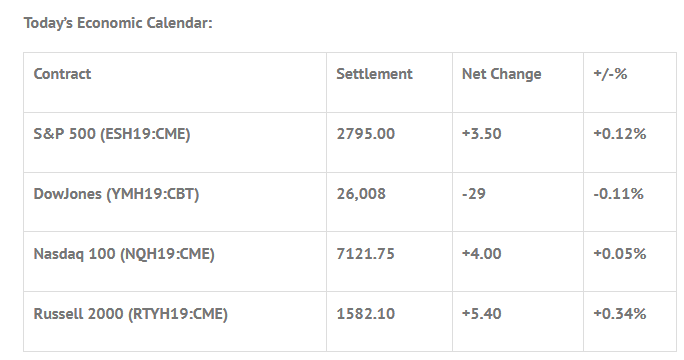

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 8 out of 11 markets closed lower: Shanghai Comp -0.44%, Hang Seng -0.43%, Nikkei -0.79%

- In Europe 10 out of 13 markets are trading lower: CAC -0.02%, DAX -0.10%, FTSE -0.43%

- Fair Value: S&P +0.37, NASDAQ +4.98, Dow -0.64

- Total Volume: 1.13mil ESH & 128 SPH traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes the 52-Week Bill Settlement, Richard Clarida Speaks 8:00 AM ET, GDP 8:30 AM ET, Jobless Claims 8:30 AM ET, Raphael Bostic Speaks 8:50 AM ET, Chicago PMI 9:45 AM ET, EIA Natural Gas Report 10:30 AM ET, Kansas City Fed Manufacturing Index 11:00 AM ET, Patrick Harker Speaks 12:15 PM ET, Rob Kaplan Speaks 1:00 PM ET, Farm Prices 3:00 PM ET, Fed Balance Sheet and Money Supply 4:30 PM ET.

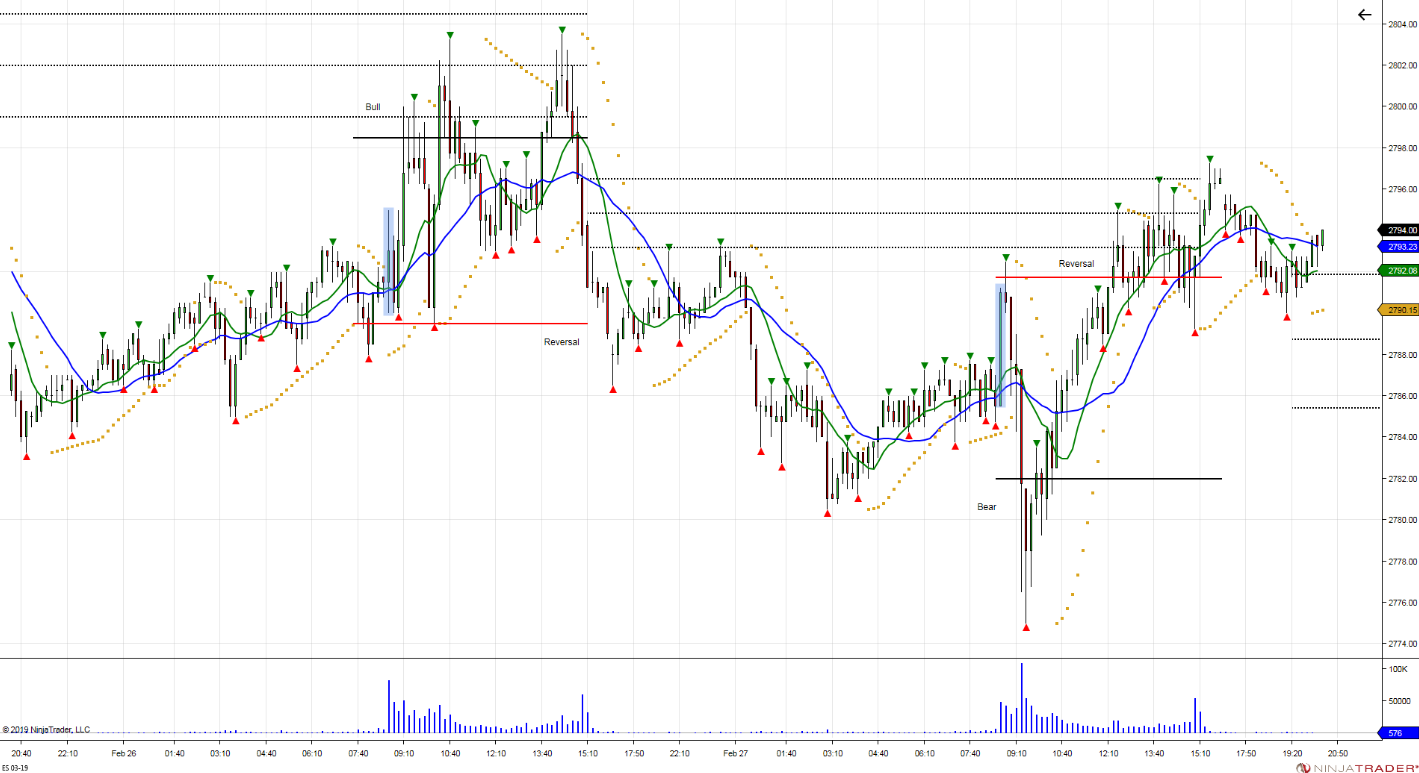

S&P 500 Futures: #ES China / Cohen Drop & Pop

Chart courtesy of @Chicagostock – $ES_F Wednesday’s Reversal 2792-2775-2795. Unable to expand due to pivots above acting as lid. Thursday, pivots below to provide support. Hold >2792 allows opp to expand 17 handle range up to 2809 (2792-2775).

During Tuesday nights Globex session, the S&P 500 futures (ESH19:CME) printed down to a low of 2780.50, and opened Wednesday’s regular trading hours at 2787.50. After the open, the ES traded up to 2792.50 before tumbling down to 2775.00 at 9:27 CT, just after the Cohen testimony began.

Once the morning low was in, several buy imbalances showed up, and the ES rallied to 2795.00 going into 12:30. From there, the futures sold off down to the 2790 area, then traded up to 2795.00 as the MiM started to show $364 million to buy. The ES pulled back a few handles, down to 2792.00, then traded up to a new high at 2796.25 as the MiM increased to over $400 milion to buy.

After another small pullback, the futures made a lower high at 2795.75, then sold off down to 2790.50 as the MiM went up to $721 million to buy. The ES went on to trade 2791.00 on the 2:45 cash imbalance reveal, then traded 2792.50 on the 3:00 cash close, and settled at 2795.00 on the 3:15 futures close, up +3.5 handles, or up 0.12%% on the day.

In the end, the headline about the lack of progress with China, while Trump’s longtime attorney Michael Cohen was testifying in front of the House Oversight Committee, caused an 18.5 handle drop. But, after the drop, the selling dried up and the ES rallied 21 handles. If you bought or sold too early you got run over. In terms of the days overall trade, total volume was on the low side, with 1.12 million futures contracts traded.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.