Microsoft Corp (NASDAQ:MSFT) recently announced the acquisition of Israel-based Cloudyn essentially confirming the earlier rumors. Reportedly, the tech behemoth is paying approximately $50–$70 million for the start-up.

Cloudyn offers cloud-monitoring software that helps enterprises manage costs effectively. Per Microsoft “Cloudyn gives enterprise customers tools to identify, measure and analyze consumption, enable accountability and forecast future cloud spending.”

Cloudyn not only supports Azure but also Amazon (NASDAQ:AMZN) Web Services (AWS), Alphabet’s (NASDAQ:GOOGL) Google Cloud and Openstack. However, Microsoft didn’t comment on whether it will continue to support the multiplatform approach going forward.

Nevertheless, the acquisition expands Microsoft’s customer base, as Cloudyn has a strong clientele that includes the likes of Hewlett Packard Enterprise (NYSE:HPE) and Proofpoint (NASDAQ:PFPT) among others.

Public Cloud Growth Escalates

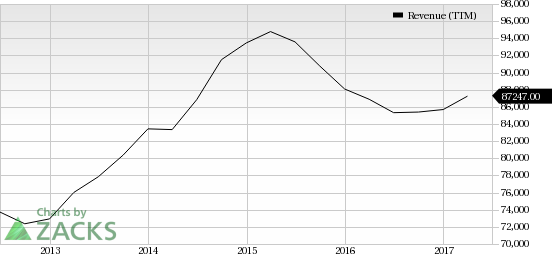

We note that Microsoft has outperformed the S&P 500 on a year-to-date basis. The stock returned 10.2% as compared with the Index’s gain of 9.2%. The outperformance can primarily be attributed to robust performance from Microsoft Azure, which is benefiting from the strong demand of public cloud services.

According to IDC, total spending on IT infrastructure products (server, enterprise storage, and Ethernet switches) for deployment in cloud environments will increase 15.3% year over year in 2017 to $41.7 billion. Moreover, the market research firm projects worldwide spend on public cloud to reach a whopping $203.4 billion by 2020, which reflects a CAGR of 21.5%.

Gartner anticipates worldwide public cloud services market to increase 18% in 2017 to $246.8 billion. We believe that the robust projections presents further growth opportunity for Azure.

Acquisitions Driving Growth at Azure

In the latest quarter, Azure revenues soared 94% at constant currency on a year-over-year basis. Microsoft also noted that Azure premium revenues grew triple digits for the 11th consecutive quarter, with more than 80% of Azure customers using the premium services.

We note that acquisitions like Deis (containers), Wand Labs (messaging app developer), Solair (Internet of Things services), Xamarin (platform provider for mobile app development), Secure Islands (data-centric security technology) over the last 18 months have enhanced Microsoft Azure’s capabilities.

Moreover, collaborations with the likes of Box and open source providers will help it to become a dominant player in the long run.

Per latest data from Synergy Research Group, AWS maintained its dominant position in the public cloud services market in the first-quarter 2017 followed by Microsoft, Google and IBM (NYSE:IBM).

We believe that rapid adoption of Microsoft Azure – as evident from the growing customer base – will further strengthen its competitive base in the rest of 2017.

Currently, Microsoft carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Proofpoint, Inc. (PFPT): Free Stock Analysis Report

Original post