Saturday saw Australians head to the ballot boxes in what was expected to be a foregone conclusion for the centre-right Coalition government.

But it’s 2016, and as we’ve seen from the Brexit shambles, there is an obvious disconnect between the demographic who participate in pre-election polls, and the wider community.

While the archaic, manual counting process of the Australian Electoral Commission mean that we wont know final results until Wednesday onward, the tightness of the initial count means that no matter what the final numbers show, Australia has a hung parliament.

The lower house crossbenchers including multiple Independents and a Green will hold the keys to which major party will be able to form government, with neither now able to do it on their own.

With Prime Minister Malcolm Turnbull calling this election in order to solidify the Coalition’s majority by ‘cleaning out the minor parties in the senate’, the fact Australia sent a higher proportion of votes away from the major parties show a clear political disconnect with the current government.

Moving onto markets and on the back of the above uncertainty, AUD/USD gapped down 45 pips on the open as expected:

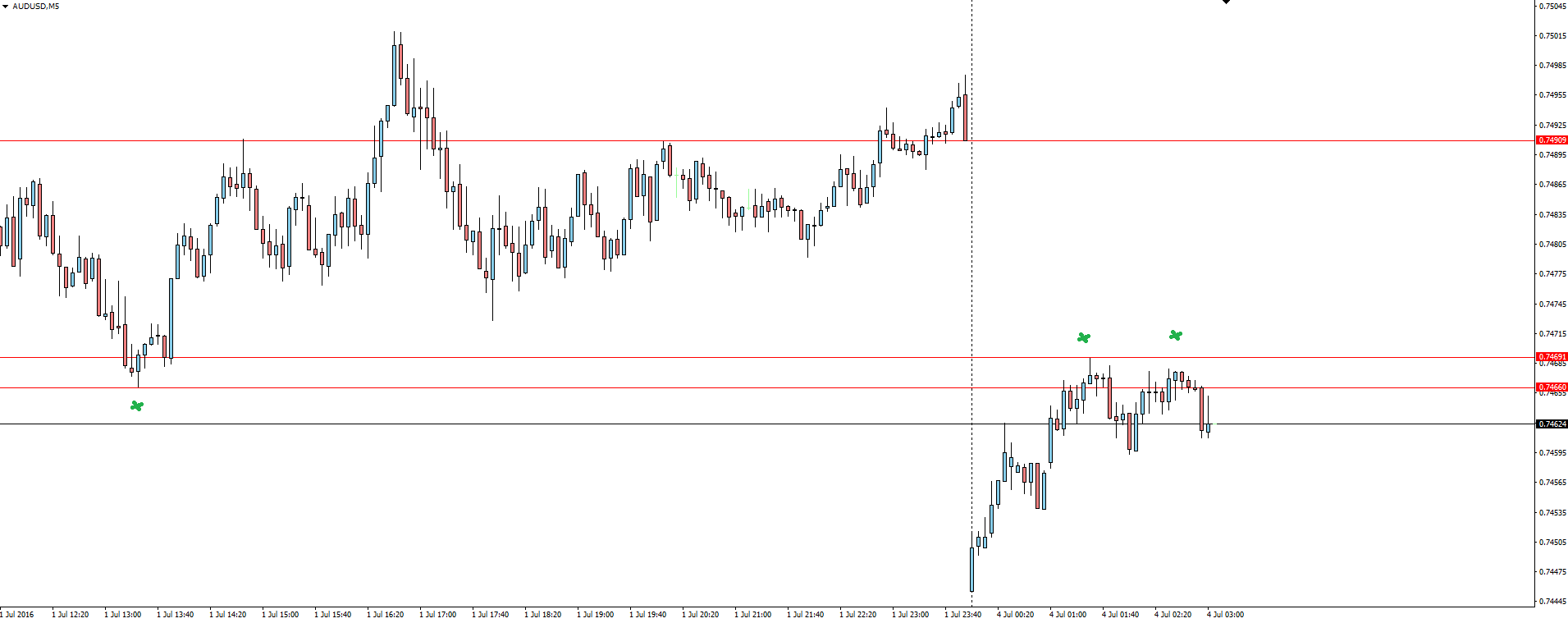

Since the gap, price has started to pull back, but three hours into the session at time of writing and we’re starting to stall at the previous intra-day swing high:

Adding to interest in the Aussie Dollar is the fact that tomorrow just happens to also be the first Tuesday of the month. Yes that’s right, it’s RBA day too!

Tue Jul 5 (Tomorrow):

AUD Cash Rate

AUD RBA Rate Statement

While the RBA (and markets) have conceded that a post-Brexit global economic landscape will mean more rate cuts are guaranteed, it is however highly unlikely that the RBA will choose to move tomorrow while the uncertainty of a probable hung parliament hangs over the economy.

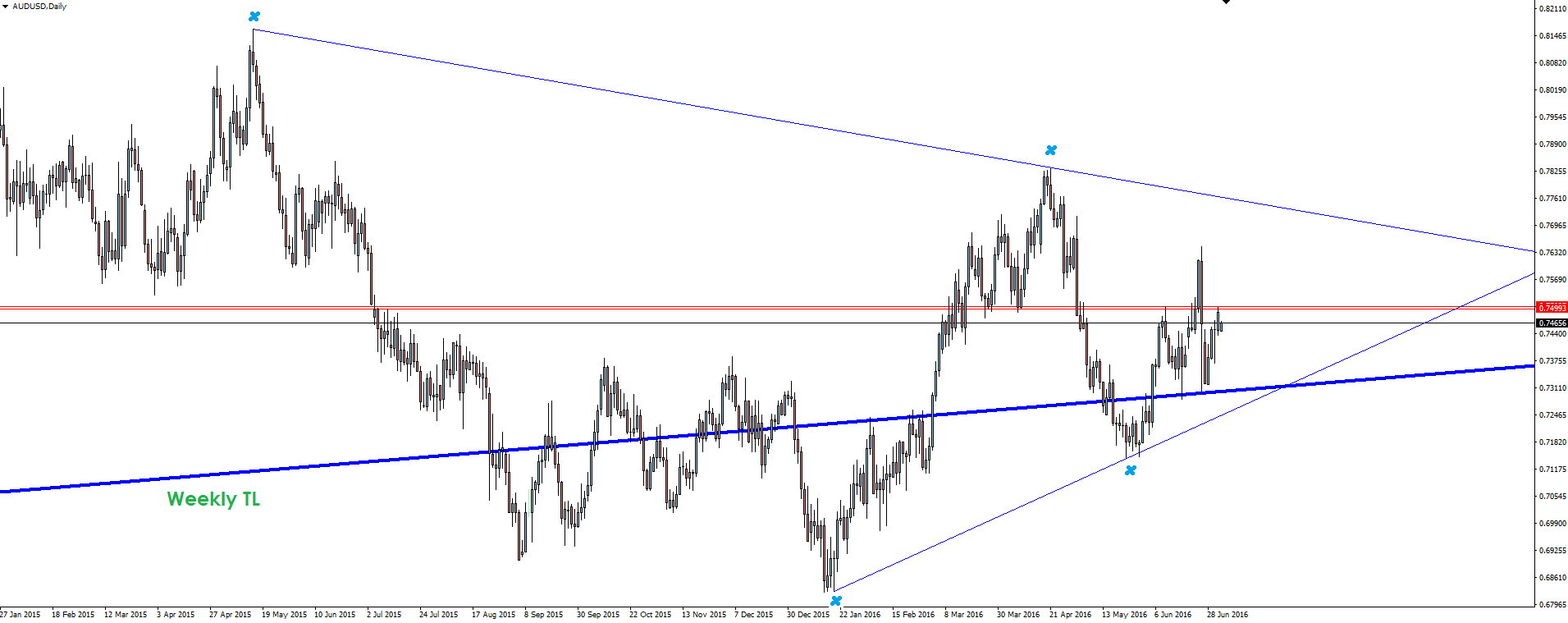

AUD/USD Daily:

The bigger AUD/USD picture is still that price has bounced out of weekly support in a wider bearish USD market and this short term instability will most likely be pushed to the background as we head deeper into this NFP week and Fed policy comes back to the fore.

Make sure you’re not getting caught up in short term, domestic noise in a currency pair affected by so much more. Keep your higher time frame levels marked and manage your risk accordingly.

On the Calendar Monday:

USD Bank Holiday (Independence Day)

AUD Building Approvals m/m

GBP Construction PMI

“Independence Day of the United States, also referred to as the Fourth of July or July Fourth in the U.S., is a federal holiday commemorating the adoption of the Declaration of Independence on July 4, 1776, by the Continental Congress declaring that the thirteen American colonies regarded themselves as a new nation, the United States of America, and no longer part of the British Empire.”

Dane Williams – @VantageFX

Risk Disclosure: In addition to the website disclaimer below, the material on this page prepared by Forex broker Vantage FX Pty Ltd does not contain a record of our prices or solicitation to trade. All opinions, news, research, tools, prices or other information is provided as general market commentary and marketing communication – not as investment advice. Consequently any person acting on it does so entirely at their own risk. The experts writers express their personal opinions and will not assume any responsibility whatsoever for the Forex account of the reader. We always aim for maximum accuracy and timeliness, and FX broker Vantage FX shall not be liable for any loss or damage, consequential or otherwise, which may arise from the use or reliance on this service and its content, inaccurate information or typos. No representation is being made that any results discussed within the report will be achieved, and past performance is not indicative of future performance.