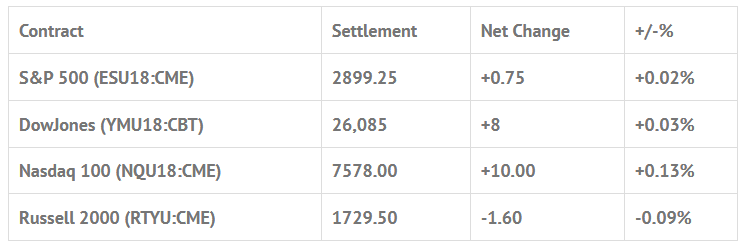

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 7 out of 11 markets closed higher: Shanghai Comp -0.31%, Hang Seng +0.23%, Nikkei +0.15%

- In Europe 7 out of 13 markets are trading higher: CAC +0.21%, DAX +0.11%, FTSE -0.34%

- Fair Value: S&P +0.73, NASDAQ +6.37, Dow +13.76

- Total Volume: 902k ESU & 318 SPU traded in the pit

Today’s Economic Calendar:

Today’s economic calendar includes MBA Mortgage Applications 7:00 AM ET, GDP 8:30 AM ET, Corporate Profits 8:30 AM ET, Pending Home Sales Index 10:00 AM ET, State Street Investor Confidence Index 10:00 AM ET, EIA Petroleum Status Report 10:30 AM ET, and Farm Prices 3:00 PM ET.

S&P 500 Futures: #ES 2906

The S&P 500 futures traded up to 2906.25 at 8:20 am on Globex Tuesday morning, and traded 2903.25 on the 8:30 futures open. From there, the futures pulled back down to the vwap at 2901.75, rallied up 2904.50, and made five lower lows down to 2894.25 at 11:05 am CT. I put this out in the MrTopStep forum Monday night just after 7:00 PM…

Dboy:(8:07:20 PM) : Im not shorting but if I were I would layer in some offers between 2902 and 2912

Dboy:(8:07:39 PM) : everyone very bullish now

As I have said many times, ‘I’m a bull but I aint no fool’. Even with the US and Canada nearing a trade deal, the S&P futures (ESU18:CME) have rallied over 100 handles in the last few weeks, with most of the gains in the last week. The main concern isn’t that the ES can’t still go higher, its a ‘wayward headline’ that worries me.

After the ES made its 2894.25 low I put this out in the forum.

Dboy:(12:04:41 PM) : nq trying to hold

The Nasdaq low was 7564.25, and 30 minutes later it traded back up to 7583.75, pulled back, then traded up to 7589.25. The ES traded up to 2900.00, pulled back, then traded up to 2901.00. After 2:00 the MiM started to show small for sale and the ES pulled back down to 2895.50. On the 2:45 cash imbalance the ES traded 2896.7, as the final MiM showed $230 million for sale. On the 3:00 cash close the ES traded 2899.25, and went on to settle at 2899.50 on the 3:15 futures close.

In the end, total volume totally stunk. On the 3:00 cash close there were only 800,000 ES contracts traded. In terms of the ES’s overall tone, it feels overbought short term. In terms of the days trade, the ES chopped around in a 4 to 5 handle range for most of the day.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI