Share price of Microsoft Corporation (NASDAQ:MSFT) rallied to a new 52-week high of $74.96, eventually closing a tad bit lower at $74.77 on Aug 31. The momentum can be attributed to the recently announced collaboration between the company’s Cortana and Amazon.com Inc.'s (NASDAQ:AMZN) Alexa.

Moreover, strong Office 365 and Windows 10 adoption as well as robust performance from Azure are helping the stock to gain momentum as evident from the last quarter’s earnings report. While Office 365 commercial revenues grew 44% at constant currency, Azure revenues soared 98% on a year-over-year basis.

We also note that Microsoft's upcoming console, Xbox One X, has significant growth potential, as evident from the record pre orders.

Notably, the stock has returned 26.7% year to date, in line with the industry it belongs to. The stock has a market cap of $559.88 billion.

Currently, Microsoft holds a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Factors

We believe that the collaboration between Cortana and Alexa will boost Microsoft’s growth potential in the Artificial Intelligence (AI) market. Currently, Alexa is dominating the digital assistant market as Amazon’s Echo speaker is expected to have 70.6% of voice-activated assistant users in 2017, per eMarketer’s latest data.

Microsoft claims that there are 145 million active monthly users of Cortana through Windows 10.

The collaboration will definitely boost Cortana’s adoption rate going forward. Moreover, the partnership improves competitive position against Apple (NASDAQ:AAPL) and Alphabet’s (NASDAQ:GOOGL) Google.

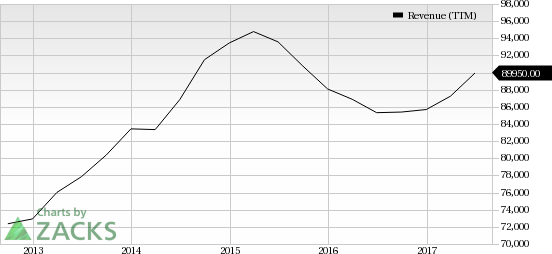

Moreover, continuing robust adoption of Azure will drive Microsoft’s top-line growth. According to data from Synergy Research, Azure trailed only Amazon Web Services in the cloud infrastructure services market in the second quarter in terms of market share and revenue growth. IBM (NYSE:IBM) and Google were in the third and fourth place, respectively.

Estimate Revisions

The Zacks Consensus Estimate for fiscal 2018 and fiscal 2019 has remained steady at $3.20 and $3.59 over the last 30 days.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Original post

Zacks Investment Research