bet that the market will rectify this situation, and likely sooner rather than later, which makes now a good time to move in.

The Income Angle

The companies I just mentioned aren’t especially well known for their dividends, but other firms in this sector are. AT&T (NYSE:T), for instance, is well known for decades of dividend growth and generous payouts; the telco now yields 7%, making it one of the highest-yielding stocks in the S&P 500. This is also one of the biggest yields in the company’s history—the highest coming when it was yielding over 7.6% back on March 23.

Historically High Income Up For Grabs

Of course, AT&T’s massive payout will come down as its stock price recovers, but you can pick up this company and other high-yielding stocks in this sector, like Verizon (NYSE:VZ)—current yield 4.3%—and lock in big upfront payouts that will grow as these companies raise their dividends.

This Crushes AT&T’s Payout (and Delivers 20%+ Gains, Too)

I’ll cut right to the chase: this crisis has triggered a flashing BUY warning on my 4 top investments now.

And no, none of them are communication-services stocks—we’re going for much bigger upside than the AT&Ts of the world can give us! Instead, we’re going hunting in the (very profitable) “backwaters” of the stock market. I’m talking about a place far too few investors (including the big institutional players) bother to go.

That’s fine—more room in the dividend shopping aisles for us!

The investments I’m pinpointing are called a closed-end funds (CEF). They’re an unusual type of fund that can—and regularly does—deliver 8%+ dividends and fast 20%+ price upside, often in the very same fund.

The 4 CEFs I’m pounding the table on right now do just that: they pay huge 8.4% average dividends now, and my models have them primed for 20%+ price upside in the next 12 months!

I know what you’re thinking: how can that possibly be, given the crisis we’re facing today.

That’s the beauty of buying CEFs as absurdly cheap as these ones are—their totally unusual valuations give their share prices stability. So, even if the market does fall hard from here, these 4 dynamic funds will likely simply trade flat, and we’ll still collect their solid 8.4% dividends!

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."