The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Monday higher, low confidence.

- ES pivot 1959.67. Holding above is bullish.

- Rest of week bias uncertain technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader standing aside.

Recap

Last Friday's call was "uncertain" and that's pretty much what the session was - down out of the gate, then wandering aimlessly before finally closing up just 29 points in the Dow. But the candles are interesting so let's check the charts as we gird ourselves for yet another wacky week on Wall Street.

The technicals

The Dow: The Dow has pretty much established 16,915 as a solid support level, putting in a second hammer in a row on Friday based on that number. And like heads, two hammers are better than one. This one also bent the stochastic around to within inches of a bullish stochastic crossover. When the Dow does this kind of depth-sounding, it's often a good sign that a reversal is at hand.

The VIX: Last Thursday night I claimed that "the VIX goes lower on Friday." And it was the right claim as the VIX sank 4% to complete a bearish evening star. Note how once again, the VIX managed only one day on its upper BB® before falling back. This move also left us right on the cusp of a bearish stochastic crossover and also right on the edge of a bearish RTC setup. So the odds seem to favor a move lower here on Monday. And VVIX is looking even more bearish.

Market index futures: Tonight all three futures are higher at 12:38 AM EDT with ES up 0.13%. Completing four days of alternating gains and losses, on Friday ES put in a small rise but remained in a descending RTC. However, the new Sunday overnight is trading outside the channel and that's a bullish setup. The stochastic is also flattening out in preparation for a bullish crossover so I'd definitely not be going short at these levels.

ES daily pivot: Tonight the ES daily pivot rises from 1957.08 to 1959.67. We remain sufficiently above the new pivot to call this indicator bullish.

Dollar index: After a doji on Thursday the dollar gave us ... yes, another doji on Friday, but a gap-up one for a 0.07% gain. The indicators are now just overbought, though the stochastic has no particular opinion. We're also right on the edge of a descending RTC, just missing a bullish setup ever so slightly. So once again, this chart is too tough to call.

Euro: Last Thursday night, the euro was similarly vague and Friday's action bore that out with a small gain on a perfect star. The indicators have mostly turned lower and the overnight seems to agree, so I'd say there's a chance the euro falls further on Monday.

Transportation: And on Friday the Trans confirmed Thursday's doji with a 0.35% gain that doubled that of the Dow. And unlike the other charts, this one gave us a genuine completed bullish stochastic crossover so this chart looks higher on Monday.

Tonight we see a lot of our predictors on the verge of going bullish. The cautious approach would be to call it uncertain but the preponderance of evidence is, I believe sufficient to call Monday higher.

ES Fantasy Trader

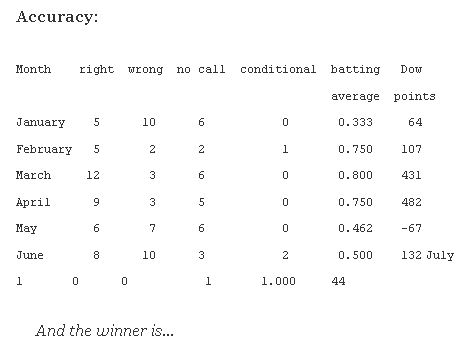

Portfolio stats: the account remains at $113,000 after seven trades in 2014, starting with $100,000. We are now 5 for 7 total, 3 for 3 long, 2 for 3 short, and one push. Tonight we stand aside.