In 2015, the stock market’s valuation was widely downplayed.

But why would market watchers do such a thing with the U.S. stock market trading at its richest valuation in more than a decade?

Well, in order to recommend an overweight position in U.S. equities or an underweight position in fixed income, pundits almost had to disregard valuation.

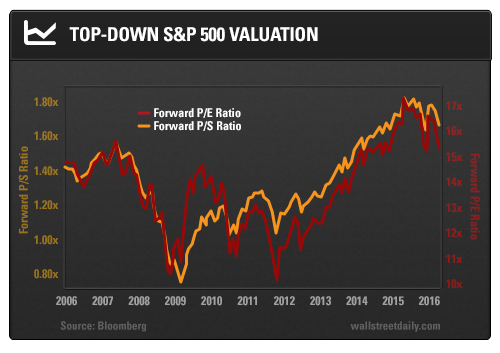

The chart below illustrates just how high the S&P 500's valuation reached last year.

These forward ratios use a blended estimate of earnings or sales over the next four quarters.

Due to the high variability in earnings estimates, the forward price-to-earnings (P/E) ratio indicated that the market was fairly expensive in late 2009. It also suggested that the S&P 500 was less expensive at the end of 2011 than it was during the end of the Great Recession. Both of these takeaways seem suspect.

On the other hand, the forward price-to-sales (P/S) ratio seems to provide a smoother, more accurate estimation of the market’s valuation.

The forward P/S for the S&P 500 is still higher than at any time during 2006 or 2007, despite the selloff in stocks we’ve experienced in 2016. The market’s lingering overvaluation may come as a surprise to many. Again, be careful about your consumption of information from the financial media.

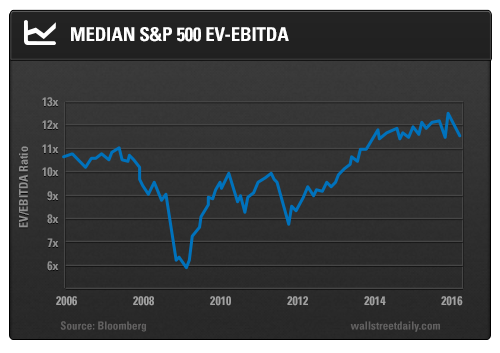

Now let’s look at valuation from a slightly different perspective. The chart below shows the median enterprise value-to-EBITDA for the S&P 500 based on reported results.

The EV/EBITDA ratio is a fantastic valuation metric that takes into account a company’s debt level. With so many companies carrying out large acquisitions or issuing debt to buy back stock, we want to keep an eye on leverage.

As you can see, this bottoms-up approach paints a similar picture as the top-down, forward P/S ratio. In other words, the market remains expensive, and 2009 and 2011 were extremely attractive buying opportunities.

Earlier this year, I stated that 2016 may be just as volatile for the U.S. stock market as 2011. Unfortunately, as the charts above show, we’re still a very long way from hitting the cheap valuation levels we saw that year.

Over the next few years, we’ll likely see the S&P 500’s forward P/S around 1.0 times and the median EV/EBITDA around 8.0 times. Inexpensive valuations such as these will forge a new bull market.

To be sure, we’ll have stock market rallies before then. However, I think they’ll prove to have been trading opportunities.

Safe (and high-yield) investing,