The Hoot

Actionable ideas for the busy trader delivered daily right up front

- Monday higher, low confidence

- ES pivot 1952.75. Holding above is bullish.

- Rest of week bias lower technically.

- Monthly outlook: bias higher.

- ES Fantasy Trader stands aside.

Recap

Huh - well that's interesting. I thought for sure we were going lower last Friday but the day was decidedly bullish, even good for another record close for the Dow. And yet there appear to be some storm clouds gathering on the horizon. For the rest of the forecast, read on.

The technicals

The Dow: So we gained 26 point in the Dow on Friday. But the interesting part is that they came on a tall inverted hammer. Following Thursday's hanging man, that makes two reversal candles in a row.. Interestingly, we had an inverted hammer at the last triple witching and the next day was lower. And right now even though we're not officially overbought, we're closer to it than we were last time. So that leaves me cautiously bearish, a caution derived from the fact that we still remain in a rising RTC.

The VIX: Now here's a bigger sign for caution. On Friday the VIX gained 2.17% on a day when the broader market was also higher. The candle was bullish engulfing in a big way and it also exited the descending RTC for a bullish setup. All that's missing now is oversold indicators and we're pretty close to that. VVIX is in a similar boat so my guess is that the VIX is due to rise on Monday. Note though that VVIX remains in a downtrend, so I'm not all that confident on the VIX going higher.

Market index futures: Tonight all three futures are higher at 1:17 AM EDT with ES up a decent 0.20%. With a now six day winning streak going, ES is getting pretty overextended. RSI is now 100 - it doesn't go any higher. And the stochastic has curved around and is on the cusp of a bearish crossover. And yet this chart's mojo seems undiminished. With the upper BB® now at 1963, ES appears more than casually interested in taking a peek. And that might be the catalyst for letting a bit of gas out of this bubble.

ES daily pivot: Tonight the ES daily pivot ticks up from 1948.83 to 1952.75. So we remain above the new pivot and this indicator remains bullish.

Dollar Index: Last Thursday night I mused "we have to wonder if Friday might now come in higher." And so it did, up 0.06% on an admittedly red spinning top that nonetheless completed a bullish morning star. Having now hit the lower BB and with indicators fairly oversold I have to think the next move is higher again.

Euro: I wouldn't call the euro last Thursday night and it's just as well, since it ended by pretty much covering the same ground as Thursday but with a small loss on a wide-ranging spinning top. It did however cause the indicators to peak and start lower just before hitting overbought. But for the time being, the euro appears to have found a new trading range about the 1.3605 level.

Transportation: Last Friday the Trans non-confirmed Thursday's spinning top with a 0.21% advance to very near resistance at 8222. Indicators however are still not yet overbought so in the absence of any outright bearish signs I have to say this chart remains bullish.

Tonight we're seeing a bit of a mixed picture. It's always difficult on Sunday night because a lot of the data is now two days old. But like the old saying goes, one of the several things you can't fight on the Street is the tape. And right now the tape just keeps moving higher. So although the VIX looks poised to move higher, the futures are also moving higher in the overnight in a non-trivial manner. And so I'm going with that (and a lack of bearish signs in the Dow and trans) and calling Monday higher.

ES Fantasy Trader

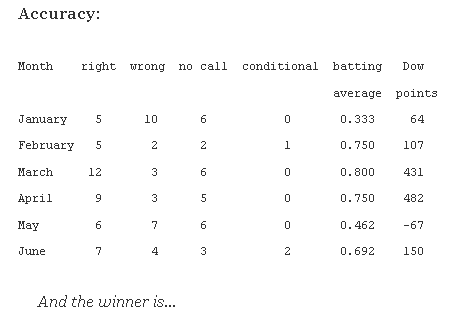

Portfolio stats: the account remains at $113,000 after seven trades in 2014, starting with $100,000. We are now 5 for 7 total, 3 for 3 long, 2 for 3 short, and one push. Tonight we stand aside.