The renowned MoviePass and its parent company Helios & Matheson (OTC:HMNY) shut down operations this past weekend due to an inability to turn a profit. MoviePass had all the workings of a genius tech start-up but was unable to execute its business model effectively. What does this mean for other unprofitable public companies?

Helios took shareholders on a wild ride over the past 5 years, with its share price looking like stairs to a cliff that Helios ultimately fell off.

The Business

MoviePass was a subscription-based business model that mimicked Netflix (NASDAQ:NFLX) only for movie theaters. It allowed users to watch up to one movie per day for only $9.99 per month. This subscription was a no brainer for anyone who goes to the theater even occasionally. The breakeven price is merely one movie ticket per month.

This whole idea sounded too good to be true, and it ended up to be precisely that.

MoviePass dropped its price from $40 to $9.99 per month in August of 2017 by CEO Mitch Lowe, a former Netflix exec. His strategy was to gain lucrative partnership deals with big theater chains like AMC (NYSE:AMC) and Cinemark (NYSE:CNK) for discounted tickets. The hope was that economies of scale would allow the firm to grow and that the company would eventually profit off of user data.

The issue was that theaters didn’t want to play ball with this newcomer attempting to leach revenue right from under them. MoviePass ended up having to pay full price for all of its users’ tickets which meant that the more users that the company had the larger its loss.

MoviePass had over 3 million users by June of 2018 but were losing almost double what they brought in, and funding was running thin. Helios finally ran out of money and shut down the program this past weekend.

Big theater chains saw an enormous opportunity once MoviePass shut down and are offering their own subscription movie passes. AMC is offering something called Stub A-List which it launched in June to fill the void that MoviePass is leaving. The big theater chains had no reason to play ball with an outsider like Helios when they could just watch it bleed dry and launch their own ticket subscription.

Implications for Unprofitable Tech Startups

MoviePass was undoubtedly a great idea, and its adaptation by the larger theater chains after its demise proved that. Helios’s inability to partner with the larger player in the industry was the core of its demise, losing $100s of millions of investors’ money.

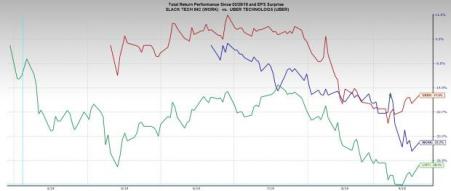

This is also proof that a good idea with strong customer demand doesn’t always turn out to be a good investment. This a cautionary tale for investors that have positions in recent IPOs like Lyft (NASDAQ:LYFT) , Uber (NYSE:UBER) , and Slack (NYSE:WORK) . All unprofitable and unproven businesses models. These stocks are down a substantial amount since their IPOs earlier this year.

WeWorks upcoming IPO is struggling to attract investors with its expected public valuation being less than half of what its most recent round of funding valued the company at. Investors are becoming increasingly skeptical about unprofitable firms.

California is in the midst of passing a ground-breaking bill that would make Uber and Lyft drivers employees instead of independent contractors. This could have significant adverse effects on the cost structure of both these ride-hailing firms if the bill becomes widespread.

Take Away

The global economy and markets worldwide are in a tumultuous state with trade uncertainty and negative interest rates being the catalyst. The EBC just announced a rate cut and along with a bond-buying stimulus program, while the Federal Reserve is expected to drop rates another quarter basis point this month.

Stocks like UBER, LYFT, and WORK are all seeing share price depreciation because investors don’t know when or if these companies will turn a profit. The rockier the markets become, the less attractive these unproven business models appear. MoviePass’s cautionary tale should be considered before investing in one of these types of companies.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +24.6% per year. So be sure to give these hand-picked 7 your immediate attention.

See them now >>

Netflix, Inc. (NFLX): Free Stock Analysis Report

AMC Entertainment Holdings, Inc. (AMC): Free Stock Analysis Report

Cinemark Holdings Inc (CNK): Free Stock Analysis Report

Uber Technologies, Inc. (UBER): Free Stock Analysis Report

Slack Technologies, Inc. (WORK): Free Stock Analysis Report

Lyft, Inc. (LYFT): Free Stock Analysis Report

Helios and Matheson Analytics Inc (HMNY): Get Free Report

Original post

Zacks Investment Research