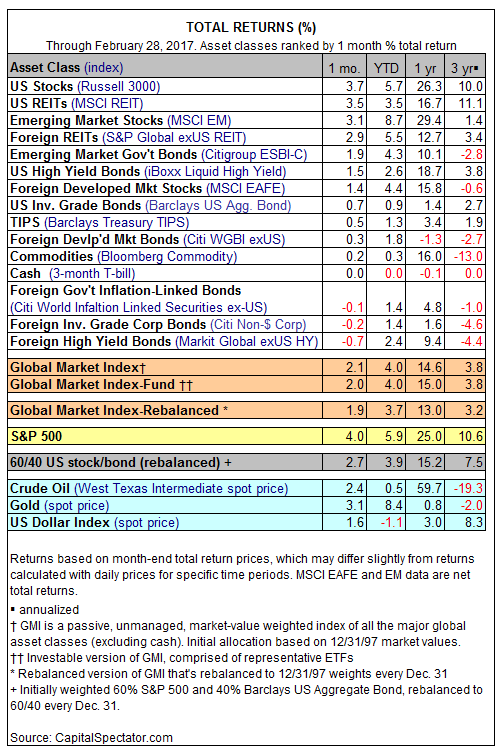

Higher prices prevailed in most markets around the world in February, with the exception of several flavors of foreign bonds in US dollar terms. Otherwise, the major asset classes were in the black last month, building on January’s across-the-board gains.

Leading the field higher in February: US equities. The Russell 3000 Index climbed 3.7% in total-return terms, marking the index’s fourth straight monthly increase. In close pursuit: US real estate investment trusts (REITs), which rebounded after a flat January. The MSCI REIT Index climbed 3.5% in February, posting its second-best monthly advance since last August.

The biggest loser last month: foreign high-yield bonds. The Markit Global ex-US High Yield Index was off a mild 0.7% in February, the first batch of red ink in monthly terms since November.

The generally rising tide for risk assets last month lifted the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI gained 2.1% in February, boosting the index’s one-year total return to an impressive 14.6% — the highest one-year trailing total return for GMI in 2-1/2 years, based on monthly data.