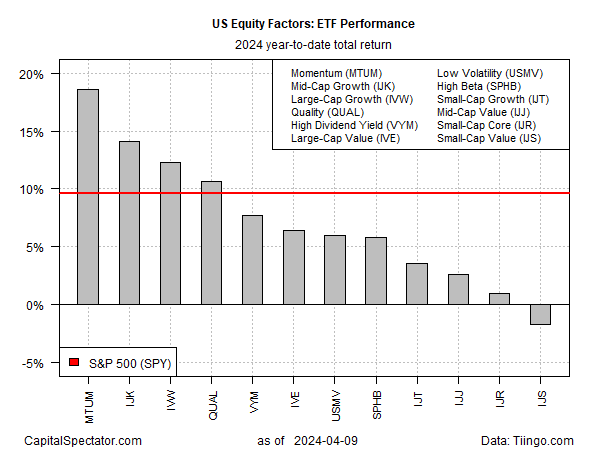

Most slices of the US equity market continue to enjoy solid gains so far in 2024, but the momentum risk factor is still the upside outlier, based on a set of ETFs through Tuesday’s close (Apr. 9).

The iShares MSCI USA Momentum Factor ETF (NYSE:MTUM) is enjoying a sizzling 18.6% year-to-date rise.

That’s well ahead of the broad market’s 9.6% advance (SPY) and a world above the worst equity factor performance in 2024: a 1.7% loss for small-cap value stocks (IJS).

Some of MTUM’s strong run this year may be linked to a recovery from its relatively weak performance in 2023, when the ETF underperformed the broad stock market (SPY) by a wide margin.

As for small-cap stocks, the frustration and regret rolls on. Several analysts in recent years have flagged this slice of the market as poised to rally, but false dawns continue to endure.

“You’re taking on more risk because these companies are smaller and less established,” says Steve Sosnick, chief strategist at Interactive Brokers.

“They typically do not have bottom-line results that can be relied upon through thick and thin. That is often a real headwind for them, and unfortunately, this is one of those times.”

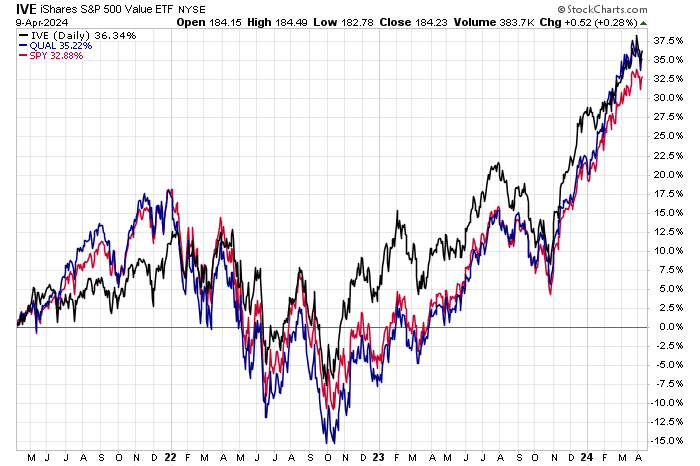

In the realm of what’s worked, it’s been tough to beat the broad market (SPY) from a factor perspective, with two exceptions: large-cap value (IVE) and quality (QUAL).

Using the trailing 3-year window, both slices of the equities factor universe have outperformed the standard measure of US stocks.

The caveat: the outperformance has been slight. Beating a relatively simple market-cap-weighted equities strategy, the chart above reminds us, has been challenging.

Indeed, critics of factor-based investing argue that recent history suggests conventional market-cap indexing is still the more appealing option vs. trying to slice and dice. If the past three years are a guide, that’s a tough argument to dismiss.