Apple (NASDAQ:AAPL) is coiling at the highs within a potential continuation pattern. Given the strong bullish trend, we’re monitoring prices for a break higher.

Overall the price action has been predominantly bullish this year, although the trend has not been without its bumps. Despite an okay earnings report, prices sold off at the end of July as traders booked a profit. Yet this hasn’t prevented buyers stepping back in to take it to new highs.

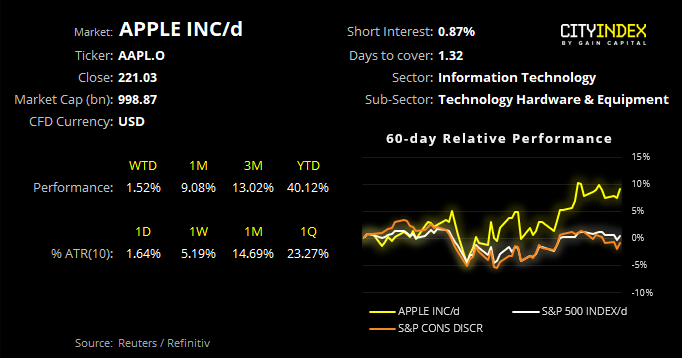

Over the past three months Apple has outperformed its sector and the S&P 500 and maintained a bullish structure. According to Reuters, only 3 of 43 analysts have Apple marked as a sell, 17 a hold, 10 a buy and 13 a strong buy. Sure, analyst’s estimates tend to be to the optimistic side (to say the least), but with another month until their next earnings release and a strong bullish structure, it still allows for further upside.

For now, we’re waiting for bullish momentum to break it out of compression to signal a resumption of its uptrend.