Financial markets celebrated the signing of the $1.9 trillion bailout package by Biden. Earlier, Yellen had called the package a turning point, promising it will jump-start the economy. The NASDAQ Composite index yesterday added more than 2.5% for the second time in three days, bouncing back above 13,000. The Dow Jones moved further towards historical highs, gaining 0.6% on Thursday.

Chinese indices also gained on Friday morning following the strengthening of Wall Street.

In the meantime, the main reason stated for the strengthening of the markets is unlikely to be a long-term driver of demand for equities. The support package is far from new, so it is mostly reflected in prices. From this point of view, one should be wary of the traditional "sell the facts".

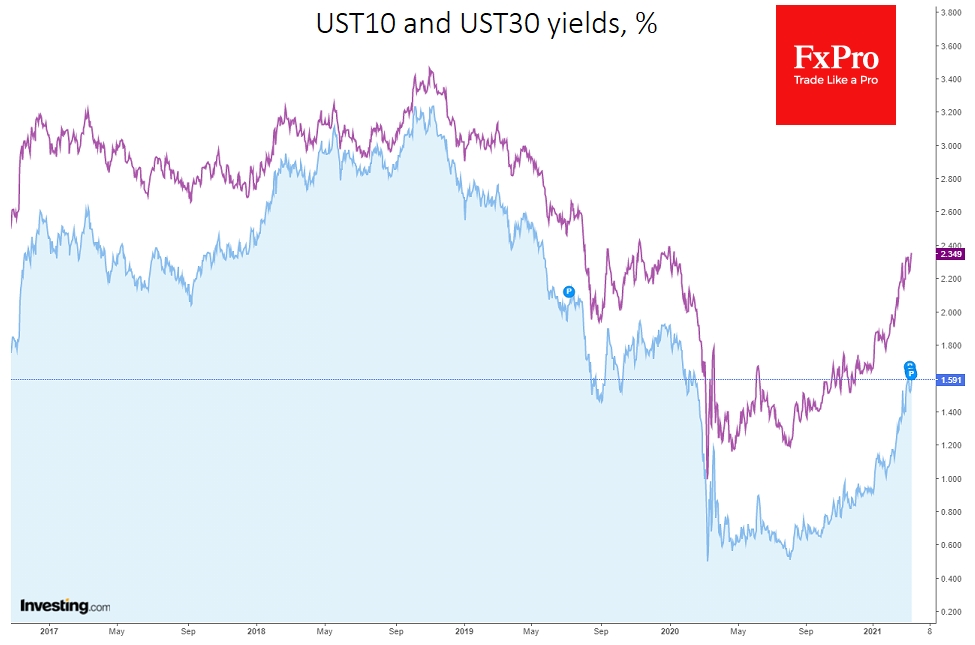

Furthermore, the approved package does not undermine but rather strengthens all those factors that drove the markets in recent weeks. The strong economic recovery has lifted long-term bond yields, which has turned into a big sell-off in the technology sector.

With the new package, the outlook promises to be even brighter, providing an additional driver for higher long-term bond yields and closing in on the moment of policy tightening.

We also note that 30-year and 10-year Treasury yields are close to their peaks from last week and at their highest levels since the start of 2020.

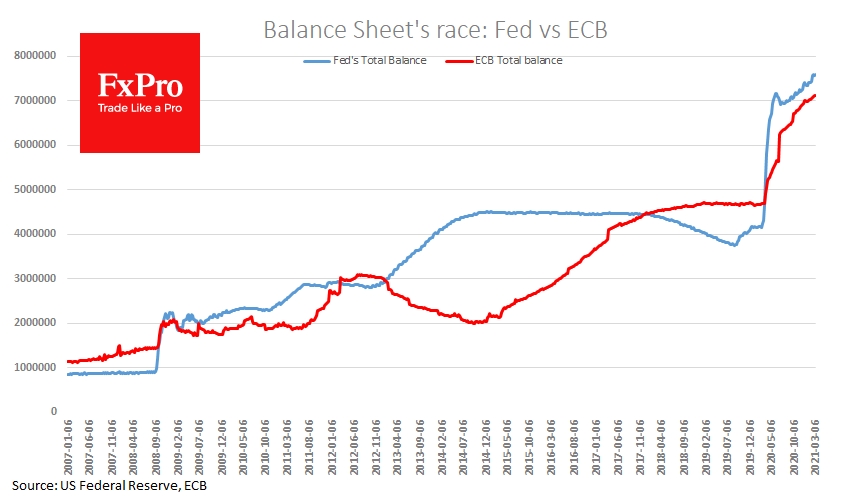

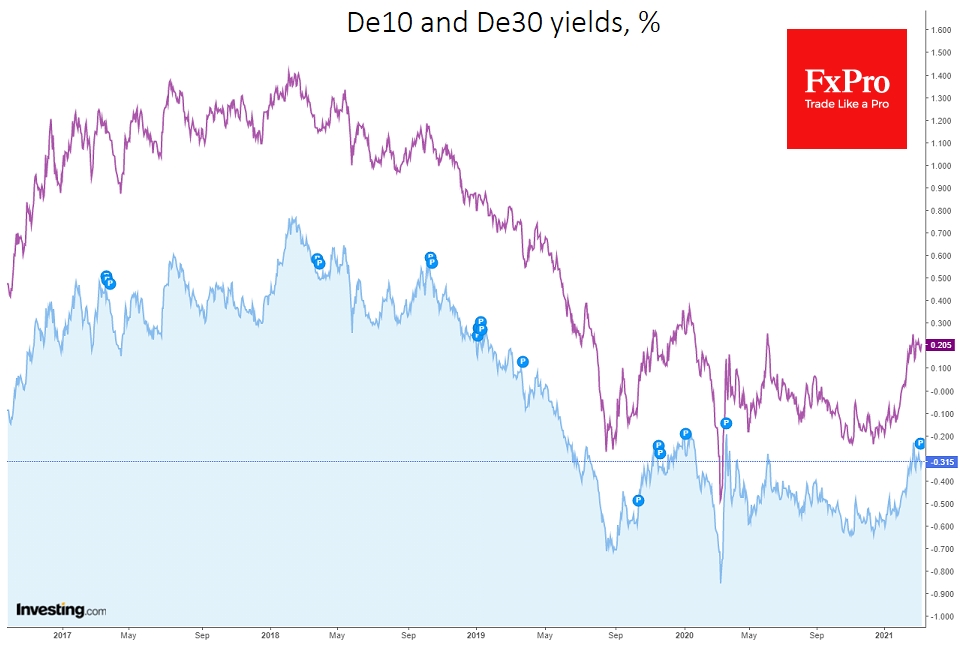

Once again, only the central bank can influence yields in the current situation. The ECB announced that it would increase its asset purchases on its balance sheet in the coming months, which will suppress the rise in yields. This news had a positive effect on European markets yesterday and was probably the main reason for optimism, in contrast to the support package.

After the ECB and similar moves to rein in long-term rates from central banks of Japan, Korea and Australia, a similar move from the Fed becomes the most logical development. The next FOMC meeting is on Mar. 17 and could be a turning point for markets.

Suppose the Fed extends its interest rate pressures. In that case, it could act as a real catalyst for the markets and cause a new round of dollar weakness proportionate with the weakening from May last year to January this year. Without such a turnaround, global risk demand would come under increased pressure, and the dollar would gain fundamental ground for growth.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

More Fed QE Can Lift The Markets, Not The Relief Package

Published 03/12/2021, 04:21 AM

More Fed QE Can Lift The Markets, Not The Relief Package

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.