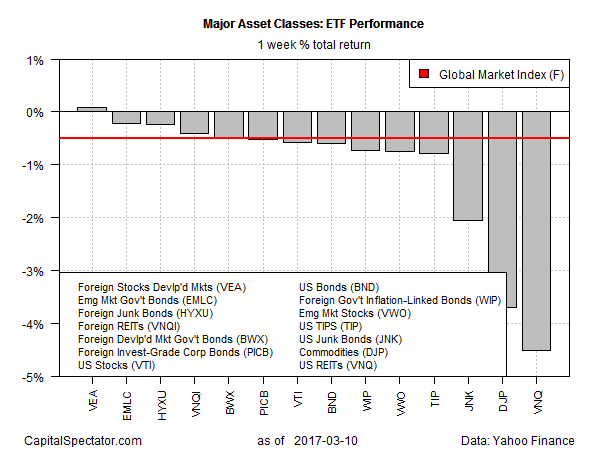

Red ink spilled across nearly every corner of the global markets last week, based on a set of exchange-traded products representing the major asset classes. The lone exception: foreign stocks in developed markets in US dollar terms. Otherwise, losses took a toll far and wide.

Vanguard FTSE Developed Markets (NYSE:VEA) bucked the trend, posting a slight gain of 0.1% for the five trading days through Friday (March 10). The advance pushed the fund near its highest close since the summer of 2015.

Last week’s biggest loser: real estate investment trusts (REITs) in the US. Vanguard REIT (NYSE:VNQ) fell a hefty 4.5% last week. Weighed down by the expectations that the Federal Reserve will raise interest rates this week, the yield-sensitive REIT fund closed at its lowest price of the year so far.

Last week’s downside bias delivered a loss for an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights slid 0.5% last week — its first weekly decline since January.

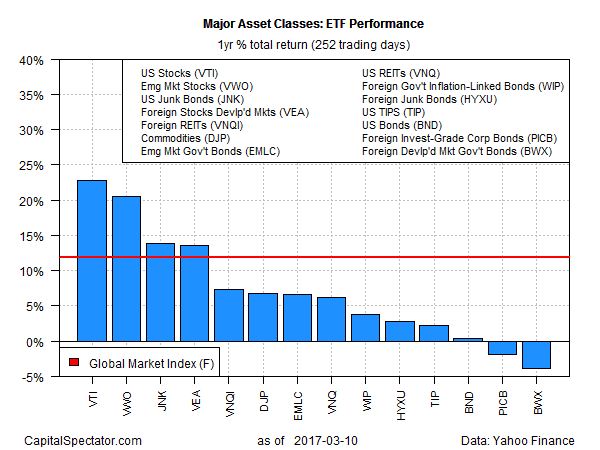

By contrast, one-year results are still mostly positive, but losses began creeping into this previously positive across-the-board profile.

Leading the field higher over the past 12 months: US equities. Vanguard Total Stock Market (NYSE:VTI) is up 22.7% in total return terms for the year through March 10.

The biggest loss among the major asset classes at the moment: government bonds in foreign developed markets in unhedged US dollar terms. SPDR Bloomberg Barclays International Treasury Bond (NYSE:BWX) is off 3.8% for the trailing one-year window.

Meanwhile, GMI.F’s one-year trend remains solidly positive over the past year. The benchmark is ahead by 11.9% for the 12 months through March 10.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.