Asia and Euro equities, along with U.S futures remain under pressure, but have reversed some of their initial deeper declines. No significant fundamental catalysts are being attributed to the bounce, although more stimulus measures out of China are helping sentiment.

CBOE Volatility Index up +10.5% Wednesday to 31.40

China is supposedly imposing controls to prevent large capital outflows. This morning, the Shanghai Composite has ended their shortened week on relatively steady note (public holiday Thursday and Friday).

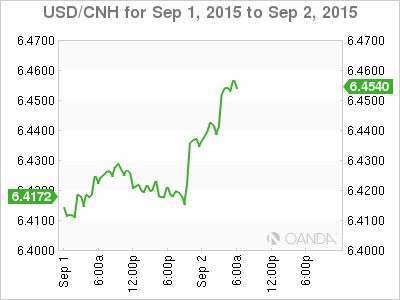

PBoC continues to scale back its devaluation, setting Yuan fix sharply higher for the fourth consecutive day, sets yuan mid point at ¥6.3619 vs. ¥6.3752

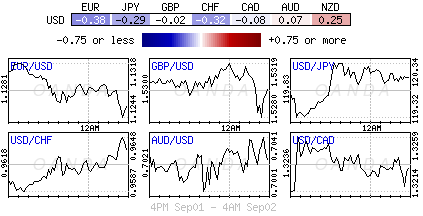

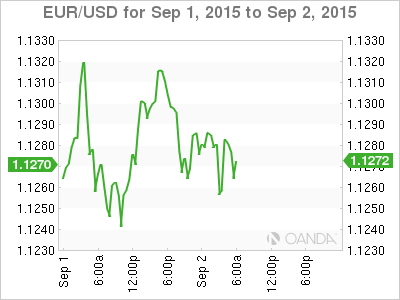

Despite risk aversion strategies continuing to dominate early trading in September, a perception of market stability is taking some heat out of a rush to unwind carry trades that boosted the safe-haven yen (¥119.90) and the low-yielding euro (€1.1281) in recent weeks.

Hong Kong Monetary Authority intervened twice in the money market overnight, injecting HK$15.5B to defend HKD trading band from breaching its upper limit. It is the first intervention in four-months.

Czech Central Bank Tomsik reiterated the need for loose monetary policy, but added that it could be needed for longer than forecasted. The EUR/CZK floor was seen in place until H2, 2016 and that the domestic economy would be far from over-heating next year (€27.03).

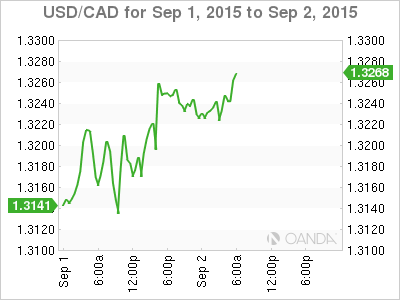

Commodity prices, specifically crude, continues to pressure commodity sensitive currencies like CAD ($1.3250) & NOK ($8.2800). Despite Canada entering a technical recession yesterday, the Bank of Canada (BoC) is expected to stand pat next week, as Gov. Poloz would not want to preempt the Fed. A strong NFP Friday (+220k and +5.2%) should support the dollar bull and have the loonie testing its 11-year low once again ($1.3352).

AUD breaks $0.7000 (first time in six-years) after Aussie GDP disappointed. Aussie Q2 GDP (+0.2% vs. +0.4%) registered its weakest growth in over four-years. Final consumption component held up, rising +0.9% vs. +0.5%, but the Terms of Trade decline worsened to -3.4% v -2.9%.

NZD has found some much needed support ($0.6335) on the back of Fonterra’s Global Dairy Trade auction where the Dairy Trade price index recorded its second consecutive increase (+10.6%).

The value of the EUR (€1.1270) is a big part of Draghi’s monetary policy, and the current unwinding of carry trades will be a concern to euro policy makers. A rise in the euro is undesired as the recovery is fragile. A change in policy is not expected at tomorrow ECB meet, but President Mario Draghi could hint about the potential to act, putting some weight on the single-unit. North America may try to preempt the decision late on Wednesday.

The upcoming G-20 meeting in Turkey on Friday is to be used as a vehicle to coordinate a game plan to reduce emerging market capital outflows and try to persuade the Fed to delay hiking rates in September.

IMF’s Lagarde remains very vocal, warned global leaders and policy makers that recent market turmoil supports the potential of further spillover risks – “all economies are impacted by the rebalancing in China and the slowing in Japan.”

Short-term focus will be on the U.S. ADP employment report today (and the European Central Bank meeting tomorrow. Despite strong U.S fundamentals, U.S policy makers may use the market volatility trump card to by pass a September hike.