The Zacks Electronics – Miscellaneous Products industry includes a number of Original Equipment Manufacturers (OEMs) of air-conditioning systems, remote control systems, GPS navigation, home automation systems, healthcare devices, industry/factory automation, robotics, semiconductor applications, and energy management solutions.

In addition to the United States, a number of companies in this industry are domiciled in Japan, Germany, the Netherlands and Switzerland. The common factor is that either these have manufacturing operations in China and South-East Asia or generate significant revenues from this region.

Here are the three major industry themes:

- Tariffs that resulted from the trade dispute between the United States and China, particularly in areas such as robotics, industrial automation and semiconductor applications, severely affected industry participants. The tariffs imposed on $200 billion worth of imports from China in September 2018 are applicable for parts and materials used in these segments of the industry. The dispute has forced a number of industry participants to find new sources of production and supply. However, the transition has delayed shipments affecting revenues. Uncertainty over settlement of the trade dispute remains an overhang on industry participants.

- Original equipment manufacturers (OEMs) are exposed to volatility in prices of commodities like copper and steel. Commodity prices are likely to increase in the near term due to growing demand and concerns over tightening global supplies. Tariffs on key components procured from China have also increased raw material costs. Moreover, short supply of transistors and capacitors is hurting production capabilities.

- Further, volatility in foreign exchange, particularly in currencies like Japanese yen and Thai baht negatively impact industry participants. The resurgence in Japanese yen is expected to continue due to growing threat of recession, slowing global economy and headwinds in the emerging markets. Moreover, weakening currencies of emerging economies against the U.S. dollar do not bode well.

Zacks Industry Rank Clouds Prospects

The Zacks Electronics – Miscellaneous Products industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #210, which places it in the bottom 18% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates continued underperformance in the near term. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are pessimistic on this group’s earnings growth potential. In the past year, the industry’s earnings estimate for the current year has decreased 18.7%.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

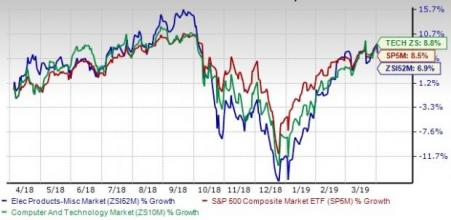

Industry Underperforms S&P 500 and Sector

The Zacks Electronics – Miscellaneous Products industry has underperformed both the S&P 500 Index and its own sector over the past year.

The industry rose 6.9% over this period compared with the Zacks S&P 500 composite’s rally of 8.5% and the broader sector’s increase of 8.8%.

One-Year Price Performance

Industry’s Current Valuation

On the basis of forward 12-month P/E, which is a commonly used multiple for valuing electronics-miscellaneous products companies, we see that the industry is currently trading at 17.94X compared with the S&P 500’s 16.96X. However, it is below the sector’s forward-12-month P/E of 19.43X.

Over the last five years, the industry has traded as high as 20.21X, as low as 12.34X and at the median of 16.28X, as the chart below shows.

Forward 12-Month Price-to-Earnings (P/E) Ratio

Bottom Line

Tariff war and component supply shortage, which is increasing lead times, could weigh on the Zacks Electronics – Miscellaneous Products industry.

However, there are a few stocks that investors can pick to gain a footing in this industry. These stocks either have a Zacks Rank #1 (Strong Buy) or 2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

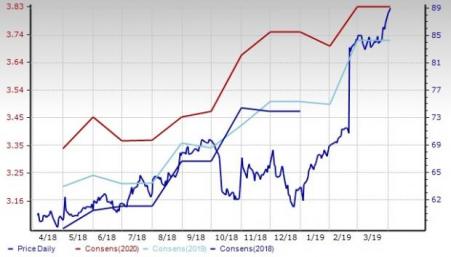

Garmin Ltd (NASDAQ:GRMN). (GRMN): The GPS technology provider sports a Zacks Rank #1. The stock has returned 48.4% in the past year. The Zacks Consensus Estimate for current-year EPS has remained steady at $3.72 over the past 30 days.

Price and Consensus: GRMN

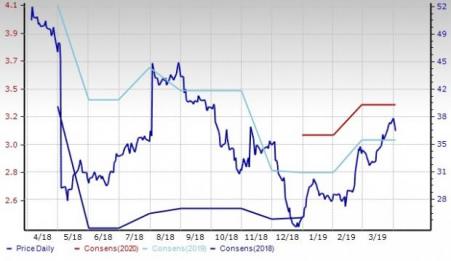

Spectris plc (SEPJY): Egham, U.K.-based Spectris has a Zacks Rank #2. The Zacks Consensus Estimate for current-year EPS has remained steady at $1.16 over the past 30 days.

Price: SEPJY

Universal Electronics (UEIC): Scottsdale, AZ-based Universal has a Zacks Rank #2. The Zacks Consensus Estimate for current-year EPS has remained steady at $3.05 over the past 30 days.

Price and Consensus: UEIC

We are also presenting a stock with a Zacks Rank #3 (Hold) that investors may want to retain.

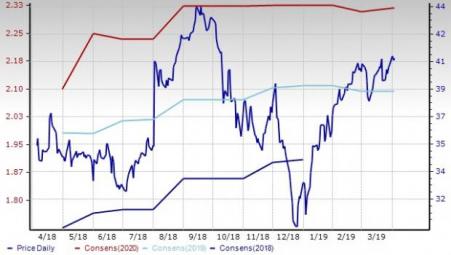

Trimble Inc. (TRMB): Sunnyvale, CA-based Trimble is an OEM of positioning, surveying and machine control products. This Zacks Rank #3 stock has returned 15.7% over the past year. Moreover, the consensus EPS estimate for the current year has moved a penny higher to $2.10 over the past 30 days.

Price and Consensus: TRMB

Universal Electronics Inc. (UEIC): Free Stock Analysis Report

Trimble Inc. (TRMB): Free Stock Analysis Report

SPECTRIS PLC (SEPJY): Free Stock Analysis Report

Garmin Ltd. (GRMN): Free Stock Analysis Report

Original post