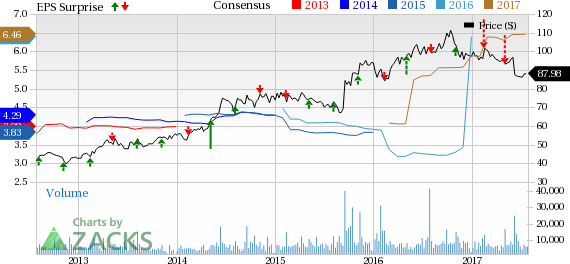

Molson Coors Brewing Co. (NYSE:TAP) is set to report second-quarter 2017 results before the opening bell on Aug 2. The question lingering in investors’ minds is, whether this beverage company will be able to post a positive earnings surprise in the to-be-reported quarter. It should be noted that the company has posted three negative earnings surprises in the last four quarters, resulting in an average negative surprise of 22.6%.

Let’s see how things are shaping up prior to the announcement.

What Does the Zacks Model Unveil?

Our proven model shows that Molson Coors is likely to beat earnings because it has the right combination of two key ingredients.

Zacks Earnings ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, is +4.90%. This is because the Most Accurate estimate is $2.14, while the Zacks Consensus Estimate is pegged lower at $2.04. A favorable Zacks ESP serves as a meaningful and leading indicator of a likely positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Molson Coors currently carries a Zacks Rank #3 (Hold). Note that stocks with Zacks Ranks #1 (Strong Buy), 2 (Buy) and 3 have a significantly higher chance of beating earnings. Conversely, the Sell-rated stocks ( Zacks Rank #4 or 5) should never be considered going into an earnings announcement.

The combination of Molson Coors’ Zacks Rank #3 and an Earnings ESP of +4.90% makes us very optimistic about a possible earnings beat.

Which Way Are Estimates Trending?

Let’s look at the estimate revisions in order to get a clear picture of what analysts are thinking about the company right before earnings release. The Zacks Consensus Estimate for the second quarter and 2017 has been declining over the last seven days. However, the current Zacks Consensus Estimate of $2.04 per share and $6.45 for the second quarter and full-year 2017 reflect year-over-year growth of 83.8% and 103.4%, respectively.

Further, analysts polled by Zacks expect revenues of $3.08 billion for the said quarter, up 212.7% from the year-ago period. For 2017, Zacks consensus revenue is pegged at $11.1 billion, reflecting a 127.6% year-over-year increase.

Factors to Consider

Molson Coors has been struggling with weak sales volume trend of late. While the acquisition of the Miller global brands helped improving sales in the International regions, sales volume continued to decline in Canada and Europe. A difficult economy, unfavorable currency and competitive pressure remained the major deterrents. The company’s dismal performance is reflected in its share price. Molson Coors’ shares have fallen 12.3% in the last one year, in comparison to the industry’s growth of 2.4%. In order to revive its performance, Molson Coors has been focusing on expanding its foothold through strategic agreements and targeting above-premium brands to help grow its market share.

The recent agreement with Hornell Brewing Co., Inc., an affiliate of AriZona Beverages, is in line with Molson Coors’ current business expansion initiatives. The deal will give Molson Coors the license to market and distribute a new Flavored Malt Beverage (FMB) brand, Arnold Palmer Spiked Half & Half, through its U.S. division MillerCoors. This would aid Molson Coors to capture the momentum of ready-to-drink teas (both alcoholic and non-alcoholic) in the U.S.

In regard to its cost savings target, the company exceeded its 2016 goal by achieving more than $165 million of in-year cost reductions. The acquisition of the remaining 58% stake in MillerCoors will also drive substantial cost synergies in the next three years and continues to expect this transaction to be significantly accretive to underlying earnings in the first full year of operations. This will also help the company to drive top-line growth, profit, cash generation, debt pay-down and total shareholder returns in the years ahead. The company expects cost savings of $550 million over the next three years till 2019.

Stocks to Consider

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post an earnings beat:

The Clorox Company (NYSE:CLX) has an Earnings ESP of +0.67% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Tyson Foods, Inc. (NYSE:TSN) has an Earnings ESP of +1.64% and a Zacks Rank #2.

Church & Dwight Company, Inc. (NYSE:CHD) has an Earnings ESP of +2.56% and a Zacks Rank #2.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Molson Coors Brewing Company (TAP): Free Stock Analysis Report

Tyson Foods, Inc. (TSN): Free Stock Analysis Report

Church & Dwight Company, Inc. (CHD): Free Stock Analysis Report

Clorox Company (The) (CLX): Free Stock Analysis Report

Original post