We are in the final lap of the second-quarter earnings season with 420 S&P 500 members having reported their numbers as of Aug 4. More than 700 companies are expected to release quarterly results this week. This includes 35 members from the S&P 500 Index.

The Q2 earnings season’s strong showing thus far is backed by a barrage of positive earnings surprises. Based on the latest Earnings Preview, total earnings of the S&P 500 members that have reported results across all sectors (accounting for 86.7% of the index’s total market capitalization) are up 11.6% from the year-ago period while revenues increased 5.6%. Of the companies that have reported, 74.3% posted an earnings beat, while 68.3% surpassed revenues estimates. Considering all the companies that are yet to report, the S&P 500 is anticipated to register 10% growth in the quarter on 5.1% higher revenues.

In this write-up, we focus on a few mining stocks that are slated to report their quarterly numbers this Wednesday. As per the Zacks Industry classification, the mining industry is grouped under the broader Basic Materials sector. So far, 90% of the sector participants on the S&P 500 index have reported quarterly numbers. Earnings for these companies increased 7.7% from the same period last year while sales improved 3.9%.

The mining industry regained ground last year after a harrowing 2015 that bore the brunt of a crash in commodity prices. The turnaround can primarily be attributed to the commodity’s upturn that aided investors to renew their interest in the industry.

Let’s take a sneak peek into three mining companies that are slated to report their second-quarter results on Aug 9.

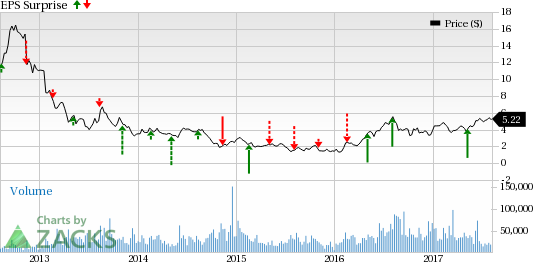

Pan American Silver Corp. (NASDAQ:PAAS) will report its results after the close. The company has an Earnings ESP of -20% as the Most Accurate estimate stands at 8 cents while the Zacks Consensus Estimate is pegged at 10 cents. While the stock carries a favorable Zacks Rank #3 (Hold), its negative ESP makes surprise prediction difficult. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Pan American has delivered an average positive earnings surprise of 19.87% for the trailing four quarters.

IAMGOLD Corporation (TO:IAG) will report results after the bell. It has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate stand at a penny. While the stock carries a Zacks Rank #3, its 0.00% ESP makes surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The company delivered an average positive surprise of 141.67% over the trailing four quarters.

SSR Mining Inc. (NASDAQ:SSRM) will report after the closing bell. The company has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate stand at 6 cents. The stock carries a Zacks Rank #4 (Sell). We caution against Sell-rated (Zacks Rank #4 or 5) stocks going into the earnings announcement.

The company delivered an average positive surprise of 75.40% over the trailing four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Iamgold Corporation (IAG (LON:ICAG)): Free Stock Analysis Report

Pan American Silver Corp. (PAAS): Free Stock Analysis Report

Silver Standard Resources Inc. (SSRM): Free Stock Analysis Report

Original post