I believe there are two broad issues at play that are having a positive influence on equity prices. The first issue is a fundamental one and related to a much improved corporate earnings picture. Looking solely at companies in the S&P 500 Index, Thomson Reuters publishes a weekly report summarizing the quarterly earnings reports of companies. Friday's report notes,

- Q4 '16 earnings are expected to increase 8.4% on a year over year basis. The financial sector is projected to show the strongest YOY growth at 20.8%

- Of the 357 companies in the S&P 500 that have reported earnings to date for Q4 2016, 68.3% have reported earnings above analyst expectations. This is above the long-term average of 64% and below the average over the past four quarters of 71%.

- 48.3% of companies have reported Q4 2016 revenue above analyst expectations. This is below the long-term average of 59% and below the average over the past four quarters of 51%. Revenue growth for Q4 '16 is estimated to equal 4.4% YOY.

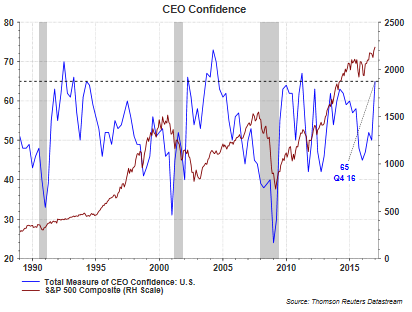

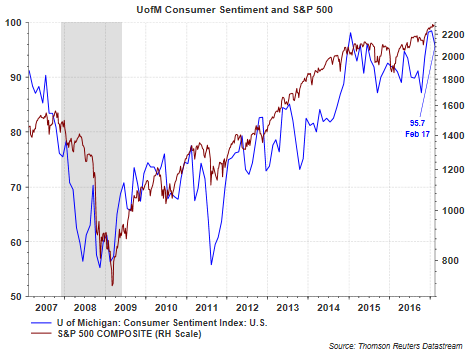

The second issue influencing the market is the dramatic positive shift in sentiment by both consumers and businesses. I could probably show a dozen different charts that support the positive shift in sentiment with just two of them below. The first one measures CEO Confidence and it had one of the largest month over month increases in the measure's history. The second one shows consumer sentiment jumping higher subsequent to the election as well.

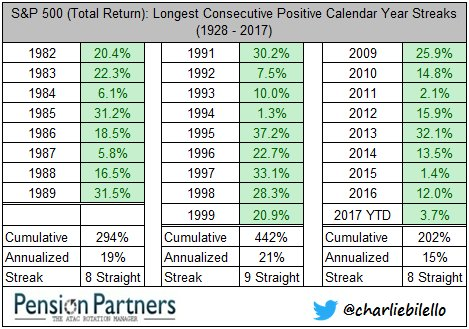

The equity market has been on a remarkable run since the end of the financial crisis and if positive this year, it will be the ninth consecutive up year for the S&P 500 Index. Charlie Bilello of Pension Partners prepared the below table comparing other time periods where the S&P 500 Index went on a sustained winning streak. What does jump out to me is the fact the cumulative percentage return for the current streak remains the lowest although the advance is in its ninth year.

Further, the below chart shows improved corporate fundamentals and an improved sentiment picture have translated into a higher move in the S&P 500 Index. Importantly, there are a technical measures related to the market that remain positive. The money flow index has turned slightly higher yet remains at a neutral level, i.e., not an indication of an overbought market. Also, the MACD indicator is showing a positive cross. And lastly, volume for the market does not appear at a level where one might conclude we have excessive exuberance.

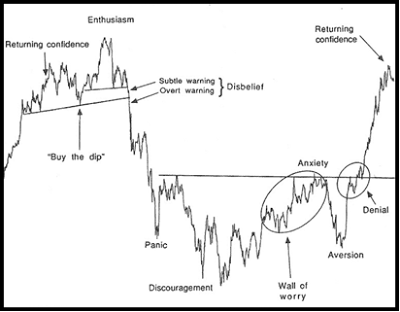

The technical analyst, Justin Mamis, author of the 1991 book, The Nature of Risk, developed the below sentiment cycle chart.

The market decline in to the bottom last year on February 11, 2016 may have represented the 'discouragement' phase with the rally near the election equivalent to the 'wall of worry' phase. The 5% or so sell off prior to the election might be the 'aversion' phase with now being the 'denial' phase. If sentiment suggests we are in the denial phase (I am hearing from more investors that the market is over due for a correction), then the market has yet to go though the run up to a blow off top. Higher volume would certainly be an indication of this.

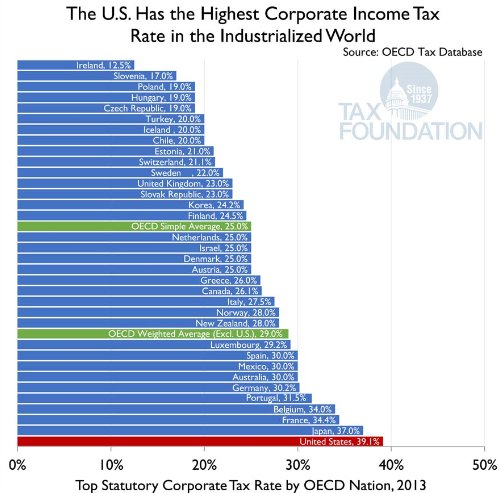

One factor that could derail the positive sentiment picture is policy inaction from Washington. President Trump's election promises of reducing regulation and reducing taxes, especially for businesses, seems to be playing a large part in the positive swing in business and consumer sentiment. Reducing the corporate tax rate and reducing regulation in the U.S. would go a long way in improving the growth rate of the overall economy, or at least creating a better business operating environment.

As the above graph shows, the U.S. has the highest corporate tax rate in the industrialized world. This factor alone does carry weight in the corporate board room in terms of a company's growth decisions.

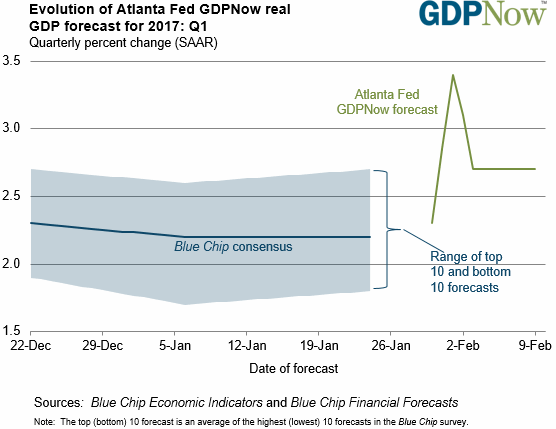

The Atlanta Fed's GDP Now model is projecting Q4 '16 GDP growth of only 2.7%. Certainly the administrative changes in Washington took place less than a month ago, but some of the proposed policies will take time to work there way through the economy. And as of today, it seems positive sentiment rests on future expectations. Fulfilling those expectations requires policy implementation out of Congress and an extended delay could be a headwind for the economy and the markets.

Business fundamentals have certainly improved; however, the strong year over year earnings growth is being influenced by the low earnings level in the prior year. And with sentiment, as the quick swing following the election shows, it can swing the other way just as quickly. Policy action will be important to justify the positive sentiment expectations.