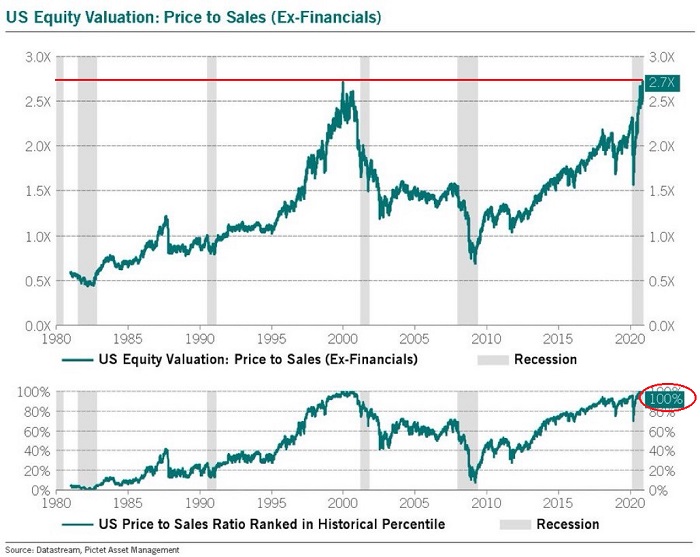

The investment community is not only willing to look beyond virus vaccination to economic nirvana, it is also willing to ignore extraordinary stock overvaluation. Consider the price-to-revenue metric. At 2.7x corporate sales, stocks have never been frothier.

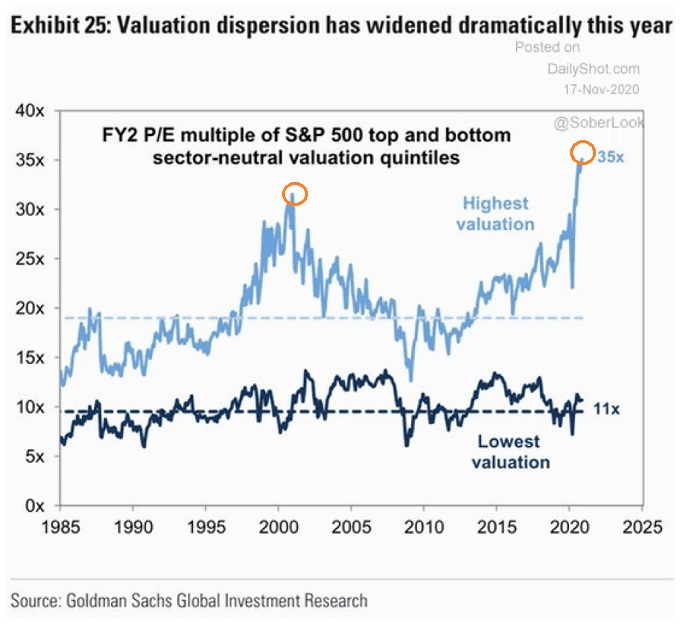

Another way to dissect the frothiness? Forward price-to-earnings ratios for the highest valuation quintile and the lowest valuation quintile.

Typically, investors might pay 20x for growth-oriented companies versus 10x for value-oriented companies. Today? Investors are coughing up an obscene 35x for bubbly mega-cap growth exposure. That is a higher P/E multiple than what we witnessed at the height of 2000’s infamous stock bubble.

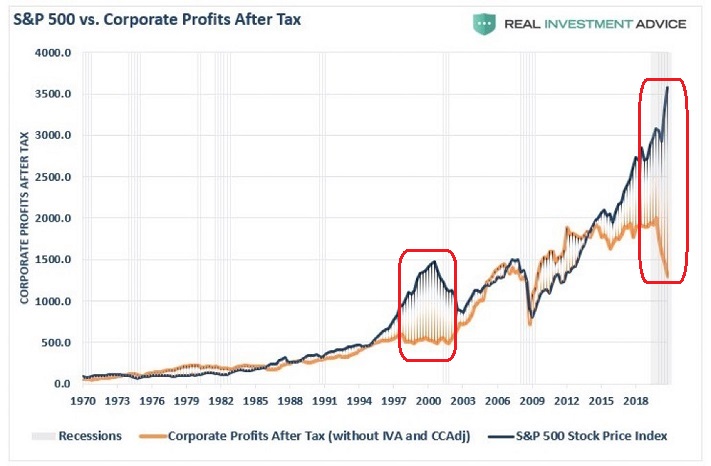

Historically, stock prices used to correlate with after-tax corporate profits. Then came the unchecked euphoria of the late 1990s. Eventually, though, dot-com infatuation led to the popping of the 2000 balloon.

Perhaps ironically, the 2020 gap between after-tax corporate profits and S&P 500 stock prices has widened to an even greater extent. If what the world witnessed back in 2000 represented peak insanity, what does 2020 represent?

Can analysts as well as the media rationalize the price movement? They can and they do. Fiscal stimulus (e.g., forgiveness loans, direct household payments, etc.) and Federal Reserve stimulus (e.g., electronic money printing, asset purchasing, rate suppression, etc.) are far more critical for inflating asset prices than pesky valuation metrics.

Then again, there may be significant repercussions for central bank rate manipulation, deficit spending and money printing. How much higher will inflation hedges like gold (SPDR® Gold Shares (NYSE:GLD)) and Bitcoin (BTC/USD)) rise, while the dollar sinks toward an abyss?