The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Monday higher.

- ES pivot 1928.75. Holding below is bearish..

- Rest of week bias higher technically.

- Monthly outlook: bias lower.

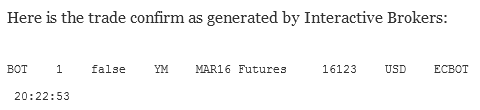

- YM Futures trader: now long at 16,123.

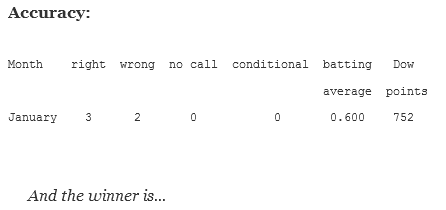

Here's an interesting factoid: if the Dow keeps falling at the same rate it's been this year so far, it will hit zero on April 13th - that's just three months from now. Obviously there's something very screwy going on in the market right now. My call for a higher close last Friday was looking really good early on until another wave of selling hit after lunch and sent the Dow lower again.

The First Five Days of January indicator is now officially a bust. And according to the Stock Traders Almanac, in presidential election years (and yes, we finally get rid of Obama), the market has followed the First Five Days fourteen of the last sixteen times. So 2016 ain't lookin' good. Meanwhile, let's see if we can figure out Monday as we begin the first op-ex week of 2016.

The technicals

The Dow: Just looking at the chart, the Dow is pretty dismal. It has given up multiple support levels since the beginning of the year including 17,000 and remains in a very steep descending RTC. The only bright spot is that RSI has now hit 0.69, its lowest level since since November of 2012 amazingly enough. That alone should hint that a move higher is due very soon though just looking at the chart it isn't there yet.

The VIX: The VIX ignored its upper BB on Friday and instead kept on moving higher, this time on a tall green marubozu that gained another 8% to close at 27.01, its highest level since last September. Indicators are now extremely overbought and look like the logical next move is lower. However the stochastic has yet to begin curving around for a bearish crossover. So in the absence of any bearish candles I can't call the VIX lower yet.

Market index futures: Tonight, all three futures are slightly lower at 12:20 AM EST with ES down 0.07%. ES continued its seemingly endless descent last Friday making it now down 6 out of 7 for its worst annual start since the late Pleistocene era. We remain stuck in a very steep descending RTC and indicators are now at extreme oversold levels with all RSI = 1.8, a level that I haven't seen in many years. Of interest is that the stochastic has finally curved around and is getting very close to putting in a bullish crossover though that hasn't happened yet. However, the new overnight has been slowly drifting higher to the point that it has now formed a solid hammer, suggesting a reversal is imminent.

ES daily pivot: Tonight the ES daily pivot falls again from 1950.83 to 1928.75. So once again ES remains below its new pivot and this indicator continues bearish.

Dollar index: And in another example of this topsy turvy market, I thought the dollar would go lower on Friday but instead it moved higher gaining 0.33%. But it did it on a big classic red dark cloud cover. That left indicators continuing falling off of overbought and the stochastic in full-on bearish crossover mode. All of this looks like a lower close for the dollar on Monday.

Euro: At least I was right about the euro last Thursday night. On Friday it was indeed unable to move any further than its big gain on Thursday falling instead back to 1.0920 on a tall red hanging man. However the indicators have not yet reached over bought and continue to rise. In fact the new Sunday overnight is putting in a strong gain on a small dogs star which could possibly signal a move lower on Monday. But that requires confirmation, which we do not have yet.

Transportation: Like everything else last Friday the trans had a dreadful day, trading entirely below their lower BB. That sent all the indicators to extreme oversold levels with RSI of just 1.63. At least here we are now seeing a stochastic that is curving around in preparation for a bullish crossover though we're not there yet. In the meantime we remain in a steep descending RTC and it's too early to call this one higher yet.

The SPX Hi-Lo indicator hit 1.22 last Friday, its lowest level since last November 13th, after a similar six out of seven day decline. And the next day then was strongly higher. And tonight all the charts are looking extremely oversold, to levels not seen in several years. And finally we're seeing good reversal candles forming in the futures. So I'm thinking I might have just been a day early in calling Friday higher. Therefore I'm going to do it again and call Monday higher. If it doesn't (go higher), I'll eat my hat.

YM Futures Trader

Welcome to our new feature for 2016: the YM Futures Trader. Here I will trade YM, the Dow futures, in free-form fashion. I'm not going to limit myself to swing trades. I may hold for a minute, I may hold for a month. Part of it depends on what all else I have going on that day. I definitely do not spend the entire day glued to my screen watching every tick go by. We'll see how it works out.

I am now long YM at 16,123. With an RSI of zero, as in zip, zilch, nada, the square root of nothing,, this one has nowhere to go but up. I am prepared to hold this as long as it takes to be profitable.