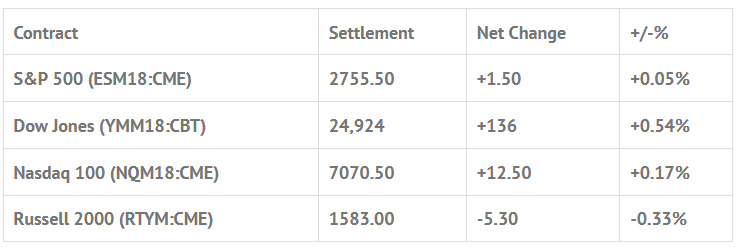

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed lower: Shanghai Comp -0.63%, Hang Seng -0.12%, Nikkei -0.58%

- In Europe 8 out of 12 markets are trading higher: CAC +0.27%, DAX +0.52%, FTSE +0.24%

- Fair Value: S&P +4.07, NASDAQ +25.01, Dow +18.93

- Total Volume: 766k ESH and 1.9mil ESM; 2.5k SPH, and 3.0k SPM traded in the pit

Today’s Economic Calendar:

Quadruple Witching, Housing Starts 8:30 AM ET, Industrial Production 9:15 AM ET, Consumer Sentiment 10:00 AM ET, JOLTS 10:00 AM ET,and the Baker-Hughes Rig Count 1:00 PM ET.

S&P 500 Futures: Long Slow Grind

The S&P 500 futures (ESM18:CME) dropped down to 2745.00 in the blink of an eye during Wednesday nights Globex session, then rallied all the way up to 2762.50, and opened at 2757.00 on Thursday mornings 8:30 CT futures open. After the open the ES traded up to 2761.00, sold off down to 2751.50, rallied back up to 2760.50, double topped, and then sold down to the 2754 area before rallying up to a new high of 2767.50 at 10:30 CT.

Once the high was in, the ES started to grind lower. Around 12:45 a headline hit that special counsel Mueller had subpoenaed the Trump organization, demanding documents about Russia, and other documents, and the ES sold off down to 2745.75, just three ticks off the overnight Globex low. From there, the futures went on to rally back up to 2752.00, and then pulled back to a higher low at 2646.25, rallied and sold off again to a higher low at 2748.00, and then pushed up to 2755.25. The ES pulled back down to 2751.00 on the 3:00 cash close, traded up to 2757.25 just before the 3:15 futures close, and went on to settle at 2755.50, up +0.25 handles, or +0.01%.

The best trade setups were buying Wednesday night when the ES dropped down to 2745.00, and selling the early rally yesterday morning. The rest of it was a chop-shop. All week long the ES rallies have failed, but we think that may change during todays quad-witching.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.