The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Monday lower.

- ES pivot 2294.33. Holding below is bearish..

- Rest of week bias lower technically.

- Monthly outlook: bias higher.

- YM futures trader: no trade tonight.

Recap

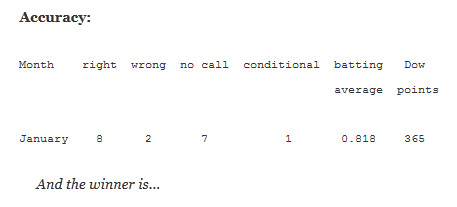

Last Thursday night I called the Dow lower for Friday and despite several rally attempts during the day, the Dow just kept sagging to eventually end with a slight seven point loss. But that was enough to snap a four day winning streak with a little red spinning top sitting on the Dow's upper BB. We now look ahead to Monday, the end of the month and an upcoming Fed meeting. So that all ought to make for an interesting week.

The technicals

The VIX: And last Thursday night I wrote of the VIX that "with two reversal candles in a row, it can't be long before we see a move higher, possibly as soon as Friday". Well it didn't happen on Friday but this time the loss was a mere 0.47% on a doji star that now makes it three reversal candles in a row. The VIX is now quite oversold, near its lower BB, at historic multi-year lows, and with a stochastic ready for a bullish crossover. It can't keep going lower forever and I think it's now ready for a move higher on Monday.

Market index futures: Sunday night, all three futures were lower at 12:19 AM EST with ES down 0.25%.

ES daily pivot: Sunday night the ES daily pivot fell from 2294.33 to 2290.92. That leaves ES below its new pivot so this indicator continues bearish.

Sunday night the charts were looking fairly bearish. The Dow is now overbought and put in a small dark cloud cover with a red spinning top on Friday and both the VIX and the iShares 20+ Year Treasury Bond (NASDAQ:TLT) look primed to move higher. The trans, after outperforming much of last week are now underperforming. Oil seems to be ready to move lower and the futures are already moving lower, and ES is under its new pivot.

In fact I don't see any particularly bullish signs no matter where I look, so I guess the only thing to do is call Monday lower.

YM Futures Trader

No trade tonight.