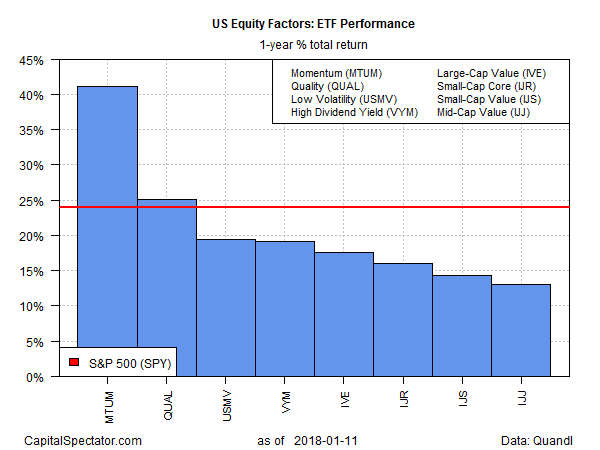

The US stock jumped to another record high yesterday, providing more fuel to keep the momentum factor sizzling. All the major factor strategies are posting solid one-year returns these days, but momentum’s trend remains a bullish outlier, based on a set of proxy ETFs.

The outsized return for the momentum-factor strategy, which targets equities that exhibit relatively strong and persistent performance in recent history, is nothing new. As reported previously (last month, for instance), this slice of the so-called smart beta set has been leading the rest of the field in recent history for the one-year trend.

The iShares Edge MSCI USA Momentum Factor (NYSE:MTUM) is currently posting a 41.2% total return for the trailing one-year window through yesterday’s close (Jan. 11). The gain is dramatically above the second-strongest one-year performer, currently held by the quality factor via the iShares Edge MSCI USA Quality Factor (NYSE:QUAL), which is up 25.1% vs. its year-earlier price.

The stock market overall, according to the SPDR S&P 500 (NYSE:SPY)), is ahead by 23.9% on a total-return basis — a strong gain but well below MTUM’s red-hot one-year performance.

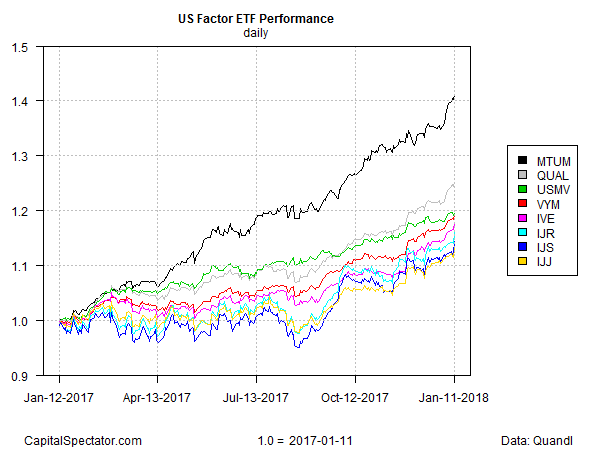

The powerful bull run for the momentum factor ETF in recent history is clearly shown in the chart below. One dollar invested in MTUM a year ago would now be worth $1.41. A dollar invested in any one of the other factor ETFs would have increased to a range between $1.13 to $1.25.