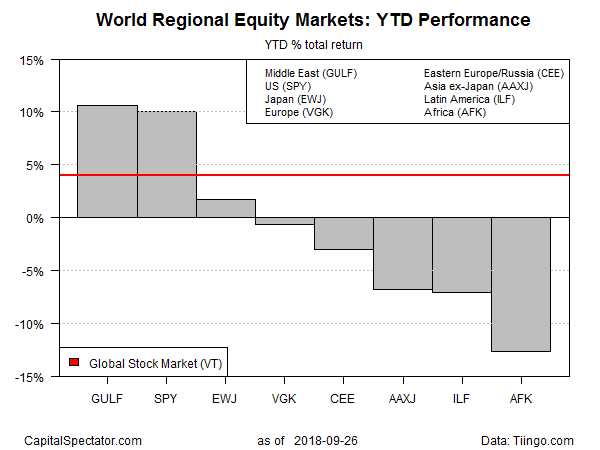

Stock markets in the Middle East and Gulf are holding on to a small performance edge over the US equity market so far in 2018, based on a set of exchange-traded funds.

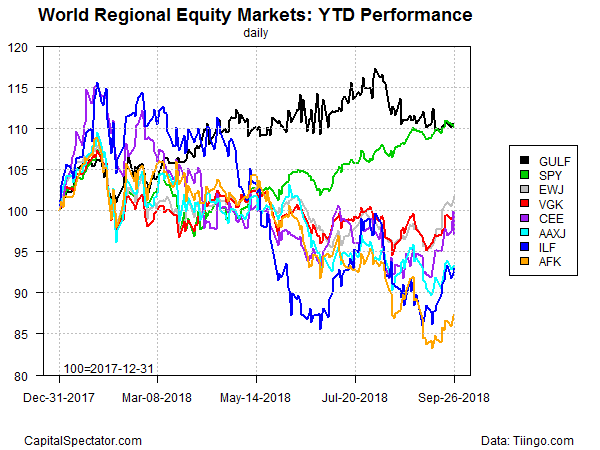

The neck-and-neck horse race between the two regions reflects diverging trends in recent months. The formerly high-flying performance WisdomTree Middle East Dividend (NASDAQ:GULF) has lost ground lately, taking a bite out of its year-to-date gain. Meanwhile, the steady upward climb in 2018 for US equities via SPDR S&P 500 (NYSE:SPY) has leveled the playing field and essentially left the two leaders with similar results through yesterday’s close (Sep. 26).

Compared with the major equity regions of the world, GULF and SPY are far ahead of the rest of the field. The third-best performer is Japan: iShares MSCI Japan (NYSE:EWJ) up a slight 1.8% so far in 2018. The remaining regions are posting losses. Equities in Africa are currently posting the biggest year-to-date setback via VanEck Vectors Africa (NYSE:AFK), which is off 12.7% year to date.

For perspective, note that a global equity benchmark via Vanguard Total World Stock (NYSE:VT) is posting a moderate 4.0% rise so far in 2018.

The recent deterioration in Mideast stocks (GULF) this year, along with the steady rise in US equities (SPY) over the last several months, is clearly visible in the performance chart below.

Investors will be closely monitoring what happens next for the S&P 500, which fell sharply in intraday trading following Wednesday’s announcement by the Federal Reserve that it raised interest rates for the third time this year.