The fourth quarter of 2018 was an outright horror, with the S&P 500 total return index dropping a stunning 9% in December alone. Since 1988, there were only six months that saw steeper declines. It is the type of month that does not happen often, and we can only hope that it does not happen again for a very long time.

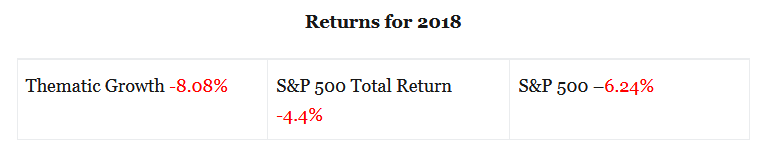

For the full quarter, the S&P 500 total return fell a stunning 13.6% giving up all its gains from the first nine months of the year. The S&P 500 total return index (which is inclusive of dividends) managed to finish the year down by 4.4%, while the S&P 500 (which does not include dividends) dropped 6.24%. We, unfortunately, did not fare any better, with the MCM Thematic Growth Composite declining by 8.08% including all fees and transactions costs.

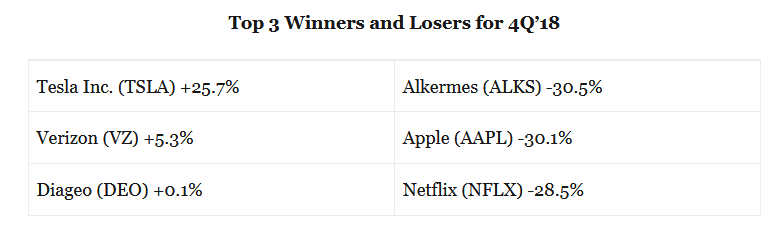

There is no sugar coating these results; some of our portfolio stocks were hammered during the quarter, with only 3 of the 18 rising. Also not helping was the overall market volatility that made the losses in stocks that were already falling steeper and more severe.

The losers were the driving story of the quarter.

An FDA advisory panel decided to vote against Alkermes’ depression treatment ‘5461, rendering full FDA approval highly unlikely. Additionally, the company presented data in December for its schizophrenia treatment ‘3831. The drug did show efficacy, but the data underwhelmed investors. This latter drug has the potential to find a viable user market and create value for the company, but to sit in the stock for another 2 to 3 years waiting for the drug to reach prospective patients is not a good use of investible resources at this point, and the steep pullback in the broader market has created too many other opportunities. Therefore, the stock was removed from the portfolio during the first few weeks of January.

Apple (NASDAQ:AAPL) dropped sharply as investors became concerned about iPhone sales and slowing global growth, an issue made more uncertain by the trade war with China, Apple’s second largest market. In our opinion, many of these market jitters are overblown, and the stock seems exceptionally oversold at current values. It is becoming increasingly apparent that Apple’s future is not the iPhone, but instead its iOS software, services, and wearable businesses, all of which are growing much faster than iPhone sales. Apple did provide solid second quarter guidance recently, which has helped the stock rebound from its lows.

Netflix (NASDAQ:NFLX) fell sharply during the quarter along with the broader market. Overall, the company continues to execute and recently reported a solid fourth quarter adding nearly 8.9 million paying subscribers. The company expects to see similar growth when it reports first-quarter results in April. Netflix now has almost 140 million global subscribers. The stock has already recovered nearly all of its fourth quarter losses in the first few weeks of the year.

Tesla (NASDAQ:TSLA) shocked investors when it delivered strong third-quarter results easily topping analysts’ revenue and earnings estimates in October. The company continues to build out its model 3 business and is now in the process of starting shipments to Europe and China.

Verizon (NYSE:VZ) and Diageo (LON:DGE) I will not review because their performances were largely driven by investors reaching for safety.

In addition to the sale of Alkermes, there have been many other changes to the portfolio since the beginning of 2019. Over the first four weeks of the year Celgene (NASDAQ:CELG), Vodafone (LON:VOD) and Altria (NYSE:MO) were removed from the portfolio. We sold Celgene after Bristol Myers Squibb said it would acquire the company, closing out our holding. Vodafone’s prospects in India continue to worsen as competition continues to heat up and the position has been sold. Finally, due to shifting trends towards smoking and electronic cigarettes, Altria was taken out of the portfolio. The stock does not afford the same safety and security that it historically offered.

Microsoft (NASDAQ:MSFT) has been added to the portfolio, just recently. The company is a leader in cloud computing with its Azure platform. Additionally, it offers excellent software as a service product in Office 365 and has a tremendous opportunity in the future with its video gaming unit.

As a result of the removal of these positions, accounts are holding an above average level of cash. More stocks will be added to the portfolio to return our holding to a more typical invested percent profile.

Overall, the market is likely to continue to recover throughout 2019. There is little evidence to suggest that earnings in 2019 will fall sharply from their 2018 levels and no meaningful indicators that the US is heading toward recession.

As we read the current signals, the stock market has reached extremely undervalued levels. The S&P 500 is likely to rise in 2019 and has the potential of reaching a range of 3,000 to 3,100, a gain of about 17% from its current level of around 2,665. Undoubtedly this viewpoint is in the minority among most investors, but that is nothing new; our reading of market signals is typically a few months ahead of broader market opinion.