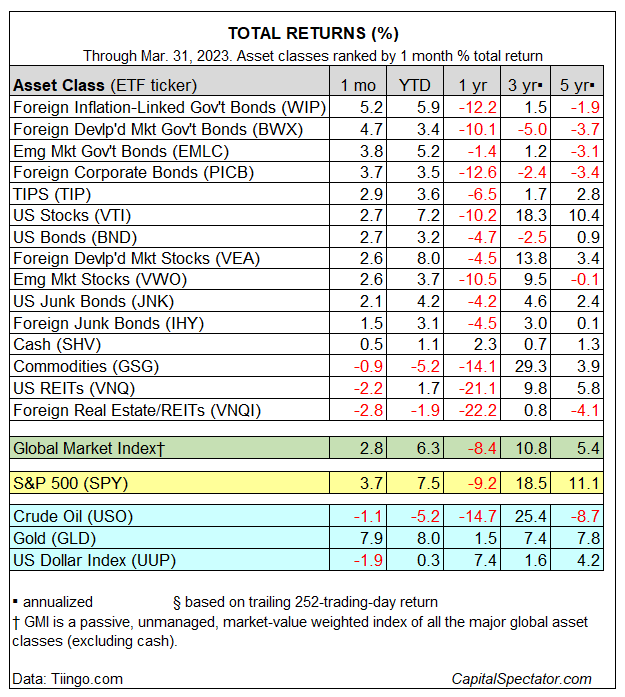

Asset classes made a comeback in March, led by inflation-indexed government bonds ex-US, based on a set of ETF proxies. The downside outlier: real estate shares in the US and around the world.

The performance leader last month: PDR® FTSE International Government Inflation-Protected Bond ETF (NYSE:WIP), which rose 5.2%, more than recovering from the previous month’s loss. The gain marks WIP’s strongest month since last November and lift’s the fund’s year-to-date gain to 5.9%, the third-best rally so far in 2023 for the major asset classes.

The majority of global markets also posted gains in March, with the exception of a slight loss for broadly defined commodities (GSG) and sharp declines for US and foreign property shares.

Vanguard Global ex-U.S. Real Estate Index Fund ETF Shares (NASDAQ:VNQI) posted last month’s steepest loss, shedding 2.8%. The slide leaves the fund with a modest year-to-date loss. The only other asset class in the red for 2023 is commodities (GSG), which is down 5.2%.

The Global Market Index (GMI) posted a strong rebound in March, rising 2.8%. This unmanaged benchmark (maintained by CapitalSpectator.com) holds all the major asset classes (except cash) in market-value weights and represents a competitive benchmark for multi-asset-class portfolios. GMI is now up an impressive 6.3% year to date.

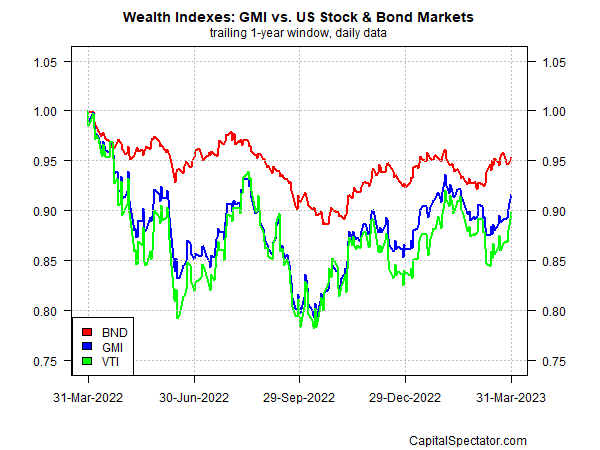

Reviewing GMI’s performance in context with US stocks (VTI) and Vanguard Total Bond Market Index Fund ETF Shares (NASDAQ:BND) over the past year shows GMI posting middling results. Stocks are modestly trailing GMI over the past year, while bonds are outperforming by a comparatively wide margin.