The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Monday lower.

- ES pivot 2023.67. Holding below is bearish.

- Rest of week bias lower technically.

- Monthly outlook: bias higher.

- Single stock trader: ended.

Happy New Year! And good riddance to 2015. With all the holidays now out of the way and a full week of trading ahead of us to start off 2016, let's see what the charts have to offer us and what might be in store for Monday.

The technicals

The Dow: Last Thursday, for anyone who can remember that far back, the Dow plunged through its 200-day MA with a 179 point loss. On top of that, the indicators all started moving lower, falling off of overbought and the stochastic gave us a completed bearish crossover. All of that looks simply bearish for Monday.

The VIX: In contrast to an ugly looking Dow chart , on Thursday the VIX, while rising just over 5%, did it on a very tall lopsided spinning top, almost an inverted hammer. Although indicators continue to rise, they are no longer oversold and there is at least a suggestion of a reversal lower here for Monday.

Market index futures: Tonight, all three futures are lower at 12:08 AM EST with ES down 0.77%. Last Thursday, like the Dow, ES broke through its 200 day MA with a very ugly red candle, making it two in a row to fall back to 2035 and a half. That sent it just to the edge of overbought with a freshly completed bearish stochastic crossover. The new Sunday overnight is now down nearly as much, making this all look pretty grim indeed.

ES daily pivot: Tonight the ES daily pivot falls from 2061.00 to 2041.17. ES remains below its new pivot so this indicator is clearly bearish.

Dollar index: After falling relentlessly through the last half of December, the dollar has now reversed course and exited that descending RTC. We now in fact have a bullish trigger on that as indicators continue to rise off of oversold. The dollar last Thursday in fact rose 0.4% and with no resistance now until back in the middle of December, it looks like it will test its upper BB on Monday at 66.32 (on the USD/UPX).

Euro: Similarly the euro is now has now fallen out of its rising RTC from last month, and last Thursday continued that descent falling all the way back down to 1.0859. Indicators are now oversold but the stochastic is still a long way from even starting a bullish crossover. And with the lower BB now not too far away at 1.0821, I wouldn't be surprised to see the euro test that level on Monday.

Transportation: After a decidedly weak showing on Wednesday, last Thursday the trans fell further, but this 0.38% loss was on a red spinning top. Although the indicators are all now moving lower just short of overbought, there's at least the suggestion of reversal here for Monday, though one which requires confirmation.

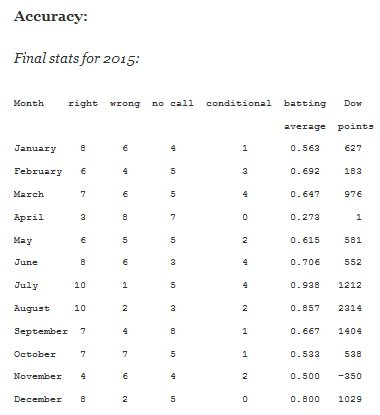

This wasn't too bad. Four months of four-digit returns and only one losing month. Recall that the "Dow points" are calculating by taking abs (Dow open - Dow close) and adding that number to each month when I called the close correctly and subtracting it when I was wrong.

For conditional calls, I increment the "conditional" column when I'm right and the "wrong" column when I'm wrong, but I don't take any Dow points for conditional calls since there's no fixed starting value for them. The "no call" column is a bit of a misnomer. That gets incremented when I make an "uncertain" call.

On days when I make no call at all, like if I take a vacation, then nothing gets changed. I think this is a pretty reasonable way to gauge my effectiveness at calling the action of the market a day ahead of time.

And the winner is...

The first day of January is historically quite bullish but I don't think that's going to be the case this year. The charts are uniformly bearish and the futures tonight are looking just plain awful, apparently on some bad economic news from our pals the Chicoms. I'm afraid I'm just going to have to call Monday lower. This doesn't bode well for the First Five Days of January indicator either.

Single Stock Trader

This feature was pretty much a bust in 2015. I had high hopes for swing trading N:VZ after it started off oscillating nicely. But that pattern broke off after a few months and then the rest of the year gave us very few opportunities to do anything productive with it. So until I figure out something more interesting, the idea of following a single stock all year long is finished.