Minerva Neurosciences, Inc. (NASDAQ:NERV) announced that an amendment to its license agreement with Janssen Pharmaceuticals, a subsidiary of Johnson & Johnson (NYSE:JNJ) , related to co-development of orexin-2 receptor antagonist, MIN-202 (JNJ 42827922), has been approved of in the EU.

Notably, Minerva entered into the agreement with Janssen in June, the execution of which was dependent on the sanction of its certain term by the EU. Subsequently, each condition has now been met and the amendment is expected to take effect on Aug 29, 2017.

Pursuant to the agreement, Minerva is entitled to receive an upfront payment of $30 million from Janssen. Additionally, Minerva will also receive an amount of $20 million at the start of a phase III insomnia study for MIN-202 and $20 million upon 50% completion of enrollment in the study. Also, an amount of $13 million has been waived by Janssen that was due from Minerva for phase II development of the candidate.

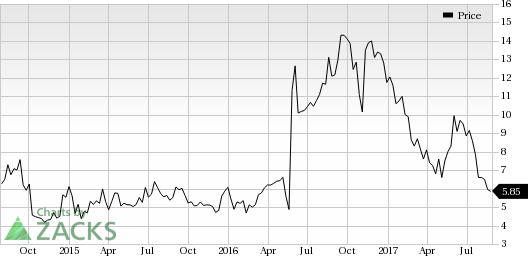

Shares of Minerva have significantly underperformed the industry year to date. The stock has plunged 50.2% compared with the industry’s 2.2% decrease during the period.

We remind investors that in January 2016, the company announced positive top-line results from a phase IIa study of MIN-202 for the given indication. The trial was conducted on 28 patients with insomnia disorder.

Minerva’s other pipeline candidates include MIN-117, currently in clinical development for major depressive disorder (MDD), MIN-101 (three phase IIb study) for schizophrenia and MIN-301 for Parkinson’s disease.

Significantly in July, Minerva completed a public offering, having generated net proceeds of approximately $41.5 million. The company expects that this fund along with finances raised from the public stock offering and current financial resources, will together support five clinical studies projected to take place by 2019-end for other pipeline candidates including MIN-202.

Zacks Rank & Stocks to Consider

Minerva currently carries a Zacks Rank #2 (Buy). Some other stocks worth considering in the pharma sector are Aduro Biotech, Inc. (NASDAQ:ADRO) and ACADIA Pharmaceuticals Inc. (NASDAQ:ACAD) , both carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Aduro Biotech’s loss per share estimates reduced from $1.46 to $1.32 for 2017 and from $1.41 to $1.24 over the last 30 days. The company delivered positive surprises in two of the trailing four quarters with an average beat of 2.53%.

ACADIA’s loss per share estimates narrowed from $2.82 to $2.59 for 2017 and from $2.07 to $1.92 for 2018 over the last 30 days. The company came up with positive earnings surprises in two of the last four quarters with an average beat of 7.97%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Johnson & Johnson (JNJ): Free Stock Analysis Report

Aduro Biotech, Inc. (ADRO): Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD): Free Stock Analysis Report

Minerva Neurosciences, Inc (NERV): Free Stock Analysis Report

Original post

Zacks Investment Research