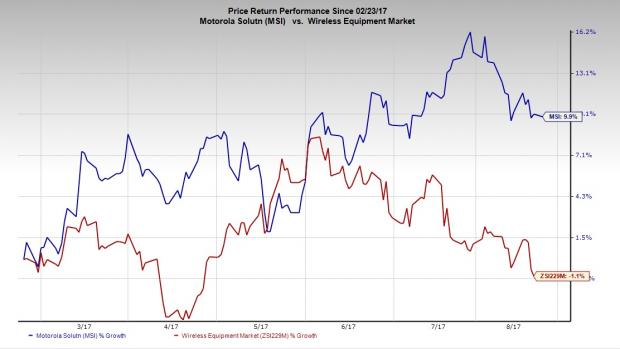

Shares of Motorola Solutions, Inc. (NYSE:MSI) have performed well of late owing to multiple tailwinds. The stock has gained 9.9% in the last six months, significantly outperforming the industry’s 1.1% loss over the same period.

The company performed impressively in the second quarter of 2017, reporting better-than-expected earnings per share and revenues. Both metrics also improved on a year-over-year basis. Notably, results were aided by a strong performance of the telecom giant’s land and mobile radio (LMR) operations. In fact, the bottom line is further expected to rise in the subsequent quarters.

The company boasts a commendable track record with respect to earnings. Motorola surpassed earnings estimates in each of the preceding four quarters with an average beat of 14.4%.

The company has also raised its 2017 guidance for both revenues and earnings per share. For the full-year 2017, Motorola now expects revenues to increase in the band of 3-4% (previous guidance had called for growth of approximately 2%). Earnings (on an adjusted basis) are projected in the range of $5.20-$5.30 per share (the earlier view had projected earnings in the $5.08-$5.23 per share range).

Motorola’s efforts to reward investors through dividend payments and buybacks are also appreciative. The company returned approximately $80 million to the shareholders via buybacks and $77 million in dividends in second-quarter 2017.

The company also raises optimism with expansion initiatives. In a bid to strengthen its software portfolio, Motorola inked a deal with Airbus SE to acquire Plant Holdings, Inc., which holds the Airbus DS Communications business.

These positives substantiate Motorola’s Zacks Rank #2 (Buy) status and it seems apt to invest in the stock now. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Other Key Picks

Investors interested in the computer and technology sector may also consider some other top-ranked companies like InterDigital, Inc. (NASDAQ:IDCC) , Juniper Networks, Inc. (NYSE:JNPR) and Sonus Networks, Inc. (NASDAQ:SONS) .

InterDigital has an impressive earnings history, having outshined the Zacks Consensus Estimate in three of the last four quarters with an average beat of 15.2%.

Shares of Juniper Networks rallied above 15% in a year, while Sonus Networks shares climbed more than 12% in six months.

Zacks' 10-Minute Stock-Picking Secret

Since 1988, the Zacks system has more than doubled the S&P 500 with an average gain of +25% per year. With compounding, rebalancing, and exclusive of fees, it can turn thousands into millions of dollars.

But here's something even more remarkable: You can master this proven system without going to a single class or seminar. And then you can apply it to your portfolio in as little as 10 minutes a month.

Learn the secret >>

Juniper Networks, Inc. (JNPR): Free Stock Analysis Report

InterDigital, Inc. (IDCC): Free Stock Analysis Report

Motorola Solutions, Inc. (MSI): Free Stock Analysis Report

Sonus Networks, Inc. (SONS): Free Stock Analysis Report

Original post

Zacks Investment Research