The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Monday lower.

- ES pivot 2079.42. Holding above is bullish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- Single stock trader: N:VZ still not a swing trade buy.

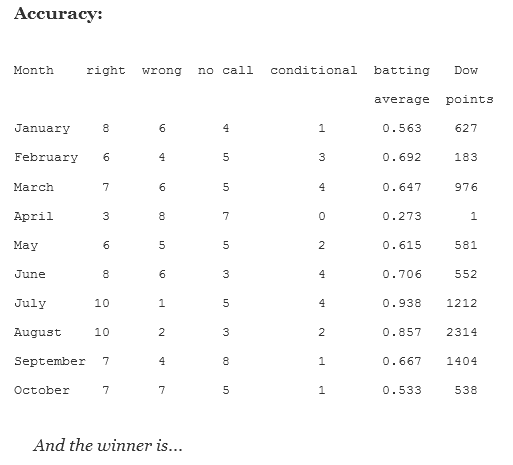

Although the spooky month of October went out with a bang in total, the final day delivered a trick instead of a treat, spoiling my call for a higher close with a 92 point decline in the Dow. Nevertheless, it was a winning month, so we really can't complain. With October now out of the way, let's look ahead to November and figure out which way it will start off.

The technicals

The Dow: On Friday, the Dow confirmed Thursday's red hanging man with a 0.52% decline. That sent the indicators a bit lower, though they remain overbought. With this bearish confirmation, on its own this chart looks negative for Monday

The VIX: Meanwhile, the VIX remains range bound as it continues to bounce around between approximately 14.10 and 16.14. Friday's action was right in the middle of that with a small lopsided green spinning top that probably doesn't mean all that much. Indicators similarly are wandering around in no man's land between overbought and oversold, so there's not much to say about that. Overall, the VIX simply continues to search for direction

Market index futures: Tonight, all three futures are lower at 1:15 AM EST, with ES down 0.37%. After a doji star reversal warning on Thursday, on Friday ES put in a lopsided green spinning top that just barely touched its upper BB. That confirmed Thursday's warning sign and we note that in the Sunday overnight, ES is continuing lower. This has already sent it off of overbought and confirmed a new bearish stochastic crossover. So there's nothing bullish looking about this chart tonight.

ES daily pivot: Tonight, the ES daily pivot falls from 2080.92 to 2079.42. ES is now back under its new pivot so this indicator turns bearish.

Dollar index: Last Thursday night, the dollar looked lower to me on Friday and that is indeed what happened, with a significant 0.35% decline on a gap down doji star that nearly touched its 200-day MA. Even at that, the indicators are still overbought and the stochastic has now finally completed a bearish crossover. Therefore, I have to take this candle with a grain of salt . It's a reversal warning, but one which requires confirmation on Monday.

Euro: I also called the euro correctly last Thursday night as it continued its rise Friday to close at 1.1009. It was something of a lopsided green spinning top, but it was enough to send the indicators finally off of oversold and confirm a newly completed bullish stochastic crossover. On top of that, in the new Sunday overnight the euro is moving non-trivially higher, so it looks like there's a good chance that it may close up again on Monday.

Transportation: After looking quite promising on Thursday, on Friday the trans simply petered out, losing 0.12 % on a classic red spinning top. However, they also formed a classic bullish stochastic crossover, so tonight this one is simply a toss up.

The market is up on the first day of most months and according to the Stock Trader's Almanac, it has been up four out of the last five first trading days of November. However, given the situation tonight, it's not clear that's going to be the case this year. I've been mentioning for a few days now that the market was looking toppy. Now it's looking liked it's topped. And given the direction of the overnight futures seeming to confirm that, I'm going to have to call Monday lower.

Single Stock Trader

After a full five days of reversal warning signs, on Friday, VZ, of all things, put in a tall green candle to finish 1% higher. Go figure. That candle just about touched its upper BB and sent the indicators back to highly overbought. It also cleared resistance at 46.46, so it's really not clear which way this chart wants to go on Monday. In any case, it's definitely not a swing trade buy set up.