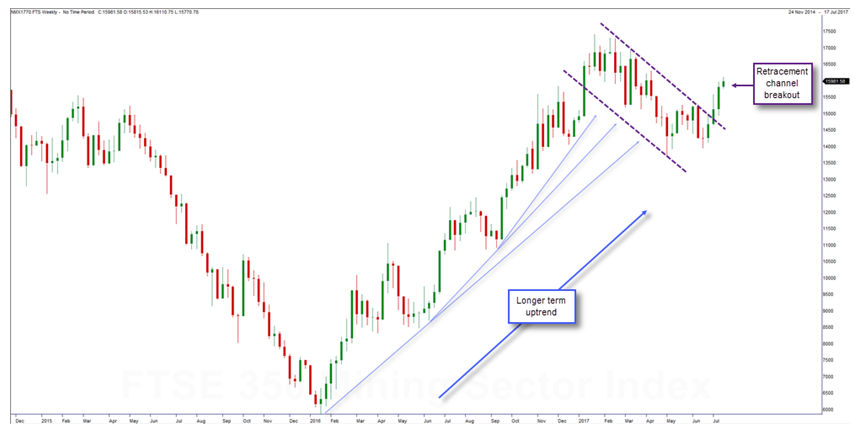

In a previous market insight piece, ‘Miners starting to shine’, we predicted the index would breakout from a prolonged retracement phase, paving the way for a powerful rally to ensure.

Having seen exactly that, as the above (updated) weekly charts highlights, and with the miners reporting this week, let’s take another look at the sector.

Firstly, we note that the medium term backdrop is firmly bullish. The index emphatically breaking out from its weekly retracement phase and clearing an interior support level in the process (see chart below) are both clear signs that buying demand is very strong.

Moreover, this week’s Chinese GDP data surprised to the upside - Chinese H1 growth was 0.2% ahead of last year’s print and above of the government’s growth target.

Another big move on the cards

However, more recently we have seen the index pause for breath and hold around 16,000 mark. As such, the index looks set, once again, for another big move.

Given the bullish backdrop, we anticipate a rally higher in line with the dominant longer-term uptrend; were we to see thiswe would be eyeing the 2017 highs. In this scenario, we would look to buy peers showing relative strength.

Conversely, a move lower would mean all eyes on the highlighted (broken) interior resistance level at 15,260. Having seen the index break through this level earlier in the month, we would expect prices to find support here pending a pullback.Assuming this, we would have another exciting entry point to move long the sector.